6 1

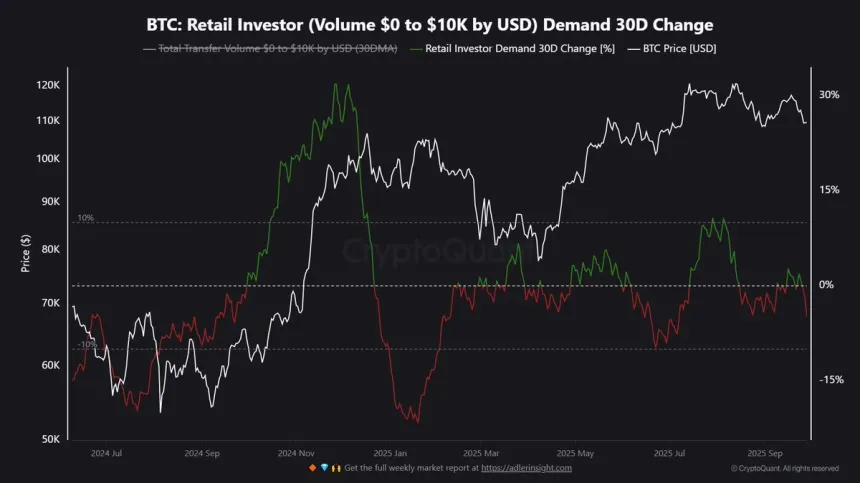

Bitcoin Faces Resistance at $112K as Retail Demand Weakens

Bitcoin has reclaimed the BTC $110,000 level, but momentum is weak with market exhaustion signs. The inability to push higher suggests a potential deeper correction. Traders are monitoring if BTC can maintain this critical level or face increased selling pressure.

- Some analysts view current consolidation as a healthy reset within a broader bullish cycle, arguing it supports more sustainable rallies by reducing leverage and strengthening support levels.

- Analyst Maartunn reports that retail demand has decreased by 5%, its lowest since July, suggesting smaller investors are retreating, leaving price direction to larger players and institutions.

Retail Capitulation and Macro Risks

- The decline in retail demand could indicate a contrarian signal, where smaller investors step aside during consolidations above $110,000, potentially leading to stronger institutional accumulation.

- Macroeconomic risks, like a US government shutdown, add complexity. Political gridlock often increases volatility, affecting Bitcoin's trajectory.

- Uncertainty might lead to Bitcoin benefiting from macro turbulence as investors seek alternatives outside traditional systems.

Bitcoin Price Dynamics: Struggling at $112K

- Currently trading around $112,141, Bitcoin shows resilience after dipping below $110,000.

- Facing resistance from 50-day and 100-day moving averages, preventing upward momentum and reinforcing a corrective phase.

- The rejection from $123,217 highlights difficulties for bulls. Failure to hold above $114,000–$115,000 could expose BTC to downside risk, with $105,000 as critical support.

- Bulls need a break above $115,000 to regain momentum; bears may target deeper retracements if $110,000 fails again.