13 1

Bitcoin Nears Record High, Eyes $135K Amid Government Shutdown

Bitcoin (BTC) increased by 13% this week, nearing a record of $124,500. A rise to $135,000 is possible according to Standard Chartered's Geoffrey Kendrick.

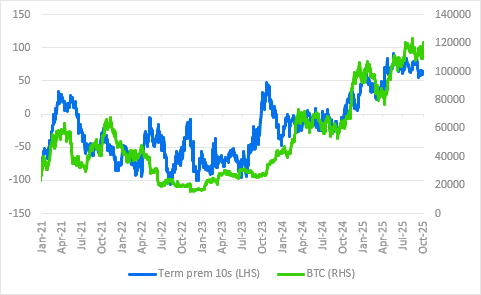

- The U.S. government shutdown is influencing the Bitcoin market more significantly than past instances, correlating closely with U.S. Treasury term premiums.

- Prediction marketplace Polymarket suggests over a 60% chance that the shutdown will last 10–29 days, during which BTC may continue to rise.

- Kendrick notes a potential shift in ETF investor behavior, with spot Bitcoin ETFs expected to see increased inflows.

- In 2025, $23 billion of the $58 billion net BTC ETF inflows have been recorded, with an additional $2.25 billion just this week before Friday.

- Kendrick forecasts an additional $20 billion in ETF inflows by year-end, supporting his $200,000 BTC price target for 2025.