10 0

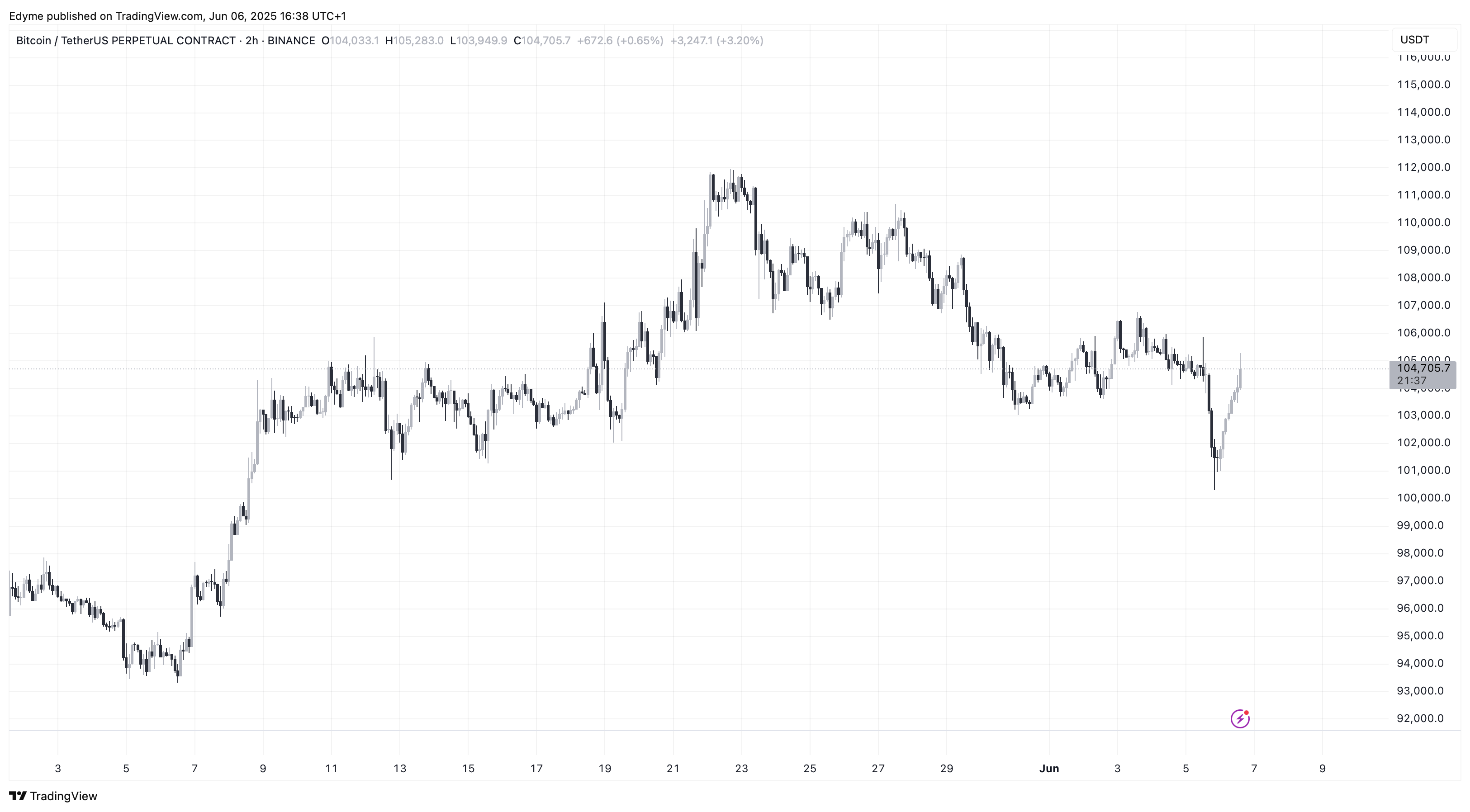

Bitcoin Recovers to $104,891 Amid Increased Miner-to-Exchange Inflows

Bitcoin is showing signs of recovery after a brief decline linked to tensions between Donald Trump and Elon Musk. The price reached nearly $100,000 but has since rebounded to $104,891. While the overall crypto market adjusts, miner activity is influencing the near-term outlook.

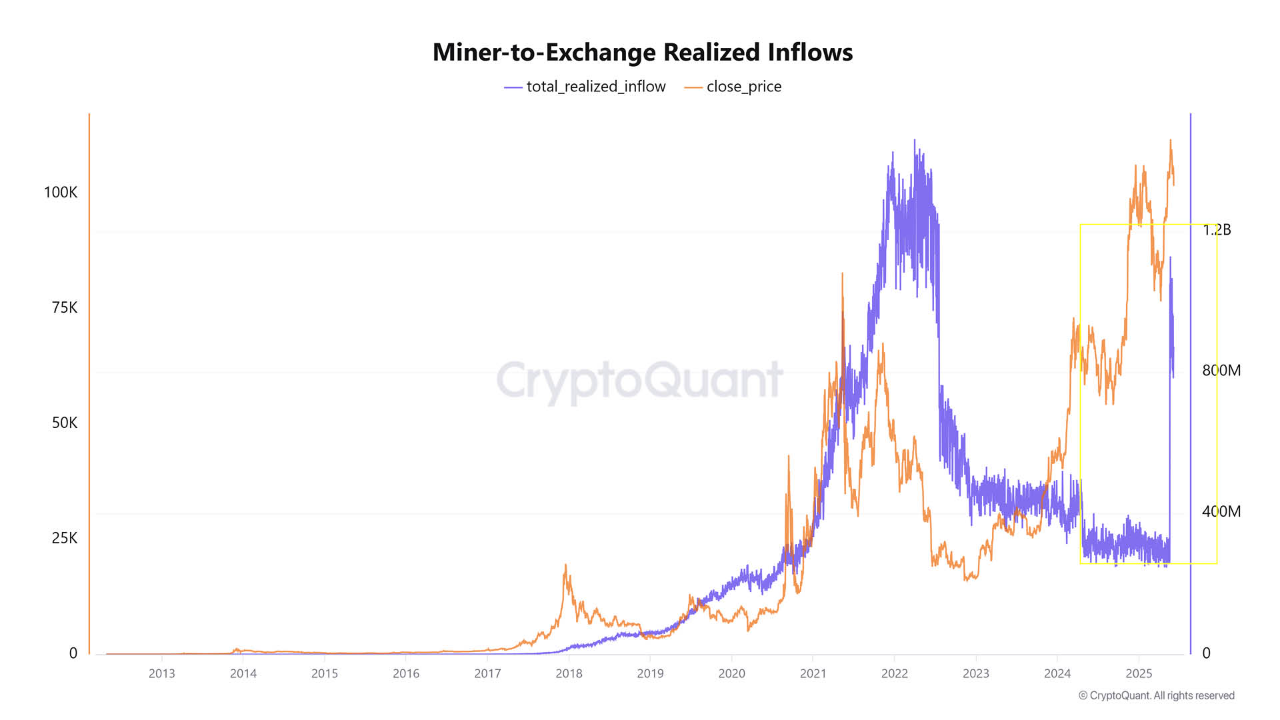

Bitcoin Surge in Miner Inflows Could Pressure Price Action

- Miner-to-exchange inflows recently exceeded $1 billion per day, indicating increased sell pressure.

- This level of inflow is unprecedented in prior market cycles.

- Large transfers to exchanges suggest miners may be preparing to sell BTC, impacting short-term supply dynamics.

- Historical spikes in miner outflows often lead to downward price pressure, especially in fragile market conditions.

- Monitoring these flows aids in risk assessment for traders and investors.

Hash Ribbon Signal Suggests Longer-Term Opportunity

- The Hash Ribbons indicator has generated a new buy signal, suggesting potential long-term opportunities.

- This metric indicates miner stabilization or recovery after a capitulation phase.

- Historically, such signals align with favorable long-term entry points.

- Periods of mining stress can precede longer-term rallies as excess supply clears from the market.