6 0

Bitcoin Faces Moderate Sell Pressure, Consolidates Below $90K Amid Market Shift

Bitcoin ended the year with a minor 6% decline, breaking its traditional four-year cycle of one red year followed by three green years. This shift hints at changing market behavior rather than significant weakness.

- On-chain analysis shows aggressive buying peaking around New Year but fading since, with increased sell-side pressure.

- The indicator remains in a moderate negative range, suggesting sell pressure but not capitulation.

- Historically, such conditions lead to heightened downside sensitivity, indicating potential vulnerability if demand doesn't recover.

Derivatives Momentum Turns Cautious

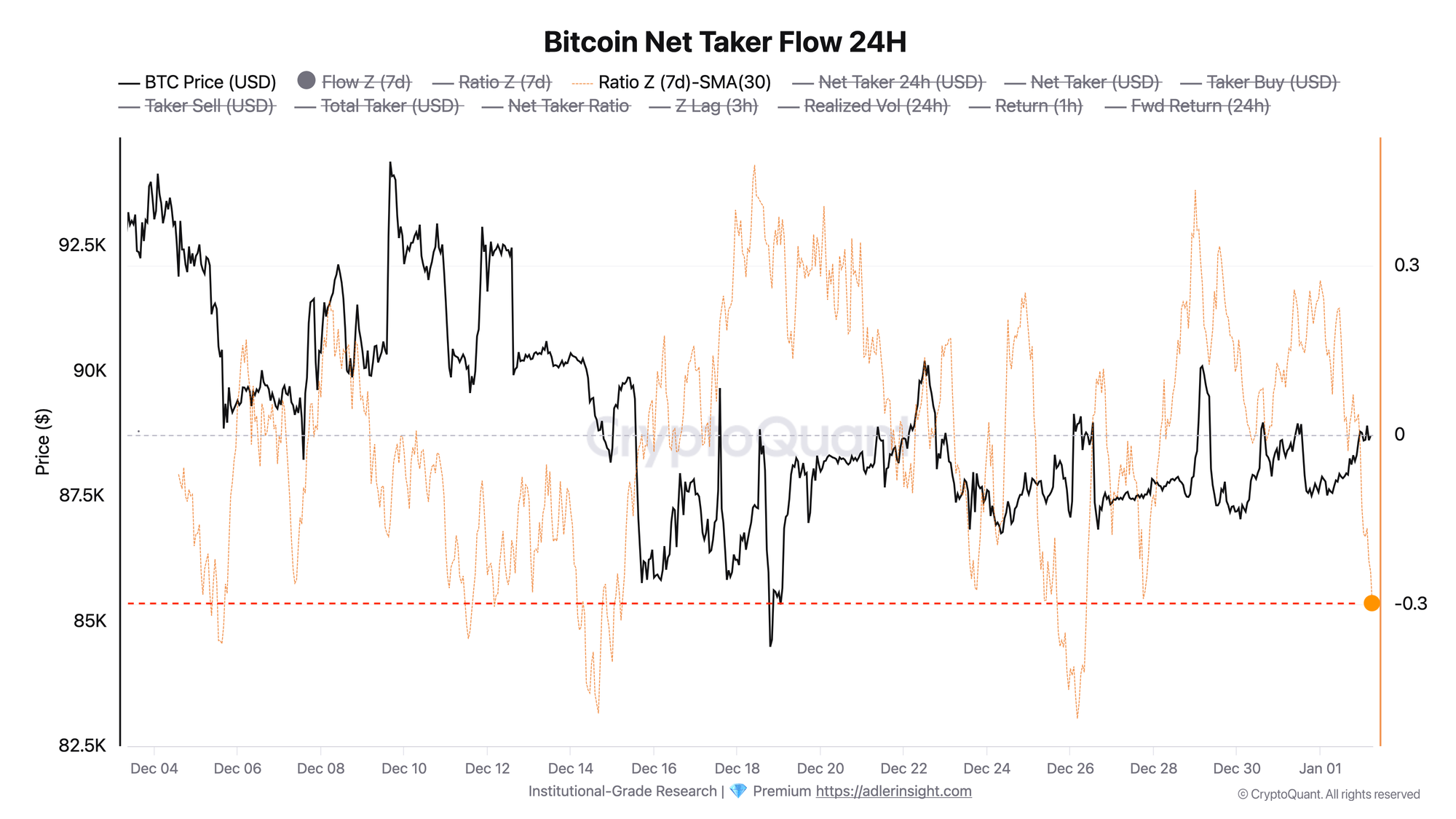

Data indicates a shift in trader behavior, with Bitcoin Net Taker Flow momentum turning negative. This suggests moderate bearish pressure as both cumulative pressure and short-term momentum weaken together, signaling broader sell-side aggression.

- If momentum weakens further beyond -0.4, deeper downside risk may emerge.

- Current conditions reflect controlled selling pressure, indicating bearish forces have upper hand.

Bitcoin Holds Key Support

Bitcoin is consolidating between $88,000–$90,000 after a pullback, with prices below short and medium-term moving averages. The 50-period average acts as resistance, while the 100-period average is flattening.

- The price remains above the upward sloping 200-period average, indicating no complete breakdown in structure.

- Volume decrease during sideways movement shows lack of conviction from buyers and sellers.

- Failure to rise above $92,000–$95,000 highlights weak demand at higher levels.

- Consolidation likely continues unless support at $85,000–$88,000 breaks, which may lead to deeper retracements.