Bitcoin Short-Term Holder Profit-Taking Remains Low After $71,200 Rally

On-chain data indicates that Bitcoin short-term holders are taking minimal profits despite the recent price rally.

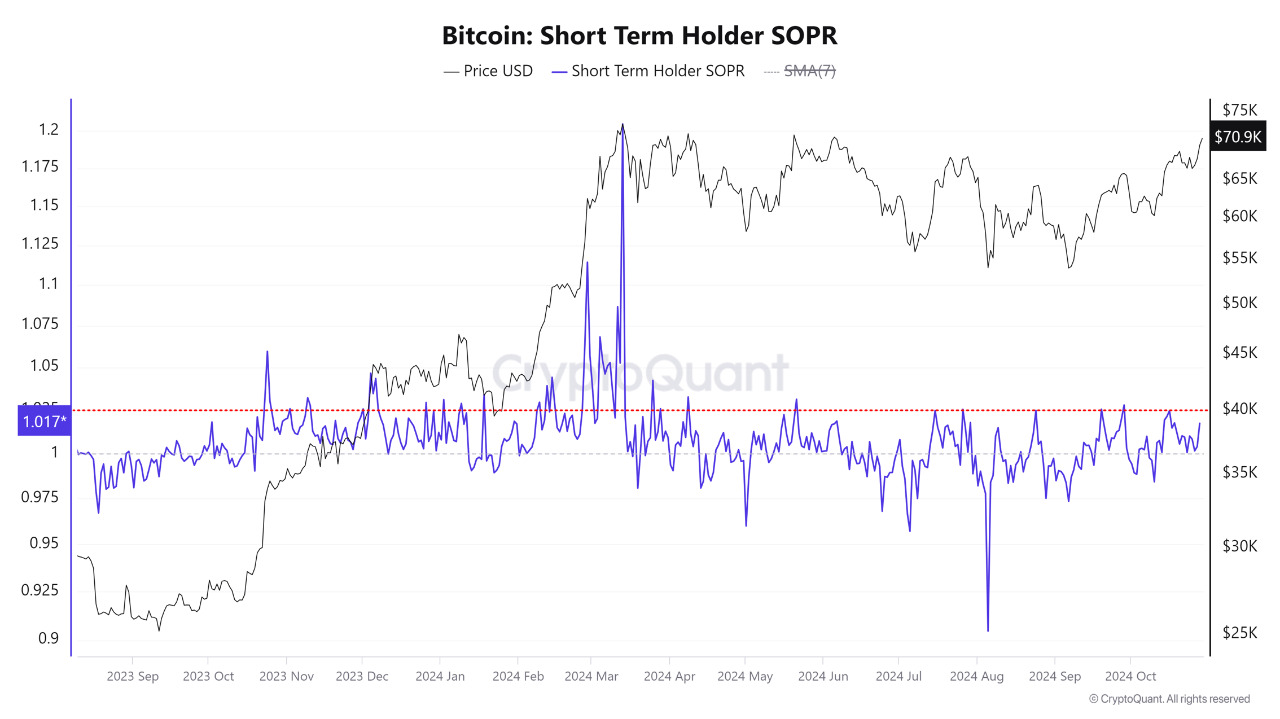

Bitcoin Short-Term Holder SOPR Is Currently At Relatively Low Levels

An analyst from CryptoQuant noted that the short-term holder Spent Output Profit Ratio (SOPR) remains below levels that typically signify overheated conditions for Bitcoin over the past year. The SOPR measures whether Bitcoin investors are selling at a profit or loss, with values above 1 indicating profit and below 1 indicating loss.

This discussion focuses on short-term holders (STHs), defined as those who purchased Bitcoin within the last 155 days. Generally, newer holders are less resilient and more susceptible to panic selling during market fluctuations.

The following chart illustrates the trend in Bitcoin STH SOPR over the past year:

The graph shows that the Bitcoin STH SOPR has recently been above 1, suggesting net profit realization among this group. Following Bitcoin's bullish movement past $71,000, the metric increased to 1.017. However, this value is not significantly high; historically, the indicator has indicated overheated conditions above 1.03 during consolidation phases. The current SOPR is below this threshold.

This suggests potential for further price growth before STH profit-taking becomes a concern. Monitoring the SOPR will provide insights into possible future price movements.

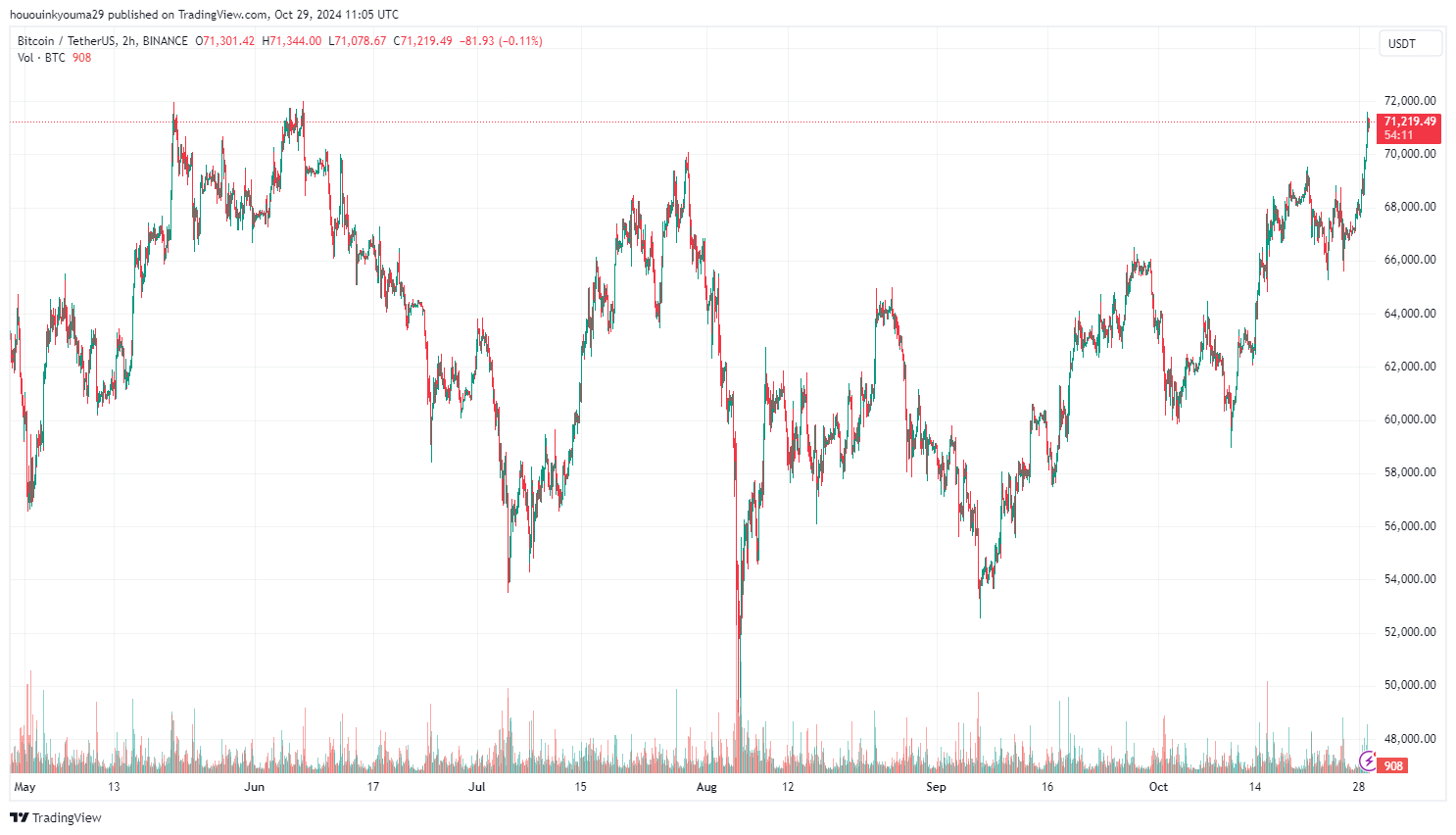

BTC Price

Bitcoin is currently priced at $71,200, approaching the highs recorded in June.