7 0

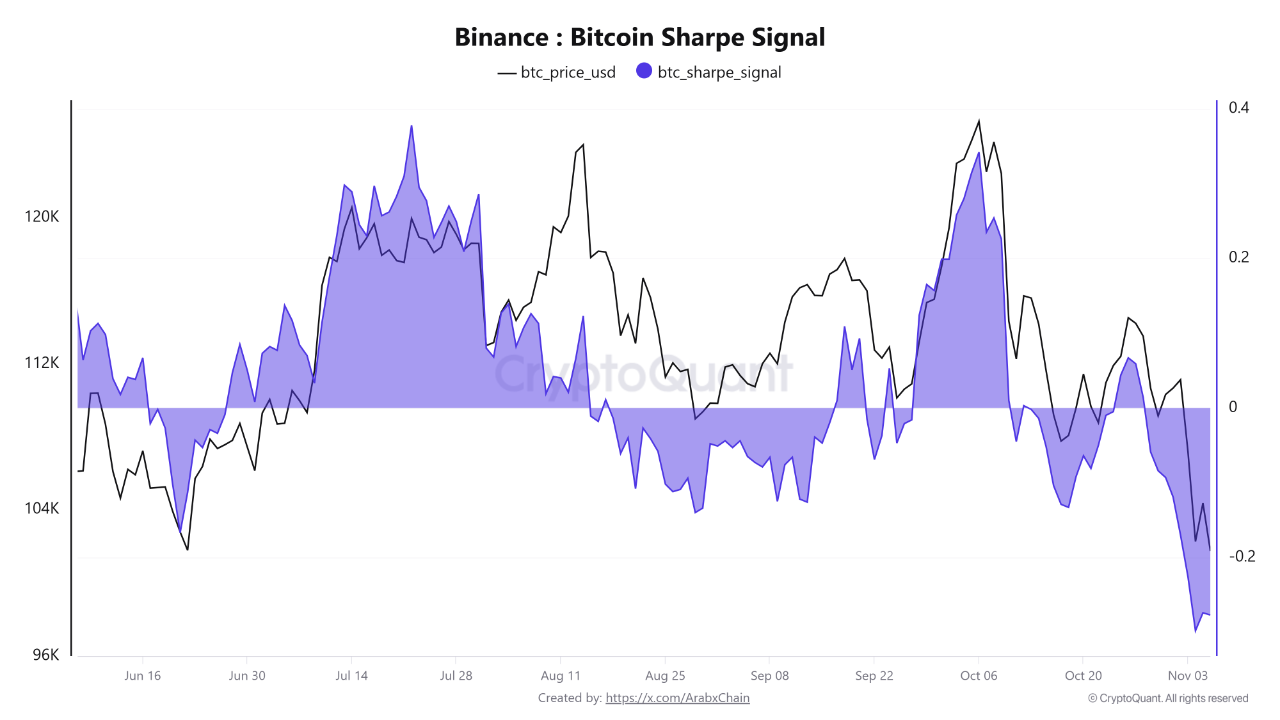

Bitcoin Sharpe Signal Turns Negative Indicating Potential Price Corrections

The price of Bitcoin has faced challenges in November, fluctuating below the $100,000 mark. Despite a current state of calm, on-chain data suggests potential short-term price corrections.

Risk-Adjusted Returns Decline for Bitcoin

- CryptoQuant's Arab Chain reports increased risks for Bitcoin investors on Binance, focusing on the Sharpe Signal metric.

- A high Sharpe Signal indicates favorable risk-reward returns, while a low or negative reading points to volatility over returns.

- Recently, the Sharpe Signal dropped to -0.277, coinciding with Bitcoin's dip to $101,747, reflecting a decline in risk-adjusted return quality.

- Previously, from July to September, the Sharpe Signal was above 0.2, aligning with positive Bitcoin momentum.

Bitcoin Price Outlook

- Despite a weakening Sharpe Signal, full-scale capitulation is not evident as trading volume remains stable.

- The decline is not driven by liquidations but indicates reduced institutional involvement, suggesting a temporary correction phase.

- If the Sharpe Signal remains negative, further short-term corrections are possible. A positive shift could signal a local price bottom.

- Currently, Bitcoin is valued at approximately $101,750, with no significant change in the last 24 hours.