11 0

Bitcoin Climbs 10% as TVL Rises $400M Amid US-China Talks

Bitcoin price increased by 2% from $111,200 to $113,800 on October 26. Bitcoin-DeFi protocols saw an increase of $400 million in TVL deposits, indicating a shift towards yield-bearing BTC positions.

Market Events

- Bitcoin reached a 10-day high near $114,000 as President Trump prepared to meet China's Xi Jinping to discuss trade relations.

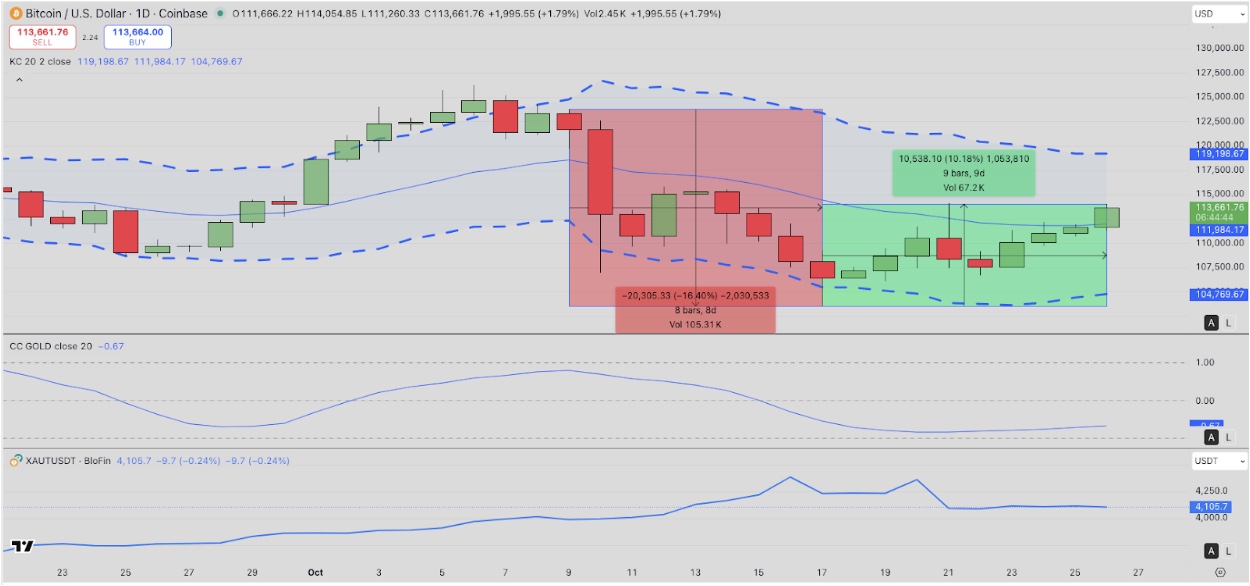

- From October 17 to October 26, Bitcoin recovered nearly 10% from previous losses, rising from $103,500 to $113,800.

- Gold declined 6% from its peak of $4,381 per ounce on October 18, trading at $4,103.

Recent Volatility

- The market experienced volatility due to Trump's tariff deferment and the U.S. government shutdown, causing capital flight to safe-haven assets and a $19.4 billion liquidation in crypto derivatives markets.

- Bitcoin fell 16% from $123,800 to $103,500 between October 10 and October 17, while Gold rose 12% during that period.

Investment Trends

- Investors shifted funds from Gold to Bitcoin, increasing Bitcoin's TVL in DeFi protocols from $7.8 billion to $8.2 billion in ten days.

- Lyn Alden commented that Bitcoin is now competing more with equities than with Gold, offering attractive risk-adjusted yields.

Outlook

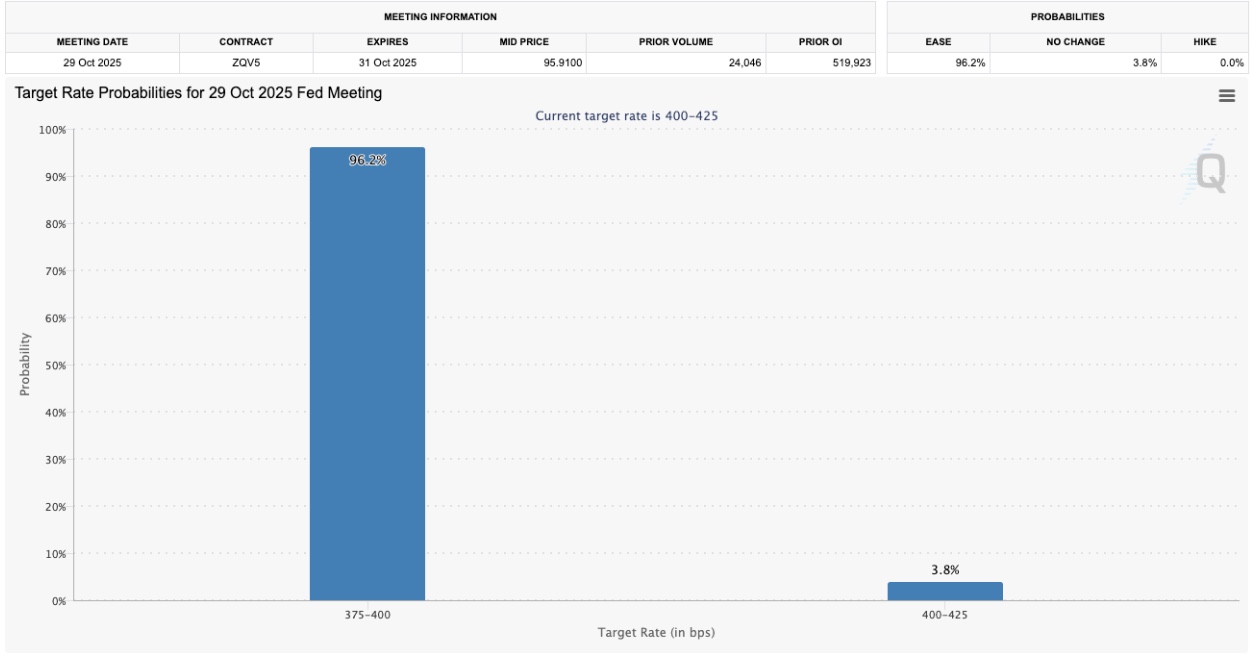

- The market awaits two key events: the Federal Reserve’s policy meeting on October 29 and the Trump–Xi summit on October 30.

- There is a 96.2% probability of a rate cut expected by investors. Positive trade talks or a dovish Fed decision could push Bitcoin toward $115,000-$118,000, while geopolitical tensions or monetary tightening might cause a pullback to $109,000.