5 0

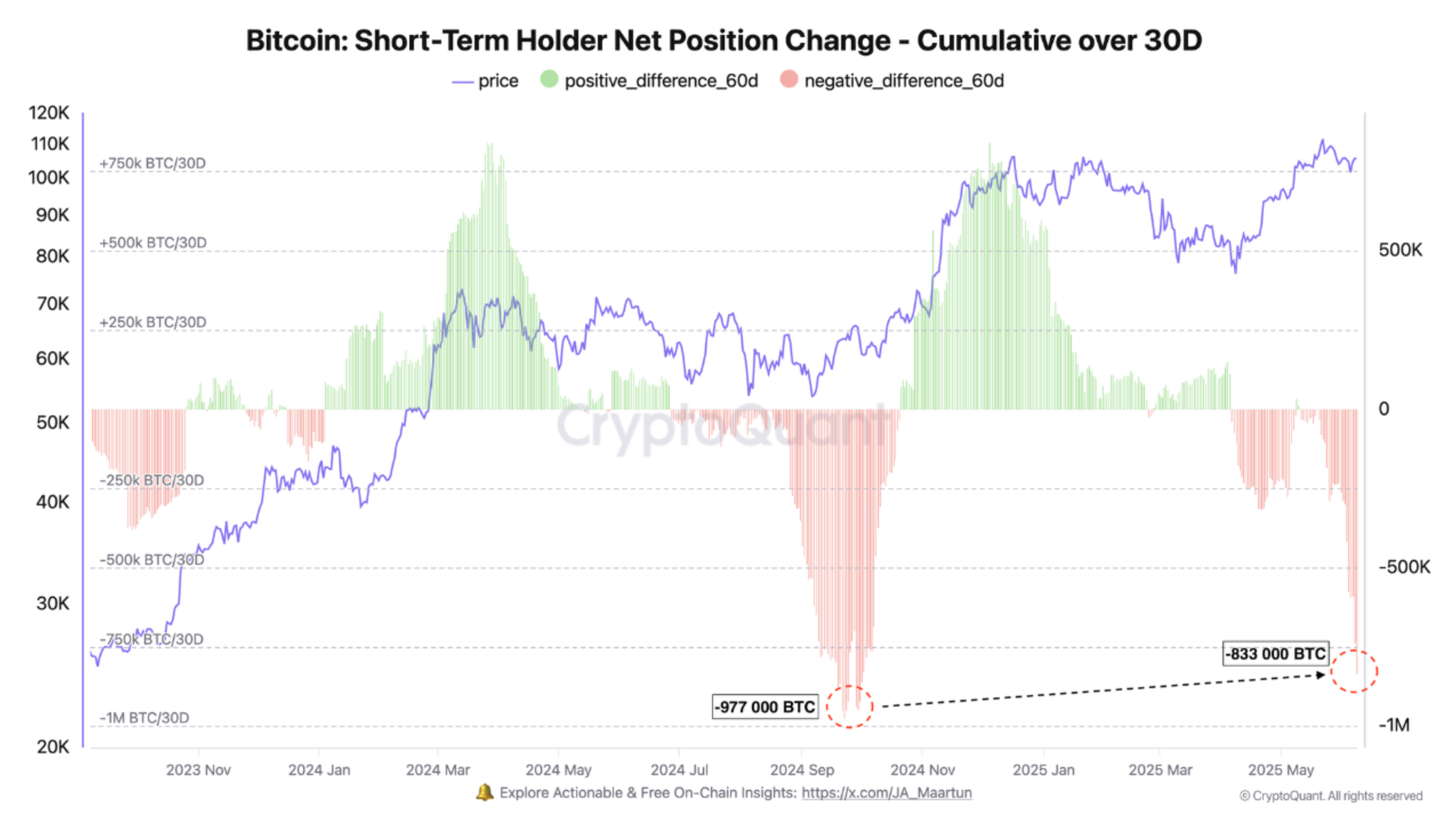

Bitcoin Short-Term Holder Selling Reaches 833,000 BTC During Pullback

Bitcoin (BTC) faced pressure near the $100,000 mark, leading to concerns among short-term holders (STH) about a potential price correction. STHs, defined as those holding BTC for less than 155 days, showed a significant negative net position change of -833,000 BTC over the past month.

Key Points

- STH net positions turned sharply negative despite BTC remaining above $100,000.

- The current cumulative net position change is less severe than the -977,000 BTC seen during the April crash.

- Investor behavior mirrors that of previous market dips, indicating increased sensitivity to price movements.

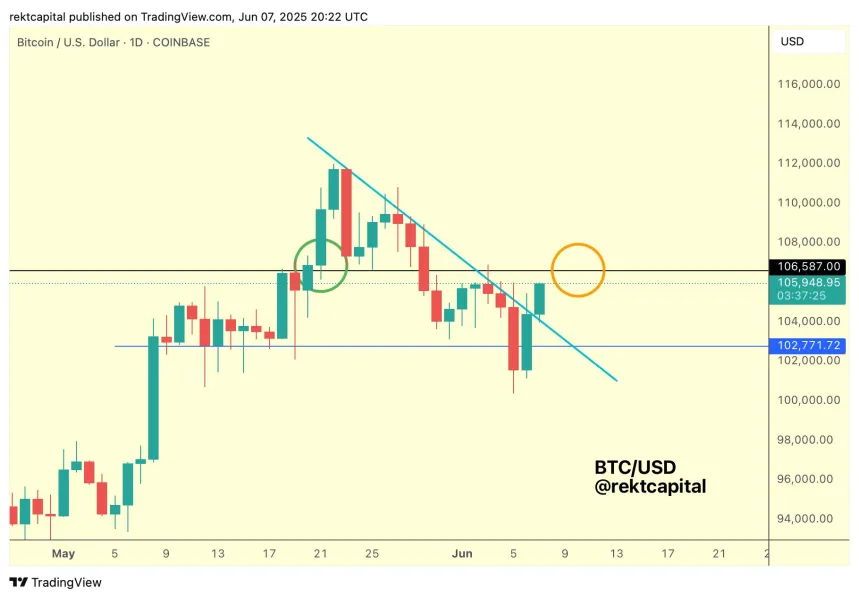

Despite recent challenges, Bitcoin displayed signs of recovery. It broke through resistance at $106,600, with analysts suggesting potential targets of $108,300 or $110,000 if momentum persists. Technical indicators and on-chain data suggest further bullish movement may occur due to prime buying signals and negative funding rates on Binance.

Considerations

- Long-term holders are exiting the market, raising volatility concerns.

- BTC is currently trading at $107,627, reflecting a 1.9% increase in the last 24 hours.