2 0

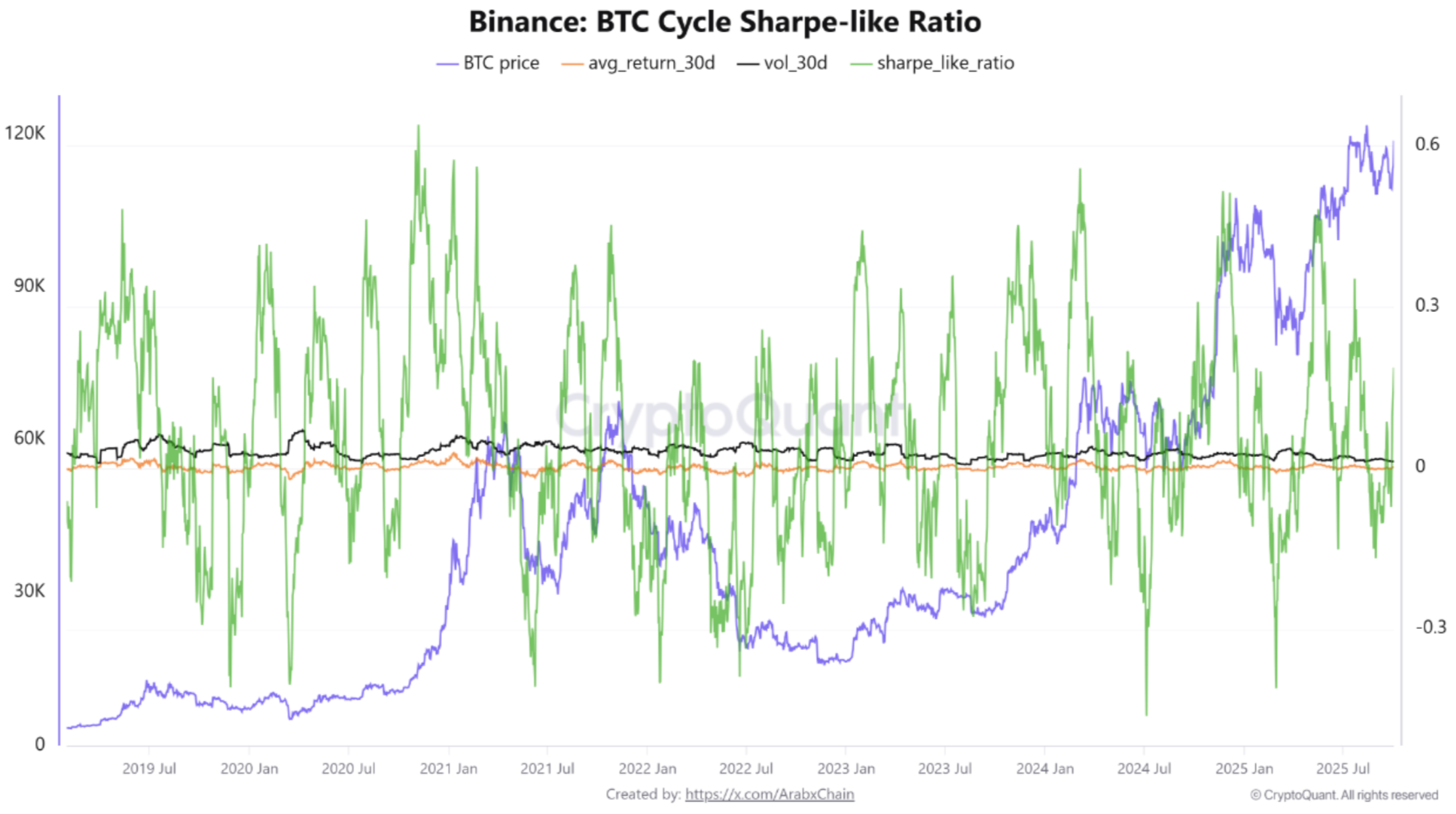

Bitcoin Sharpe-Like Ratio Indicates Stable Market Around $119,000

Bitcoin (BTC) is approaching its all-time high of $124,128, but Binance reports indicate that its gains are closely matched by the asset's volatility risks.

Risk-Reward Analysis

- Binance data shows BTC maintaining a balanced risk-reward profile with a Sharpe-like ratio at 0.18, close to neutral.

- A Sharpe-like ratio above 0.5 indicates attractive returns relative to risk, whereas a negative reading suggests higher risk than reward.

- In 2024, the ratio was often negative due to market volatility, while early 2025 saw strong uptrends with elevated ratios.

- The current market is stable, trading near $119,000, with a 30-day average return of 0.26% and volatility at 1.37%.

Future Prospects

- The market awaits a bullish catalyst or strong inflows for further growth.

- If the Sharpe-like ratio falls below zero, a price correction may occur.

- Sustained ratio above 0.5 and a breakout above $120,000-$122,000 could signal a new upward trend.

- On-chain data shows potential for a rally as short-term holder SOPR slightly recovers to 0.995.

- BTC must maintain the $90,000 support level to avoid a bear market.

Currently, BTC is priced at $118,788, reflecting a 1.3% increase in the last 24 hours.