3 0

BEARISH 📉 : Bitcoin risks falling below $60K with upcoming inflation data

The crypto market, including Bitcoin, is anticipating potential volatility ahead of the delayed January US inflation data release. Bitcoin is currently near $68K, struggling to stabilize after recent corrections due to changing macroeconomic expectations.

Key Points:

- US inflation data's impact is heightened after a robust January jobs report, with 130,000 nonfarm payroll additions and unemployment dropping to 4.3%.

- UBS Global Wealth Management anticipates two 25-basis-point rate cuts by the Federal Reserve in June and September.

- President Trump's nomination of Kevin Warsh, a pro-Bitcoin advocate, as Federal Reserve Chair may alter long-term monetary policy, impacting risk assets like Bitcoin.

Market Outlook:

- If the CPI exceeds 2.5%, Bitcoin could fall below the $60,000 support zone, where institutional buy orders are concentrated.

- A lower-than-expected inflation reading might push Bitcoin towards the $74,400 resistance level.

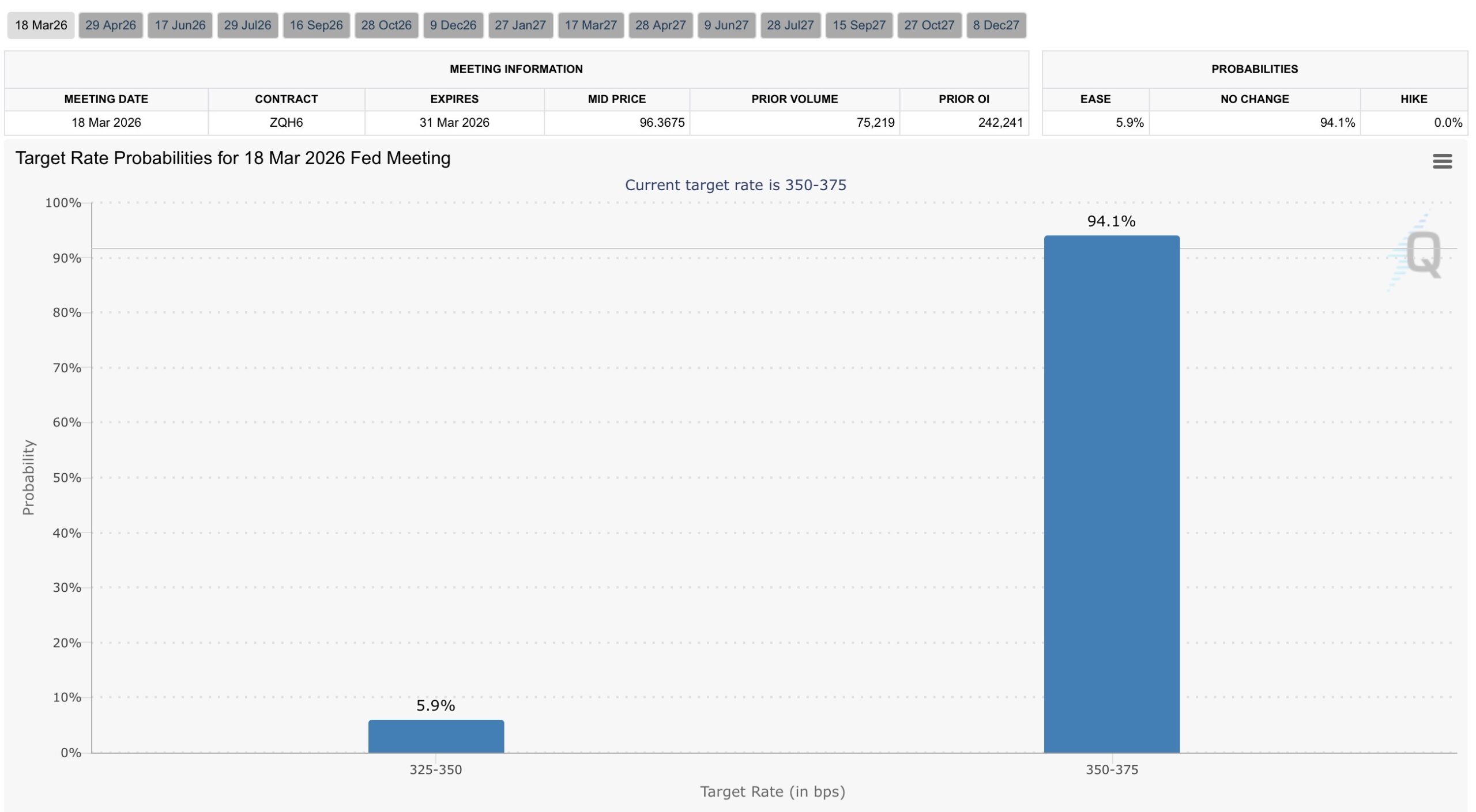

- CME FedWatch tool indicates a 95% probability of maintaining current interest rates at 3.50%-3.75% in the near future.

Tim Sun from HashKey Group highlights that positive economic news, such as strong growth, currently leads to negative market reactions by delaying liquidity boosts.

While some analysts see signs of recovery from the crypto winter starting January 2025, immediate market movements hinge on this week's critical data release.