6 1

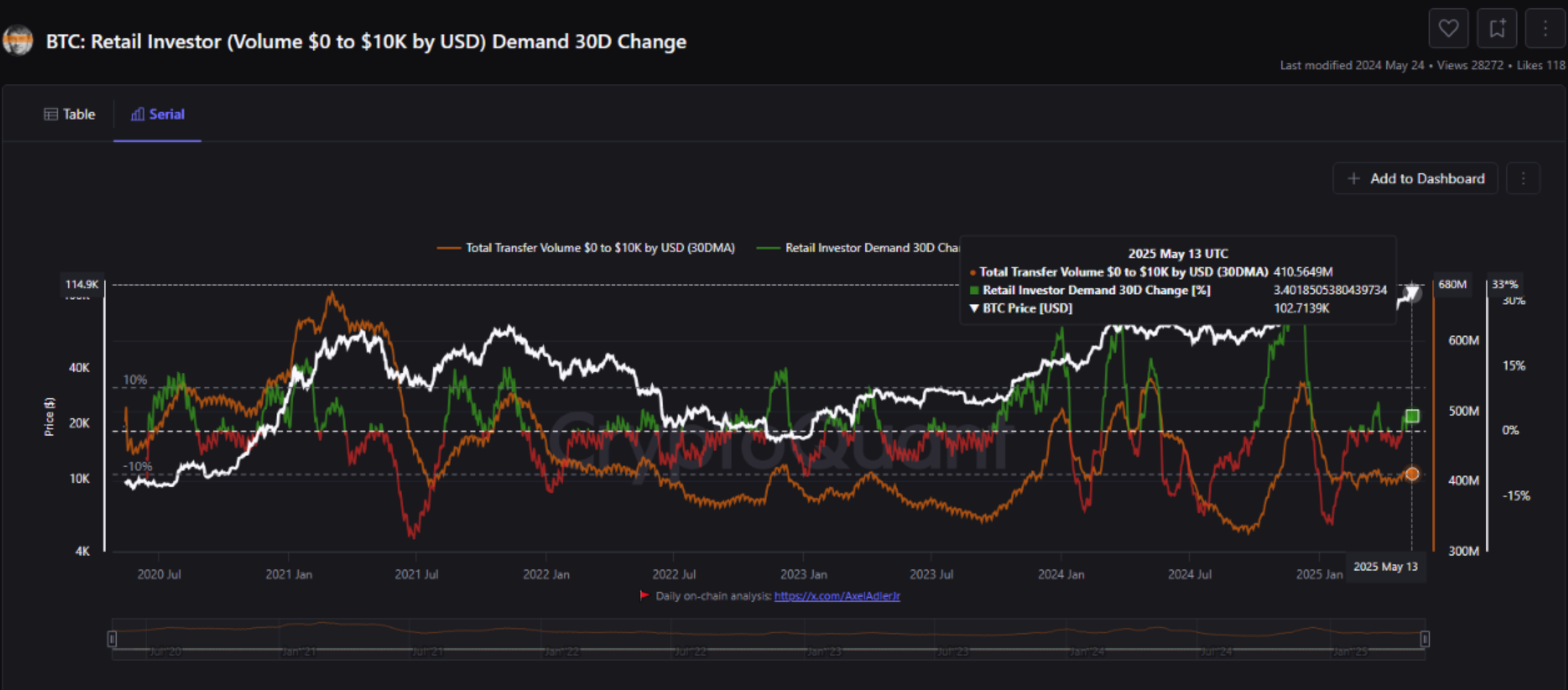

Bitcoin Retail Demand Increases 3.4% as Small Investors Re-enter Market

Retail Participation in Bitcoin Increases

On-chain data shows rising retail participation in the Bitcoin market, indicating growing confidence among smaller investors. Key points include:

- Retail investors, characterized as wallets with less than $10,000 in BTC, are re-entering the market.

- The BTC: Retail Investor 30-Day Change indicator has increased by 3.4% since April 28, signaling renewed activity.

- This trend may create a positive feedback loop, driving more buying pressure and attracting additional participants.

- If Bitcoin maintains upward momentum, retail investors might diversify into other crypto assets, potentially benefiting the broader market.

- Monitoring on-chain indicators like active addresses and transaction volume is crucial as these often correlate with retail activity.

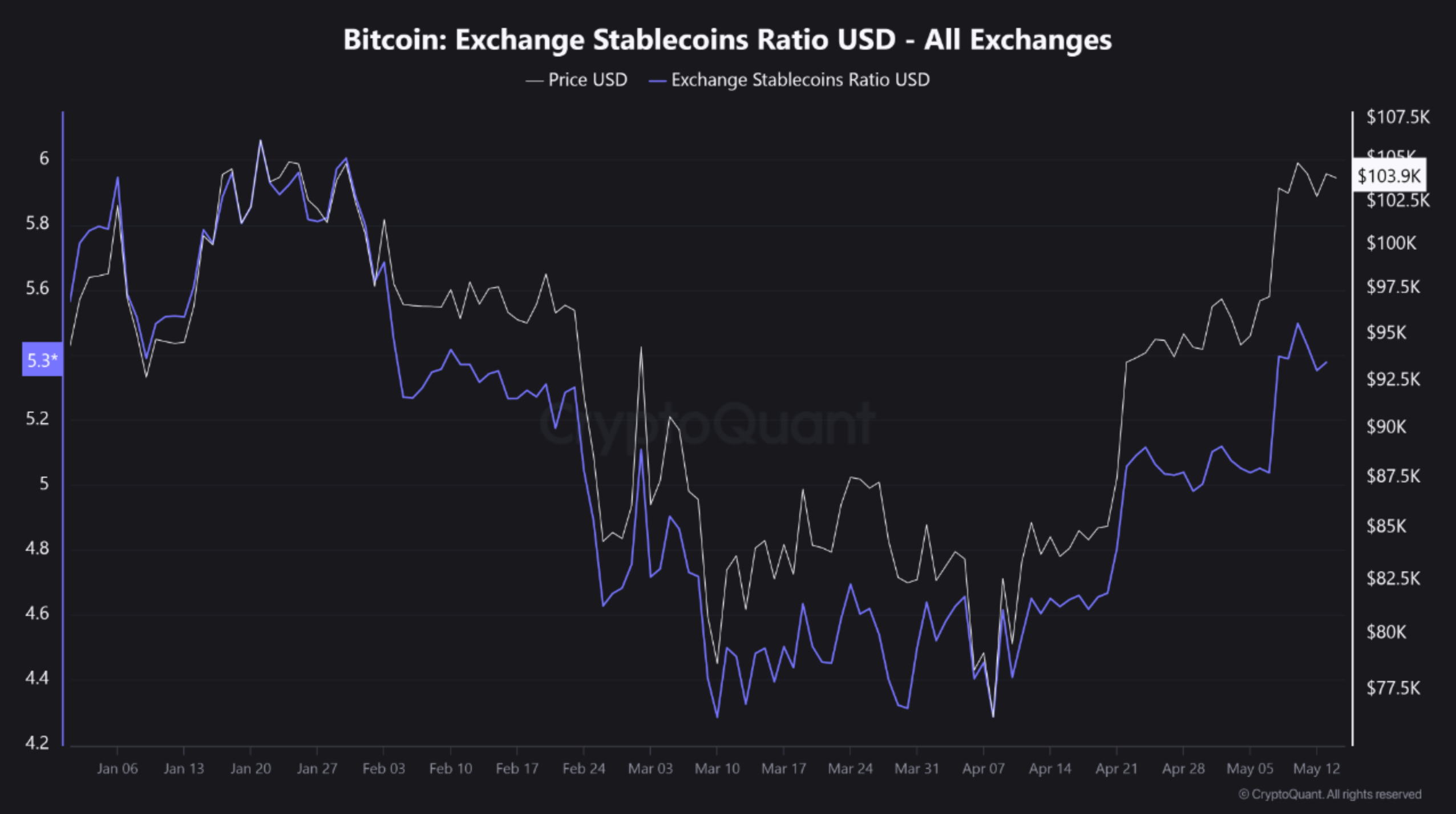

Cautionary Signals for Bitcoin

Despite encouraging retail interest, several warning signs suggest caution:

- The Exchange Stablecoins Ratio recently rose to 5.3 during Bitcoin’s rally to $104,000, indicating potential selling pressure as BTC reserves exceed stablecoin balances.

- A previous similar spike to 6.1 in January led to a significant price correction, hinting at investor rotation back into cash.

Bitcoin remains bullish, trading at $103,993 with a 0.3% increase in the past 24 hours. The Stochastic RSI indicates renewed strength, suggesting the potential for continued rally.