12 0

Bitcoin Faces Resistance at $94,000 Amid $4.7B Sell-Side Pressure

Bitcoin Faces Key Resistance Amid Market Volatility

- Bitcoin struggles to break the $94,000 barrier, attempting stabilization above $90,000.

- Recent recovery from the $85,000 Point of Control pushed BTC into a critical supply zone between $92,000 and $94,000.

- The Relative Strength Index (RSI) indicates growing bullish momentum; however, on-chain metrics suggest increased distribution risk if buyers cannot absorb supply.

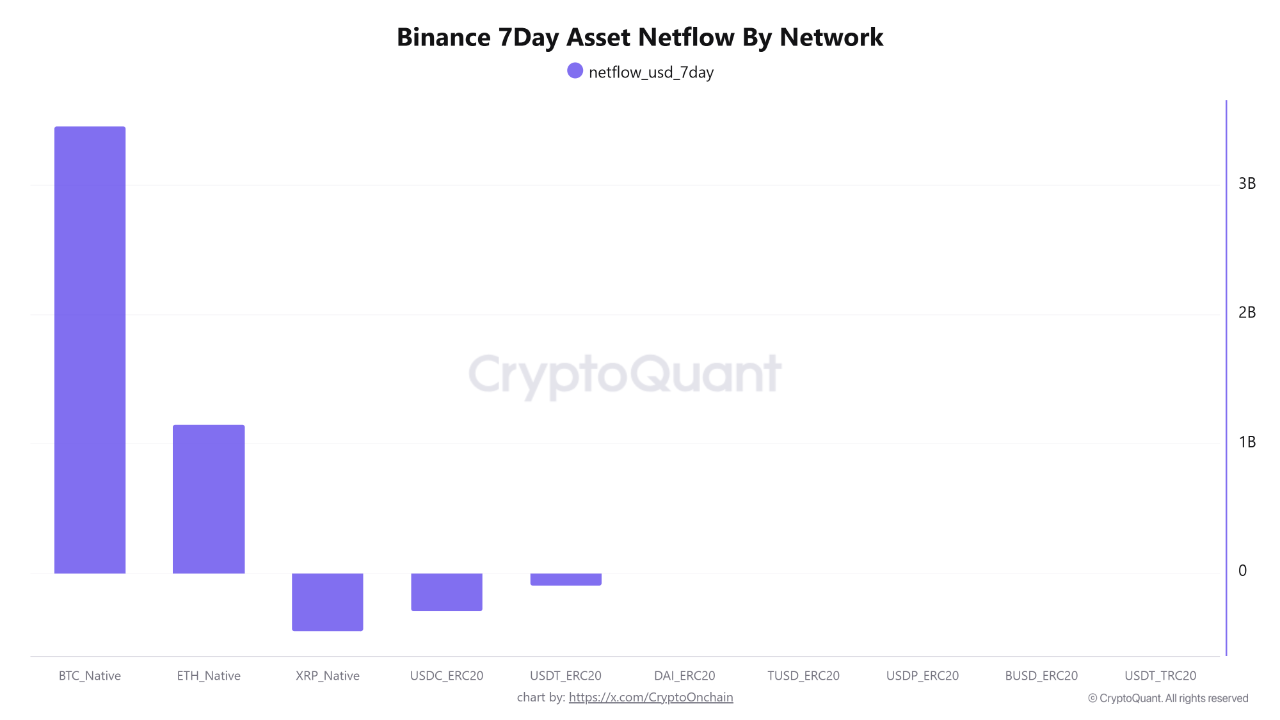

Exchange Inflows Signal Potential Sell-Side Pressure

- Binance net inflows show Bitcoin at $3.6 billion and Ethereum at $1.15 billion, indicating potential sell pressure.

- This dynamic contrasts with price action suggesting an upward attempt, as large holders may be preparing to sell near resistance.

- A failure to secure a strong daily close above $94,000 could lead to a pullback toward $85,000.

Consolidation Below Weekly Resistance

- Bitcoin stabilizes around $92,000 after a drop from $120,000, entering consolidation above former support now acting as resistance.

- BTC trades below the weekly 50-period moving average, a key resistance level in the mid-$90,000s.

- Higher lows form near $85,000–$88,000, but reclaiming the $95,000–$98,000 range is crucial for shifting to a bullish outlook.