13 0

Bitcoin at Record Highs: Key Levels $126K, $135K, $140K Analyzed

As Bitcoin trades near record highs, investors are focusing on key price levels that could influence future movements:

$126,100

- This level is the upper boundary of the expanding range pattern since mid-July.

- Defined by a trendline connecting July 15 and Aug. 14 highs.

- A reversal here might lead to a corrective pullback towards the range's lower boundary.

$135,000

- Focus shifts here if BTC breaks out from the expanding range.

- Market makers hold a net long gamma position, buying dips and selling rallies to maintain neutrality.

- This hedging activity may decrease volatility, acting as resistance.

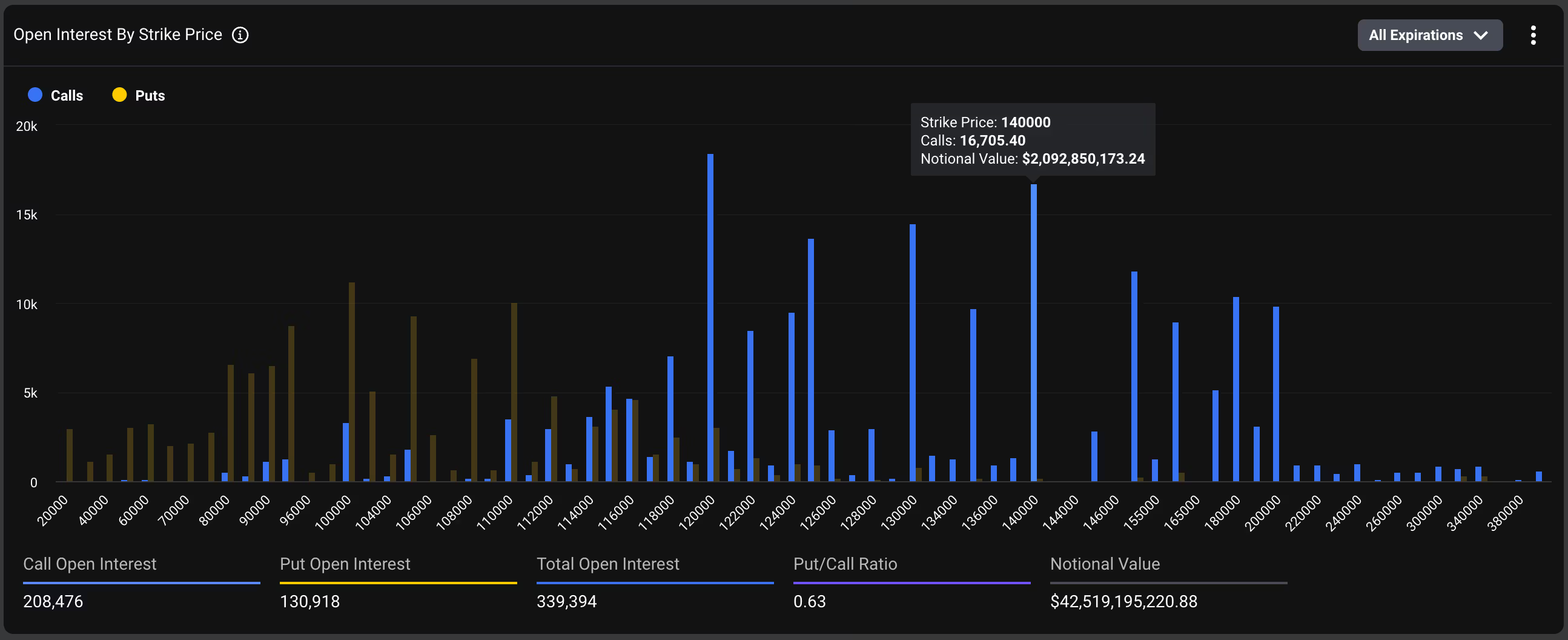

$140,000

- Significant open interest in call options at this strike, over $2 billion notional value.

- High open interest can draw spot prices toward the level.

- Institutions selling these calls aim to keep the price below this strike, creating potential resistance.