5 0

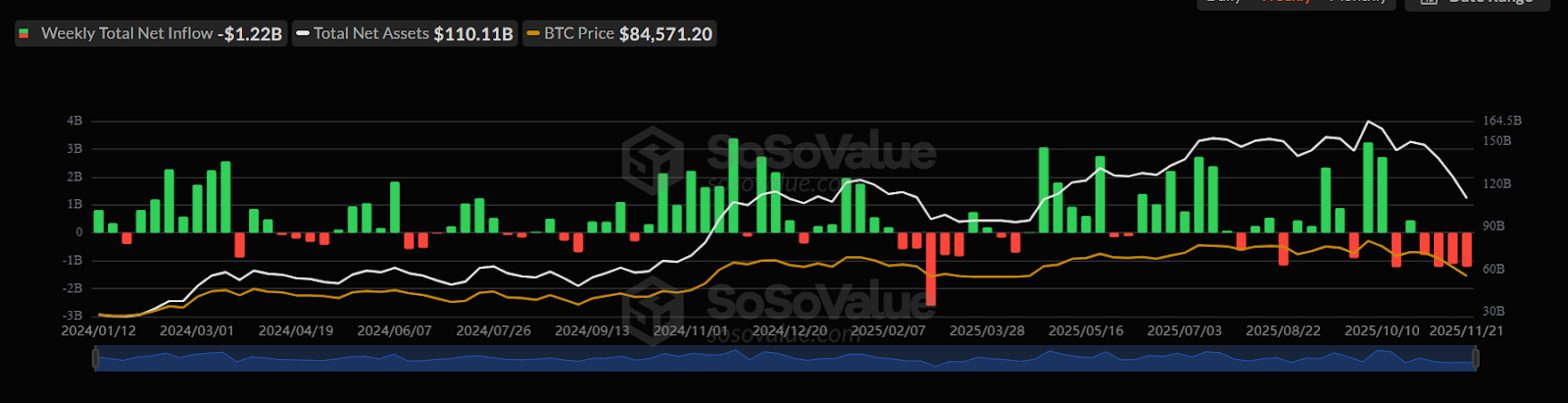

Bitcoin Spot ETFs See $4.349 Billion Outflow Over Past Month

- Bitcoin spot ETFs saw a $1.22 billion outflow from Nov. 17 to Nov. 21, totaling $4.349 billion over the past month. This is the second-largest four-week outflow recorded.

- The largest Bitcoin ETF outflow occurred between mid-February and mid-March at $4.806 billion.

- Greg Cipolaro of NYDIG highlighted that ETF inflows and digital asset treasury demands have greatly affected recent cycles, with significant selling in early October reversing inflows to outflows.

- Bitcoin's price recently dropped to around $82,000 but has rebounded to $87,221, marking a 1.8% daily gain despite a 21% monthly decrease.

- Bitcoin's market dominance remains near 59%, with traders often shifting funds from altcoins to BTC during market downturns.

Market Dynamics

- Analysts predict a potential year-end rally for Bitcoin, suggesting it may be forming a base as the Risk-Off Signal declines, indicating reduced selling pressure.

- Past similar patterns showed a subsequent 47% increase in Bitcoin's value.

- Swissblock analysts suggest the worst of the selling may be over, with this week being crucial for monitoring selling behavior.

Bitcoin has taken its first real step toward forming a bottom. The Risk-Off Signal is dropping sharply, which tells us two things: selling pressure has eased, and the worst of the capitulation is likely behind us, for now.

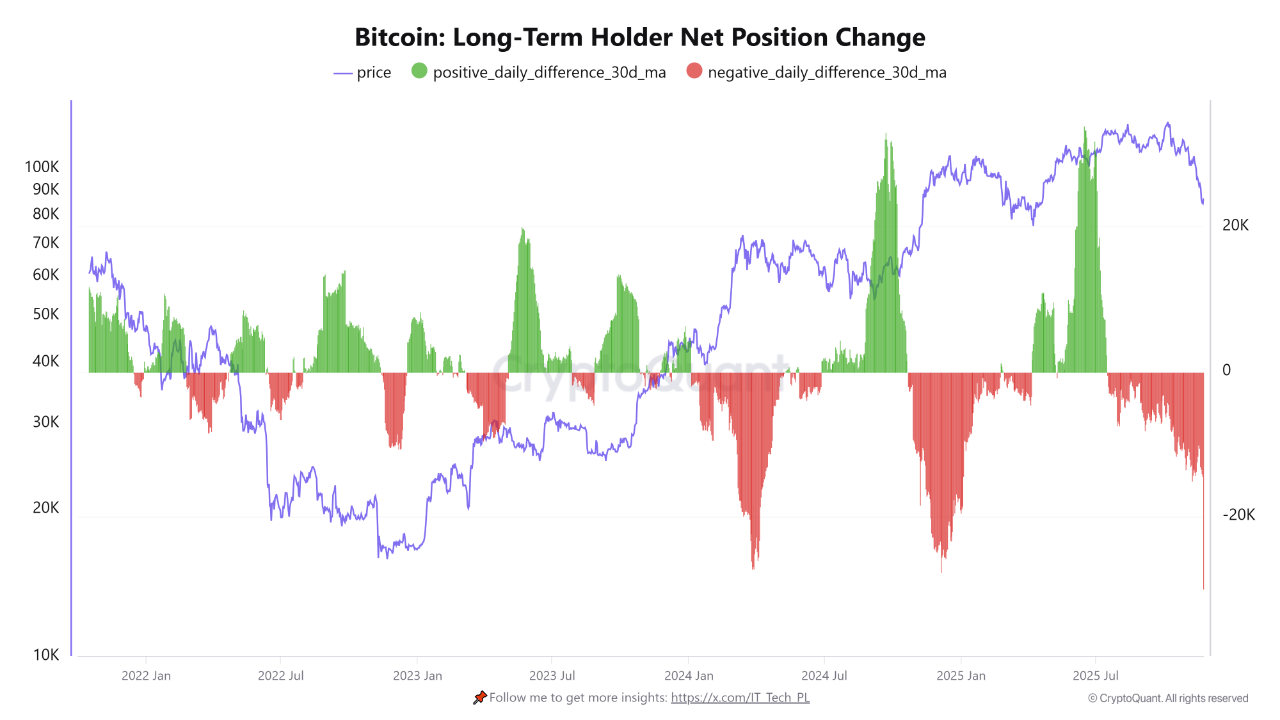

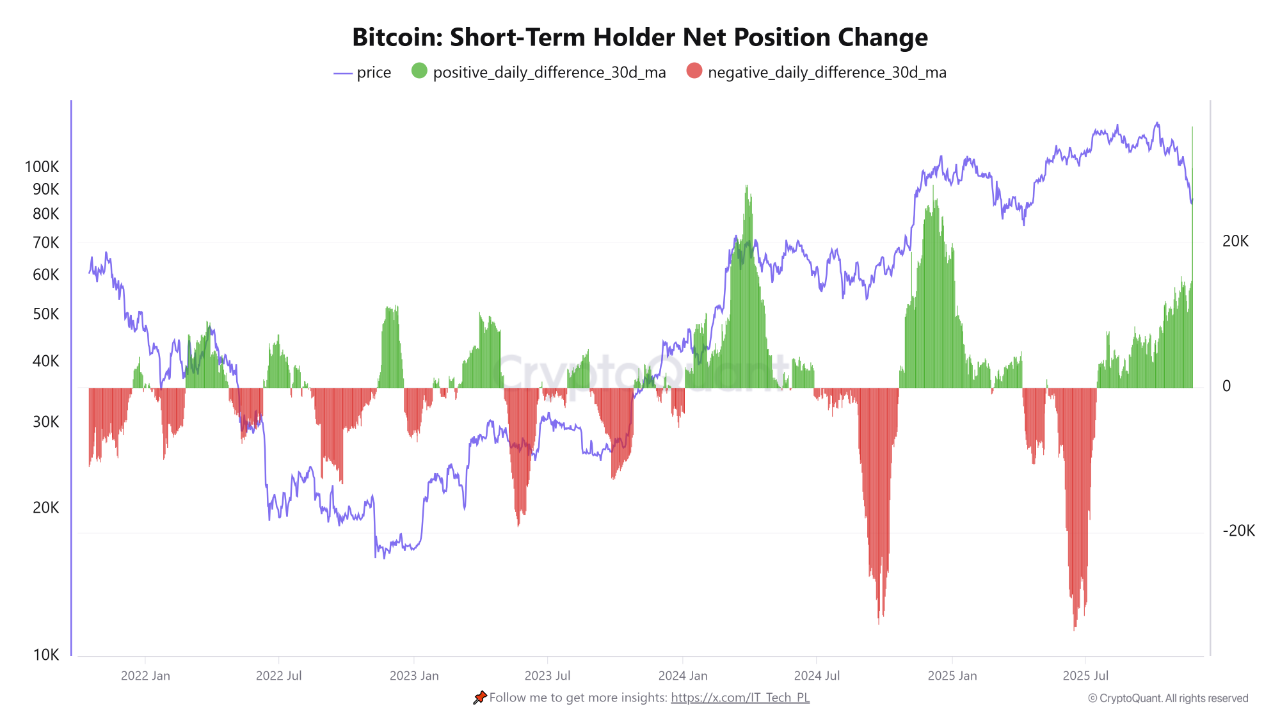

Holder Activity

- Long-term holder wallets show significant selling, typical during strong market phases when early investors secure gains.

- Short-term holders are entering the market, absorbing coins sold by long-term holders, often during rapid market movements.

- According to CryptoQuant, this influx doesn't necessarily indicate an immediate drop but suggests increased market supply, potentially leading to further pullbacks or stable prices if demand doesn't match supply.