Bitcoin Faces Resistance at $114K Amid Mature Bull Cycle Dynamics

Bitcoin is facing a critical moment, trading between bullish aspirations and bearish resistance. Key points include:

- Bulls are trying to reclaim $115K while bears maintain pressure below $110K.

- Increased volatility is expected ahead of the US Federal Reserve meeting, which may influence risk assets like Bitcoin.

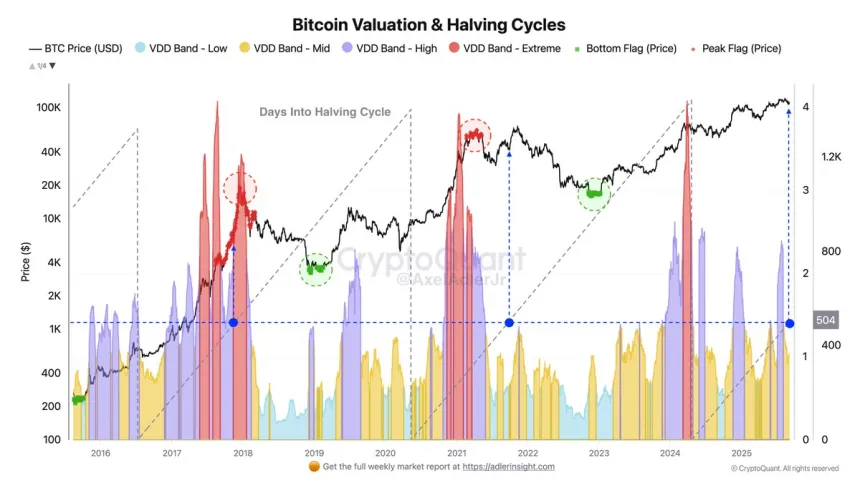

- Analyst Axel Adler notes it has been 504 days since the last halving, indicating a mature bull market phase.

- This cycle shows unique redistribution patterns; LTH activity spiked at $70K, followed by moderate distributions at $98K and $117K.

Adler suggests that institutional demand is leading to more sustainable selling patterns. The ultimate peak could occur in late 2025, contingent on specific market conditions.

Current Price Dynamics

Bitcoin is currently priced at $112,952, rebounding above the $110K support level. Key resistance is noted around $114K, aligned with the 100-day moving average. A breakout above this level is essential for further price advancement.

BTC must reclaim the 50-day moving average to build momentum. Long-term support is around $101,900, provided by the 200-day moving average. Maintaining above $110K supports the bullish outlook; however, failure to break through $114K–$115K may lead to a return to lower volatility.