4 0

BEARISH 📉 : Bitcoin’s Slide To $82K Sets Off A $1.7 Billion Chain Reaction

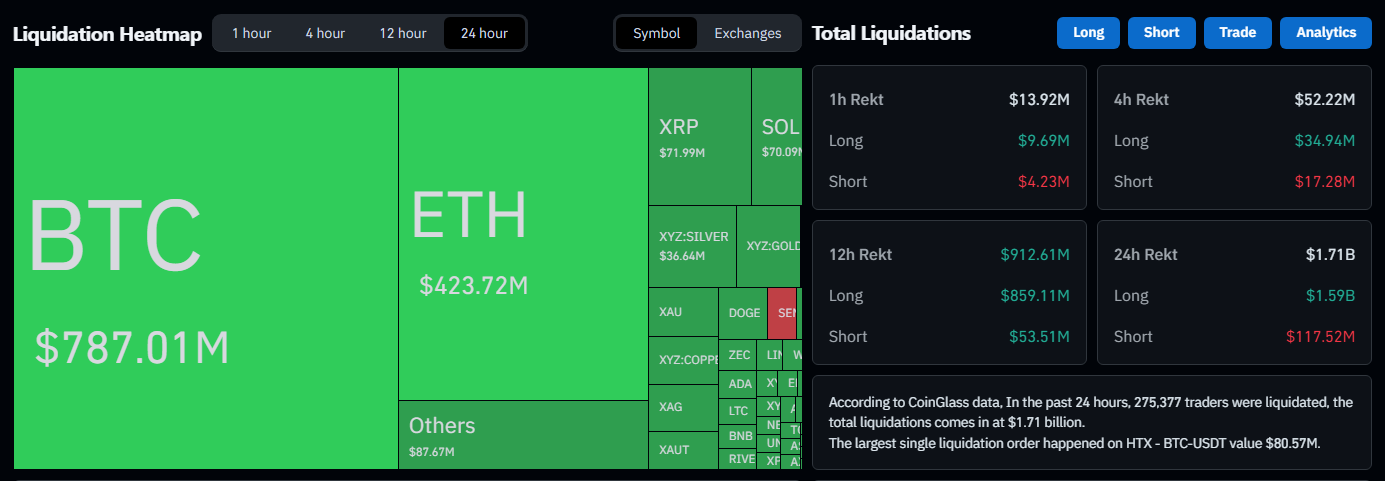

Bitcoin experienced a significant drop this week, reaching just above $82,000, causing widespread liquidation. Data from Coinglass shows approximately 270,000 accounts were affected, with $1.70 billion total liquidations, mainly impacting long positions in Bitcoin and Ether.

Key Factors Affecting the Market

- Over 90% of liquidated contracts were long positions.

- Volatility increased due to stop orders being pulled and margin calls triggered, leading to price gaps.

- Geopolitical tensions in the Middle East, including US warship deployments, contributed to market unease.

- US policy actions regarding tariffs on oil-related goods added to investor concerns.

- Microsoft’s earnings miss led to declines in major tech stocks, affecting investor sentiment.

Overall, risk aversion and volatility due to geopolitical issues influenced the sell-off.

Market Outlook

- Bitcoin is testing support levels between $94,000 and $84,000.

- The wider crypto market lost around $200 billion during the decline.

- Analysts are divided; some see the reaction as exaggerated, while others caution against prolonged macroeconomic pressures.

Benjamin Cowen noted Bitcoin may remain weaker compared to stocks, hindering rapid investment shifts from gold or silver into crypto. Meanwhile, gold and silver reached record highs, with gold at $5,608 per ounce and silver at $121.60.