26 0

Bitcoin Faces Resistance and Support Levels Between $103,239 and $143,170

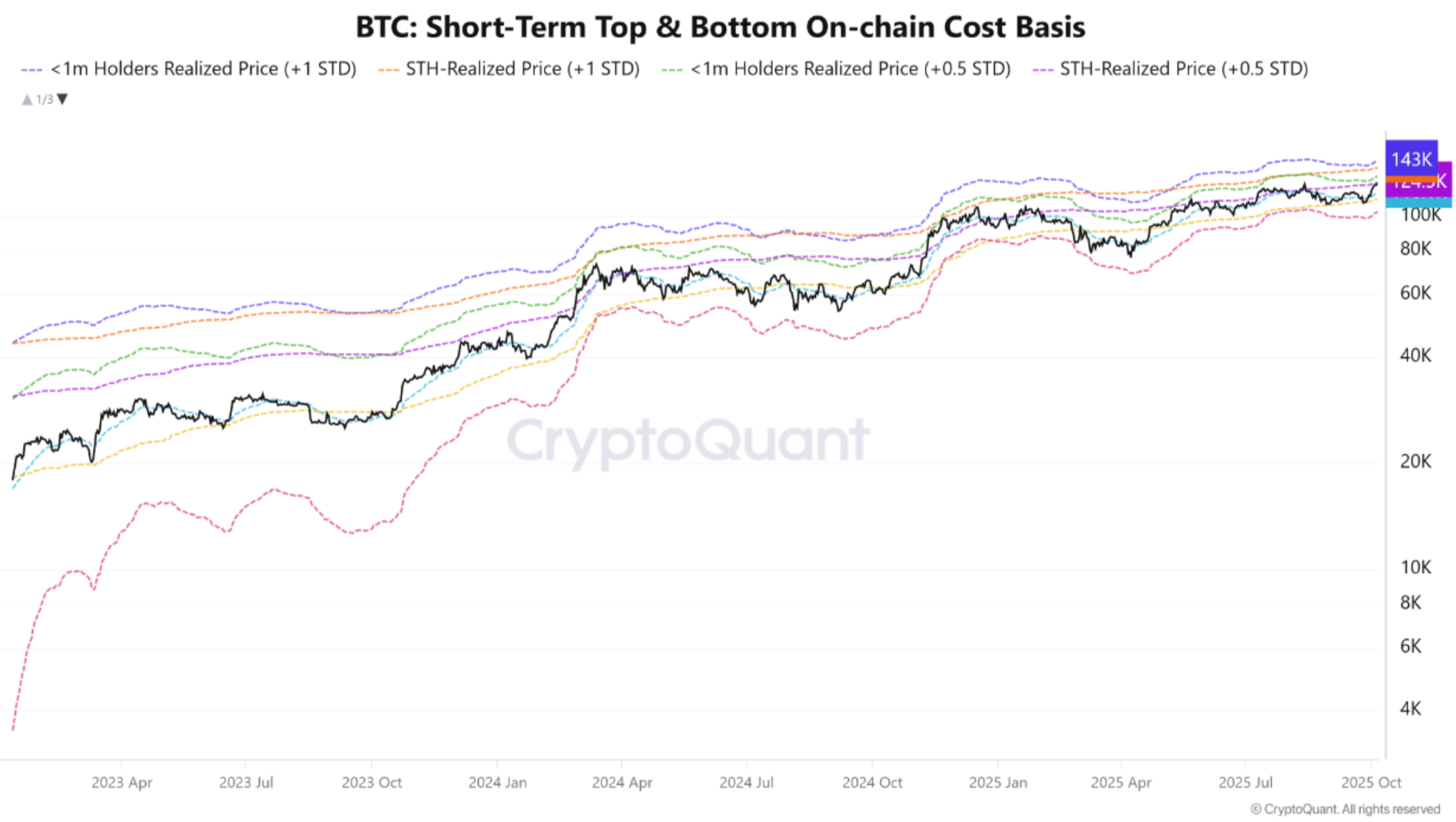

As Bitcoin (BTC) reaches new all-time highs, investors are focusing on key price levels to anticipate potential resistance points. Fresh data from CryptoQuant highlights these crucial levels.

Key Resistance and Support Levels for Bitcoin

- The Short-Term Holders (STH) Realized Price indicates important support and resistance zones.

- For holders of less than a month, the realized price with +1 standard deviation is approximately $143,170, potentially triggering selling.

- Another crucial level is $133,239 at 0.5 standard deviation.

- The STH-Realized Price with +1 standard deviation stands at $131,310.

- Current BTC spot price is slightly above a pivotal mid-point, influencing short-term market direction.

- Support levels include $117,763, $111,963, and $103,239, seen as re-accumulation zones.

Analyst Titan of Crypto suggests BTC needs to break above its ascending channel targeting $130,000, failure could lead to corrections.

Potential BTC Targets?

- Ali Martinez predicts BTC reaching $140,000 based on pricing bands.

- Alex Adler Jr. forecasts a surge to $160,000 if specific conditions are met.

- Depleting BTC reserves on exchanges might accelerate price increases.

- If BTC follows its 2021 pattern, it could target $136,000, extending to $147,000.

Currently, BTC trades at $122,113, down 2.2% over the last 24 hours.