8 1

Bitcoin Attempts to Reclaim $104,400 Support Amid Market Transition

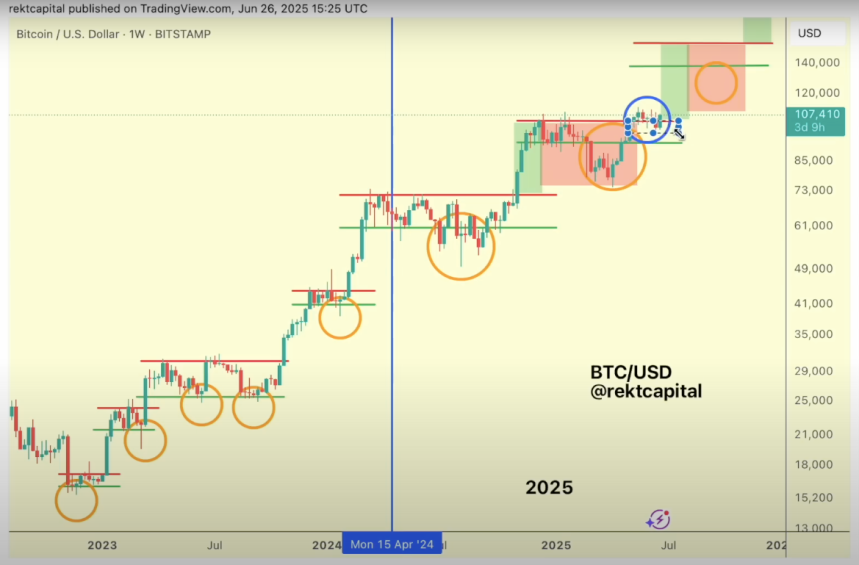

This week, Bitcoin (BTC) has rebounded from a decline below $100,000 and is attempting to establish support at the $108,000 resistance level for the fourth time. Analyst Rekt Capital provided insights on BTC's market behavior as it approaches the second half of 2025.

Bitcoin Sees Transitional Period

- Rekt Capital described the current BTC cycle as a "cycle of re-accumulation ranges" that began post-Bitcoin Halving in 2022.

- Prior to halving, BTC experienced brief price deviations below re-accumulation range lows.

- The post-halving phase saw multi-week clusters of price action below these lows.

- BTC's recent movements indicate it may enter a second Price Discovery Uptrend after a previous nine-week downside deviation.

- A new transitional phase is occurring, with prices consolidating around the re-accumulation range high.

This represents the first significant deviation below the range high, marking a critical level for an uptrend transition.

Weekly Close Key For BTC’s Future

- The pivotal level for BTC is the $104,400 support, previously held for seven weeks before recent pullbacks.

- A weekly close above this level is essential for confirming recovery and retesting it as support.

- The length of the transitional period will influence the timing of the next uptrend, which may take longer than expected.

- A potential corrective period could see BTC drop by 25% to 33%, but a short duration could allow for another uptrend before a bear market.

- As of now, BTC is trading at $107,555, reflecting a 3.2% weekly increase.