Bitcoin Faces Resistance Near $100K Amid Increased Selling Pressure

$100,000 is currently a significant resistance level for bitcoin.

Bitcoin reached $99.8k before retreating, influenced by potential selling pressure on platforms like Coinbase. A notable amount of 1,000 BTC was listed for sale at this price point.

Michael Novogratz from Galaxy noted that current selling trends reflect normal profit-taking, particularly from sellers who purchased above $56,000 earlier this year.

Despite the holiday week in the US, which typically results in lower trading volumes, there are indicators suggesting a potential rise to $100k.

MicroStrategy announced the purchase of 55,500 bitcoin worth $5.4 billion at an average price of nearly $98,000 per bitcoin, as disclosed in an SEC filing.

This filing was anticipated following its recently upsized bond offering of nearly $3 billion. The recent acquisition follows a previous $4.6 billion purchase earlier in the month, totaling approximately $10 billion in bitcoin purchases by MicroStrategy this month.

While these acquisitions may influence price action, they have not yet enabled a breakthrough past the $100k threshold. Additional market dynamics could play a role, as highlighted by FalconX’s David Lawant.

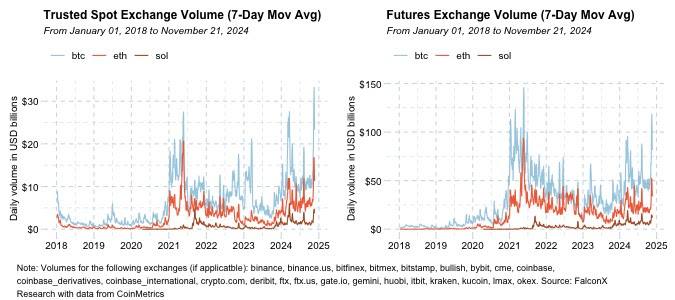

Lawant indicated that bitcoin's spot volume printed its highest levels on a seven-day moving average and is approaching similar metrics on futures volume. Recent daily traded values exceeded $40 billion post-election but have since stabilized between $25-35 billion, significantly higher than pre-election levels.

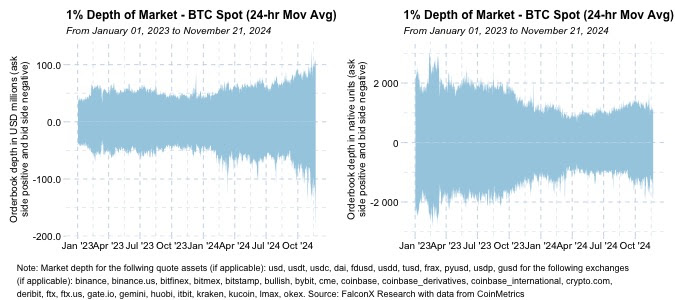

However, increased trading volume has not translated into greater order book depth, which would contribute to stronger price movements.

This suggests that while reaching $100,000 remains challenging, the overall market sentiment appears positive.

If MicroStrategy's recent buy does not catalyze a price increase, other external factors may provide the necessary push.