7 1

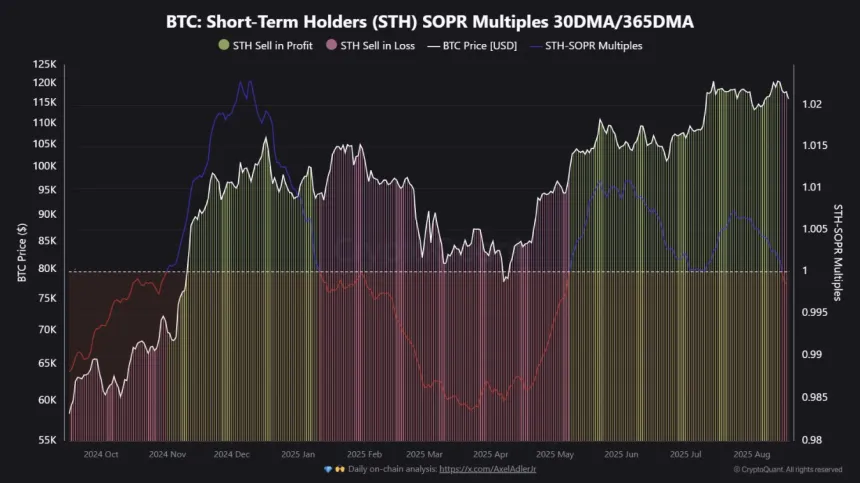

Bitcoin Short-Term Holders Sell at Loss for First Time Since January

Bitcoin faces pressure after struggling to maintain levels above $120,000, with the $115,000 mark becoming critical. Increased volatility indicates a shift toward bearish momentum, raising questions about Bitcoin's ability to sustain its consolidation range.

Key points include:

- Recent all-time highs were not maintained, leading to speculation of a deeper correction.

- Short-term holders (STHs) are selling at a loss for the first time since January, indicating a change in market dynamics.

- Loss realization among STHs historically precedes deeper corrections but can also signal a healthy market reset.

Market implications are as follows:

- Extended loss realization typically foreshadows deeper corrective phases.

- Brief dips below 1 in STH-SOPR can act as a reset, enabling stronger rallies.

Currently, Bitcoin trades near $115,000, just above its 50-day moving average, which is critical support. A break below this level could lead to further declines toward the 100-day MA at $110,957 or the 200-day MA near $100,410.

Resistance remains at $123,217, while momentum indicators suggest weakening bullish strength. The longer-term bullish trend is still intact due to strong medium-term support and higher lows being established.