22 2

Bitcoin Market Could Experience September Crash, Analyst Predicts

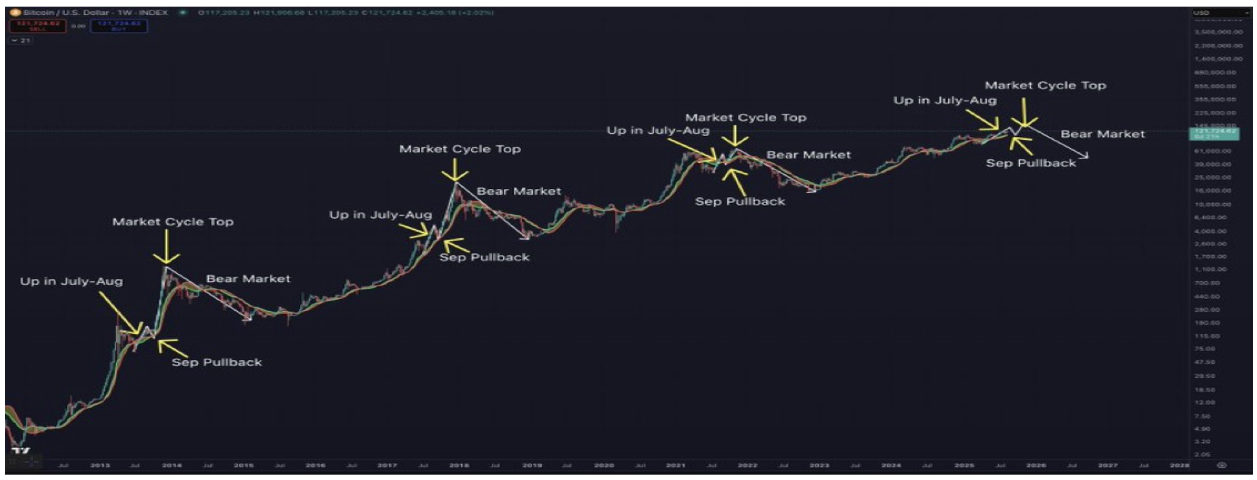

Recent technical analysis indicates that Bitcoin (BTC) and the broader crypto market may be following historical post-halving cycle patterns. The analysis suggests a pattern of market rallies in July and August, followed by potential declines in September, before reaching a cycle peak later in the year.

September Presents Risks

- Crypto analyst Benjamin Cowen identifies recurring patterns in BTC's price movements linked to past post-halving cycles.

- Historically, BTC has rallied in July and August, leading to optimism, but typically experiences a crash in September.

- This seasonal trend has been observed across multiple cycles, notably in 2013, 2017, and 2021.

- Post-peak periods have historically resulted in significant bear markets, following strong mid-summer performance.

- The current cycle mirrors these trends, with indications of an approaching pullback in September.

Market Growth Potential

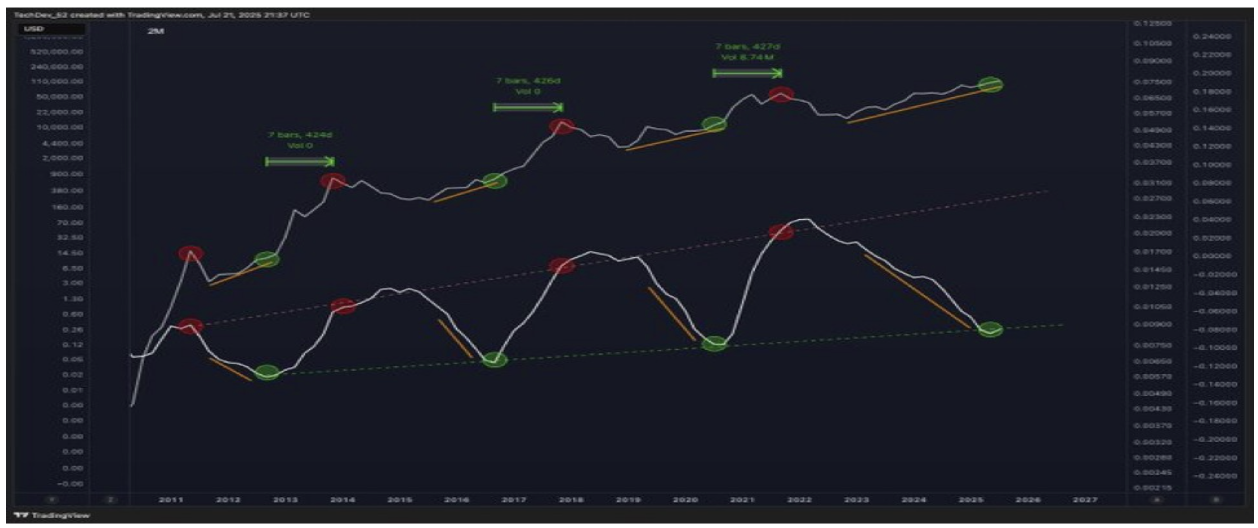

- TechDev's analysis suggests that the current market may not be near its peak, contrary to some beliefs.

- Historical data shows market tops occur around 14 months after specific cyclical signals.

- Projections indicate that BTC may still have room for growth, transitioning out of its corrective phase.

- If historical patterns hold true, the market could enter a prolonged growth phase instead of nearing exhaustion.