$212 Million Bitcoin Sell Order Vanishes, Causing Market Volatility

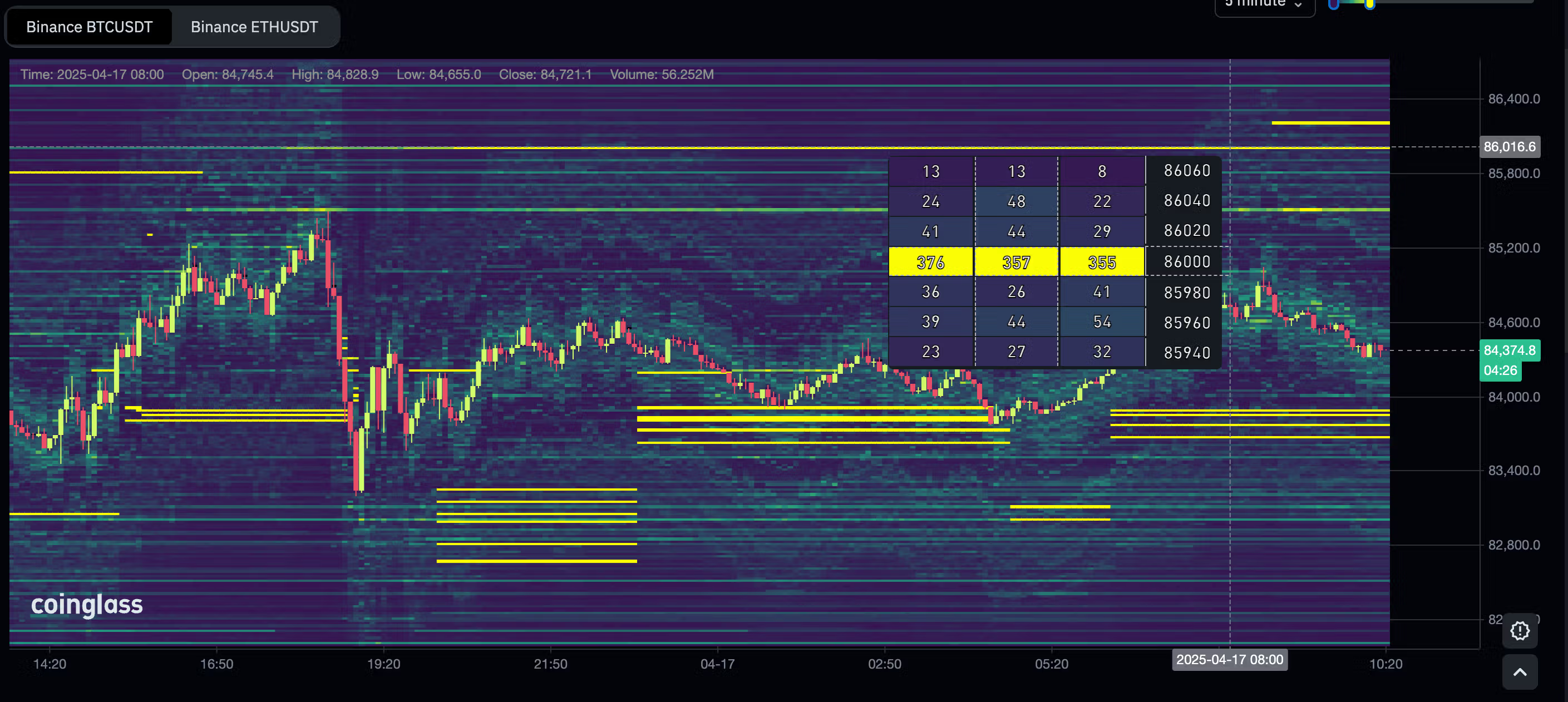

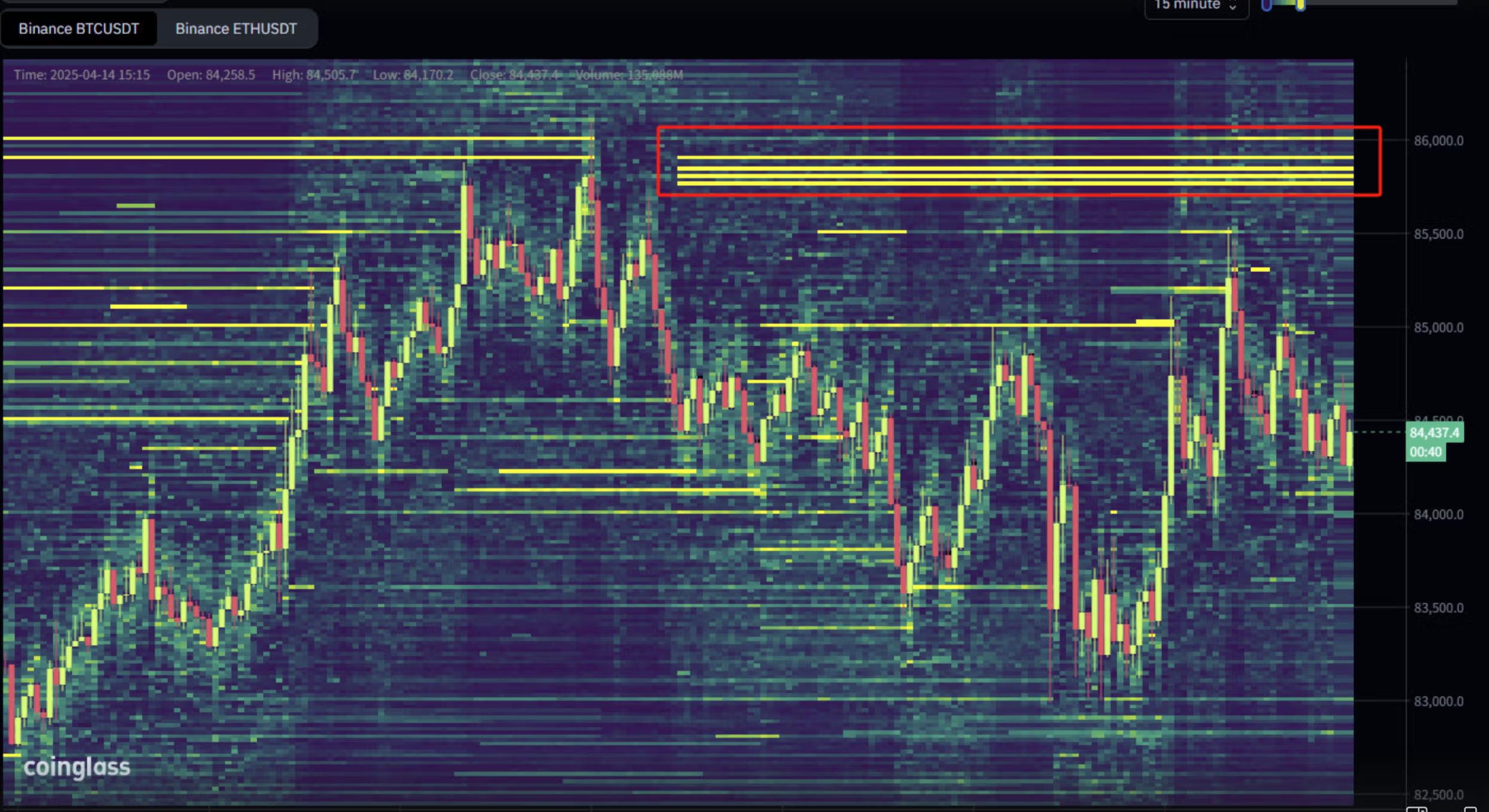

On April 14, a sell order for 2,500 bitcoin, valued at approximately $212 million, was placed on Binance at $85,600, above the current spot price. This order influenced the market, causing bitcoin prices to approach this level before the order was suddenly removed. The event led to increased market volatility as traders reacted to the sudden absence of liquidity.

The manipulation technique known as "order spoofing" may have been used, defined as placing large orders with no intention to execute them, creating false market signals. This practice is illegal under the U.S. Dodd-Frank Act.

The order's placement coincided with low liquidity periods in the bitcoin market and was removed when U.S. markets opened, likely exacerbating price movements and trader chaos. The incident resurfaced concerns about manipulative trading practices in crypto markets, particularly those that remain less regulated compared to traditional finance.

Key Points

- Large sell order created artificial resistance level

- Order removal caused market volatility

- Order spoofing raises regulatory concerns

- Binance asserts commitment to preventing manipulation

- Market manipulation remains prevalent in low-liquidity environments

- Calls for improved regulations and exchange surveillance

Experts highlighted that systemic vulnerabilities exist in unregulated markets, making retail traders susceptible to manipulation tactics. The need for stronger oversight from both regulators and exchanges was emphasized to foster fair trading environments.