Updated 1 January

Bitcoin Short-Term Holder Realized Price Now at $86,800

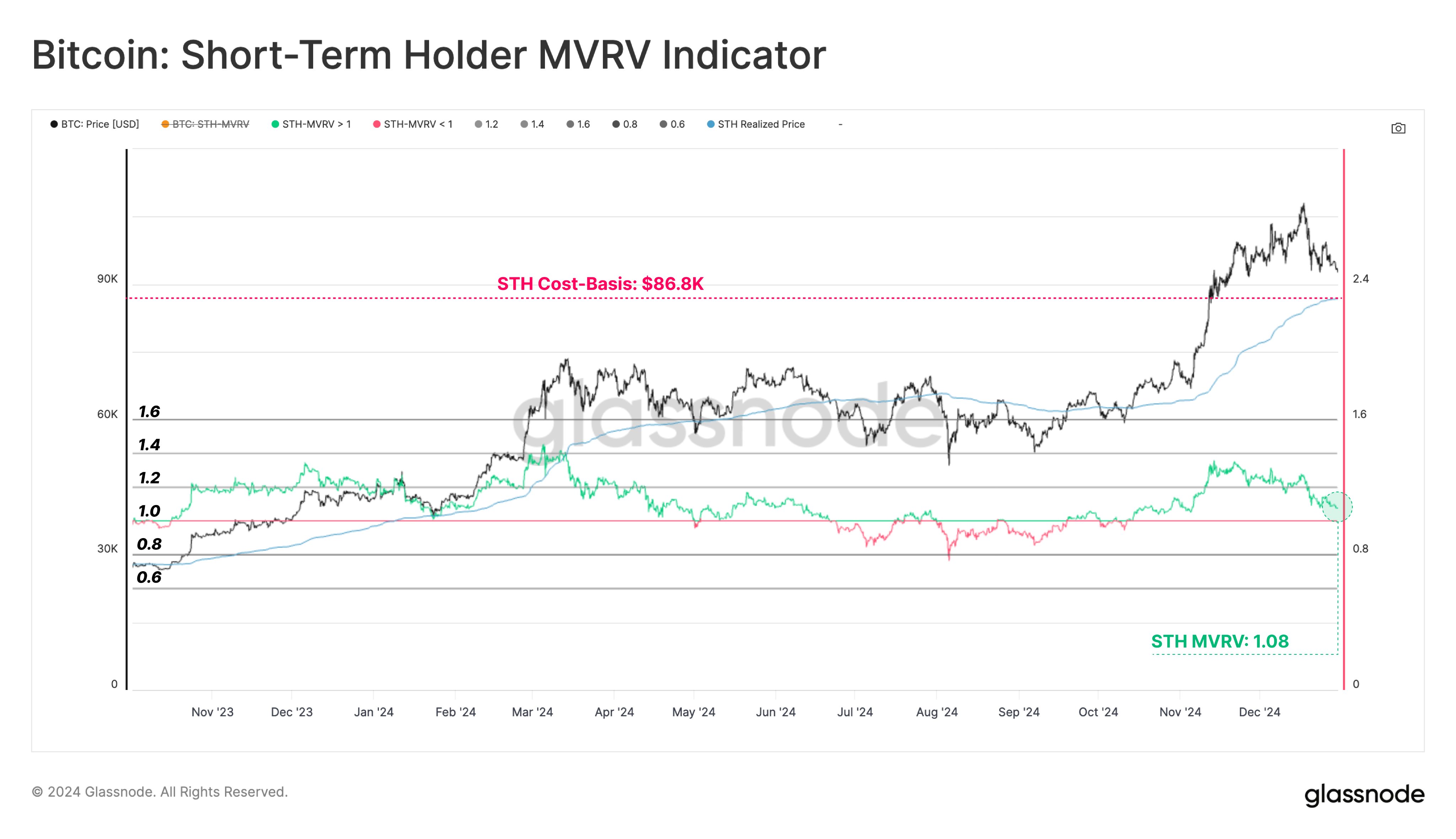

On-chain data indicates the Realized Price of Bitcoin short-term holders is currently $86,800, a key level to monitor.

Bitcoin's Gap from Short-Term Holder Cost Basis

Glassnode recently analyzed the profit-loss status of Bitcoin short-term holders. The relevant metric is the Market Value to Realized Value (MVRV) Ratio, which compares Bitcoin’s Market Cap to its Realized Cap. The Realized Cap reflects the total capital invested in Bitcoin based on transaction prices, while the Market Cap shows the current value held by investors. The MVRV Ratio indicates the overall profit-loss condition of the network.

The specific MVRV Ratio for short-term holders (STHs), defined as those who acquired Bitcoin within the last 155 days, is of particular interest. The chart below illustrates the trend in the Bitcoin STH MVRV Ratio over the past year:

The graph shows that the Bitcoin STH MVRV Ratio spiked above 1 during the recent BTC rally, indicating that the group was in a state of profit. Despite recent price declines, the ratio remains above 1, suggesting the average holder still has unrealized gains of around 8%. However, this cohort is known for rapid sell-offs, raising concerns about potential price drops.

The STH Realized Price, derived from the Realized Cap divided by the total number of tokens in circulation, currently stands at $86,800. This means that if Bitcoin's price falls to this level, short-term holders would break even.

BTC Price Update

Bitcoin briefly dropped below $92,000 but has rebounded and is now trading around $94,500.