4 0

Bitcoin Retreats From $108K As Institutional Interest Grows

Recent developments highlight the increasing institutional adoption of cryptocurrencies, particularly Bitcoin (BTC).

- Bill Pulte, director of the Federal Housing Finance Agency, directed Fannie Mae and Freddie Mac to consider cryptocurrency as an asset for mortgage purchases.

- The crypto market capitalization reached $3.31 trillion, with a 1% increase in the past day.

- BTC peaked at over $108,000, reflecting positive sentiment amid regulatory changes and increased liquidity.

- Spot BTC ETFs saw a net inflow of $548 million, marking twelve consecutive days of positive flows.

- Metaplanet purchased 1,234 BTC and raised $515 million for treasury strategies.

- Bit Digital shifted focus from BTC mining to Ethereum (ETH) staking.

- The Hong Kong Government issued a policy statement aimed at enhancing digital asset regulations and use cases.

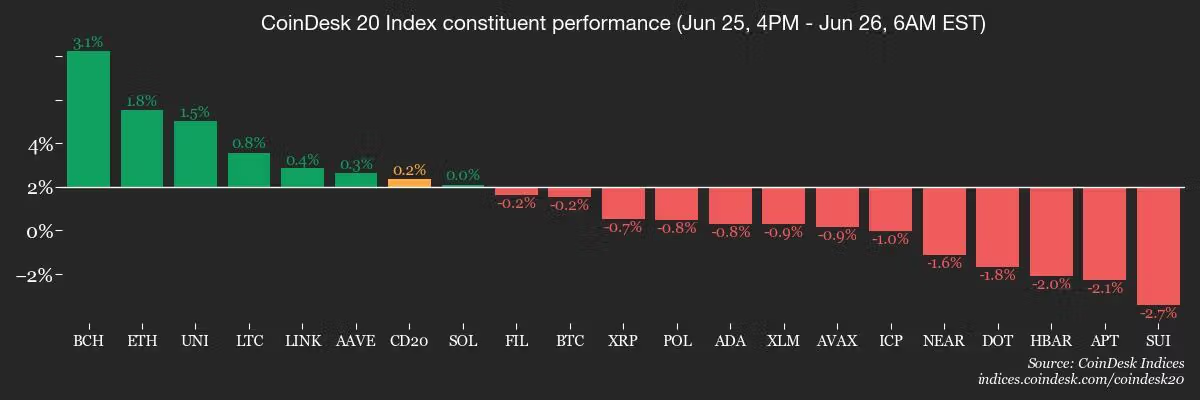

Market Movements

- BTC is down 0.37% at $107,446.08.

- ETH is up 1.29% at $2,473.17.

- CME Futures Open Interest for BTC reached 159,850 BTC.

Bitcoin Stats

- BTC Dominance: 65.65%

- Total Fees: 4.81 BTC / $515,528

- Hashrate: 803 EH/s

Upcoming Events

- June 30: CME Group plans to introduce spot-quoted futures for BTC and ETH, pending regulatory approval.

- June 26: U.S. Census Bureau to release May durable goods orders data.

- June 27: Fed Governor Lisa D. Cook will speak at a Fed Listens event.

Technical Analysis

- A potential "golden cross" may occur as the 50-day SMA approaches the 200-day SMA for the BTC/BCH pair.