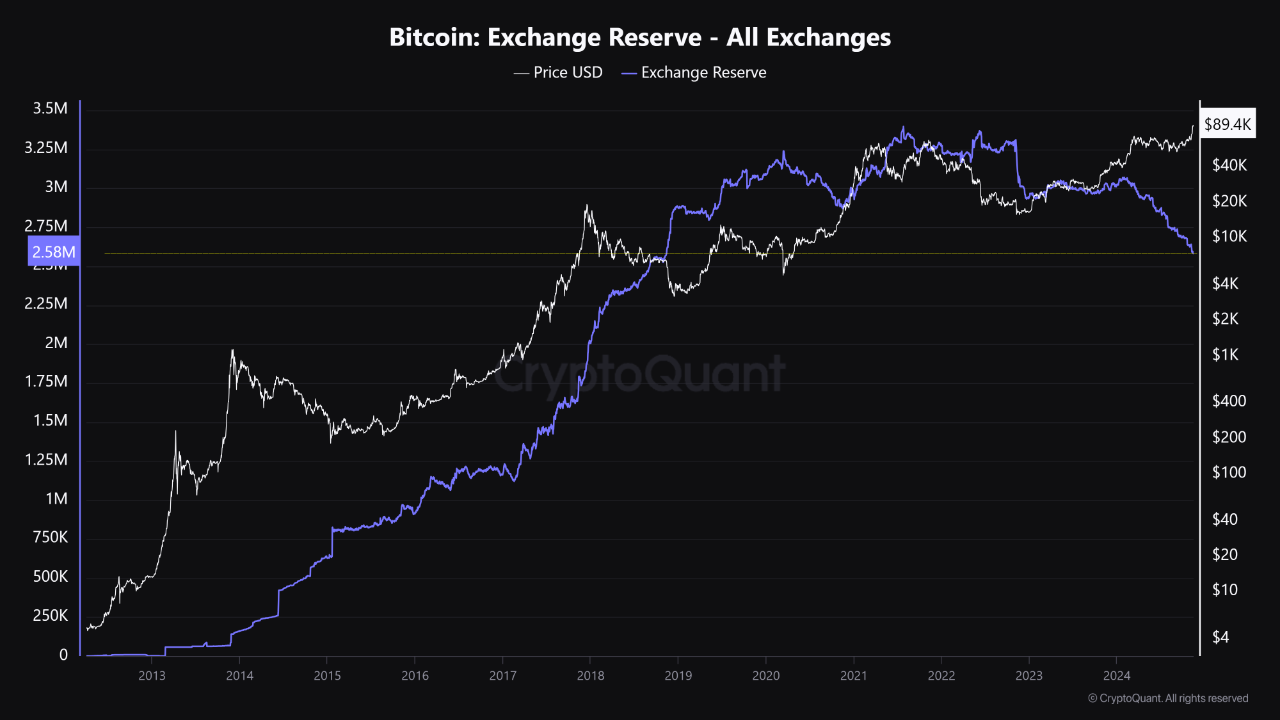

Bitcoin Exchange Reserves Reach Lowest Level Since November 2018

The Bitcoin market has reached a significant milestone, with reserves on centralized exchanges at their lowest since November 2018.

This trend, noted by CryptoQuant analyst G a a h, indicates a shift in BTC investor behavior and suggests interesting developments for Bitcoin.

Bitcoin Reserves On Exchanges Reach Five-Year Low

According to the analyst, Bitcoin reserves on exchanges have decreased significantly throughout 2024, indicating a move towards long-term holding strategies among investors.

This trend reflects that investors are increasingly transferring assets to private wallets, which reduces immediate supply and contributes to buying pressure in a constrained market. G a a h states that this behavior signifies a broader sentiment shift, with growing confidence in Bitcoin as a store of value amid economic uncertainty and rising inflation.

Reducing Bitcoin on exchanges lowers the risk of sudden sell-offs, potentially increasing price stability; however, it may also lead to heightened volatility if demand remains strong.

This scenario signals a potentially more volatile but more resilient Bitcoin market, with less selling pressure and a growing dominance of long-term holders, which could open up space for new price peaks.

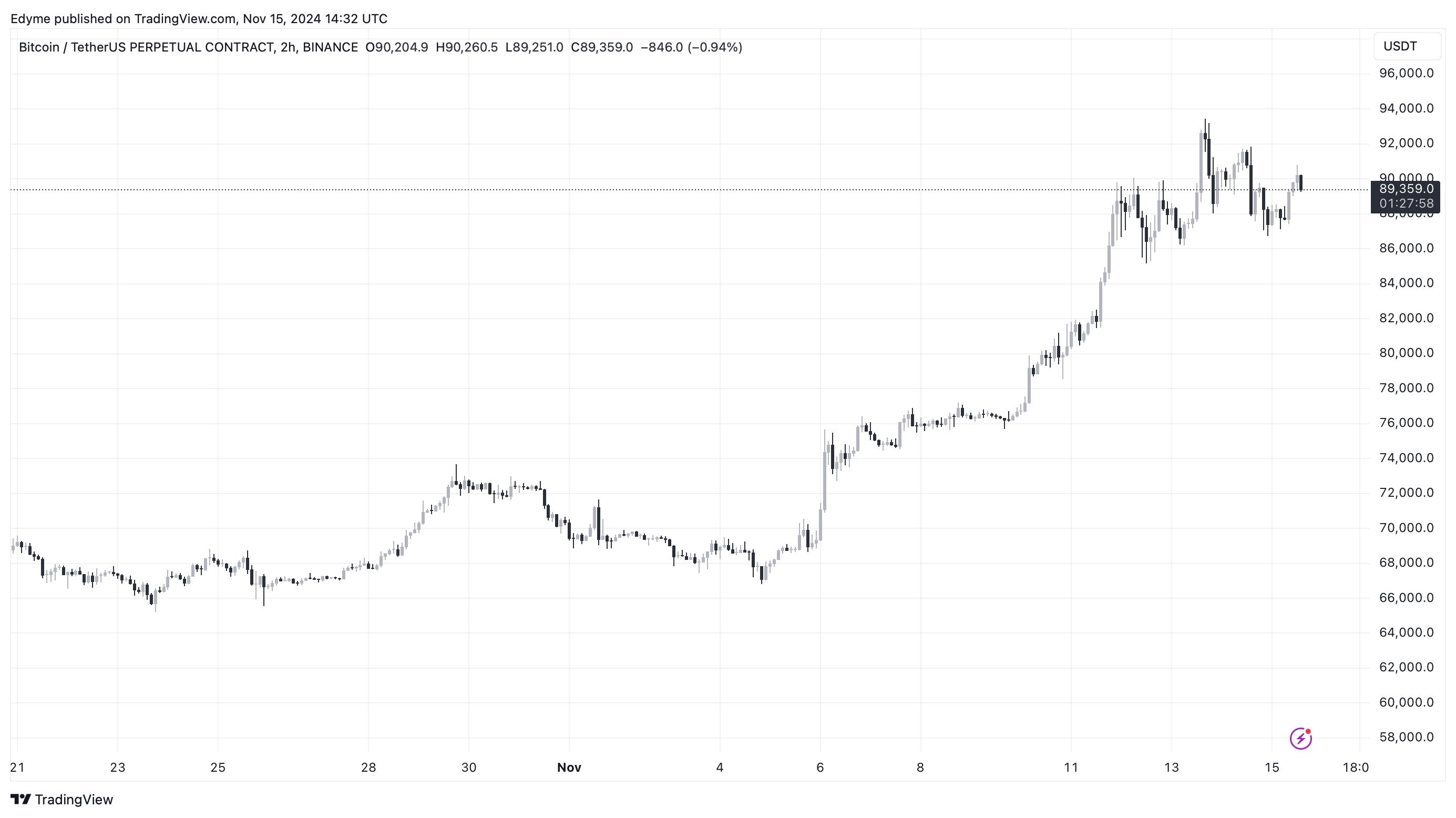

BTC's Upward Momentum Cools Off

After reaching an all-time high of $93,477 on November 13, BTC has experienced a correction, down 4% from this peak. The asset is currently trading below $90,000 at $89,779, reflecting a 1.4% decline over the past day, resulting in a market cap reduction of approximately $49 billion.

Currently, Bitcoin's market cap stands at $1.775 trillion, nearly 5% lower than its valuation of $1.835 trillion two days ago. Daily trading volume has dropped from over $100 billion to below $85 billion.

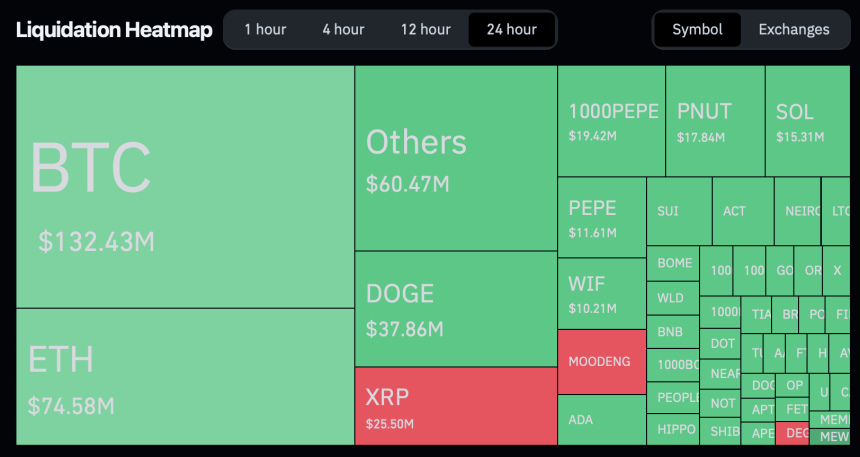

Additionally, BTC's decline has impacted traders significantly. Data from Coinglass shows that about 170,215 traders were liquidated in the past 24 hours, totaling $510.13 million in liquidations across the crypto market.

Out of these liquidations, Bitcoin accounts for $132.43 million, primarily from long positions anticipating continued upward momentum.

Featured image created with DALL-E, Chart from TradingView.