Bitcoin Faces Strong Resistance Between $97,500 and $99,800

Bitcoin is trading at $97,600 after a sharp decline from its all-time high and a recovery from the $92,000 support level. This price movement underscores ongoing market volatility as investors navigate changing sentiments and technical indicators. Bitcoin now faces challenges in maintaining upward momentum.

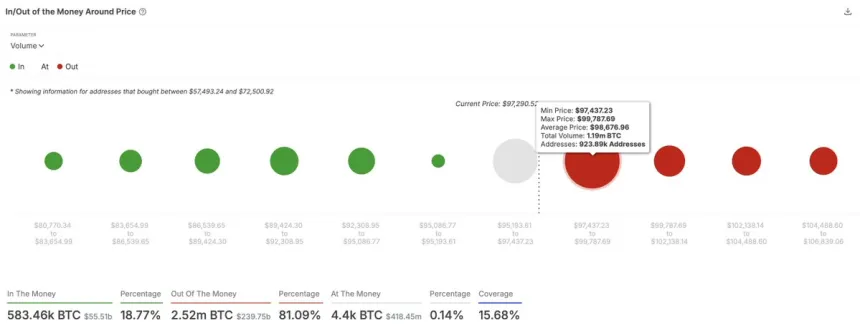

Analyst Ali Martinez noted that Bitcoin encounters strong resistance between $97,500 and $99,800, supported by 924,000 wallets that purchased over 1.19 million BTC in this range. This significant on-chain resistance may impede Bitcoin’s ability to reach the psychological $100,000 mark soon.

This area will likely determine Bitcoin's next move. A successful breakthrough could lead to further rallies, while failure might result in increased selling pressure and a retest of lower support levels. Market observers are focused on key technical and on-chain signals to assess whether Bitcoin's recovery is sustainable or if a larger correction is imminent.

Bitcoin Holding Strong

Bitcoin has seen significant price fluctuations recently, with a 15% drop followed by a quick 6% rebound within three days. This volatility reflects broader market uncertainty. Despite these fluctuations, analysts express optimism regarding Bitcoin’s outlook, noting its rapid recovery from earlier selling pressure.

Martinez shared insights on X, emphasizing the critical resistance zone Bitcoin must overcome to regain upward momentum.

This range is backed by 924,000 wallets that collectively acquired over 1.19 million BTC, potentially acting as a barrier to Bitcoin's ascent.

If Bitcoin surpasses this resistance zone, it could lead to new all-time highs. Conversely, failing to break through may increase selling pressure and consolidation below the $100,000 threshold. Currently, Bitcoin remains resilient amidst market volatility, with cautious optimism about its potential for another rally.

Technical Analysis

Bitcoin is currently trading at $98,200, demonstrating a robust recovery from the $92,000 level, which serves as a significant demand point. This reaction indicates strength in Bitcoin's price action and suggests potential bullish momentum ahead.

If BTC can exceed the critical $100,000 mark shortly, it may trigger substantial buying pressure, driving prices toward new all-time highs. However, market uncertainty persists, and a sideways consolidation phase is possible, with BTC remaining range-bound between local lows and previous highs as the market rebalances after recent volatility.

Currently, the $92,000 mark provides a solid foundation for Bitcoin, with attention focused on the $100,000 level as the next major test. Whether Bitcoin breaks out or consolidates, its resilience indicates potential for significant moves in the near term.

Featured image from Dall-E, chart from TradingView