0 0

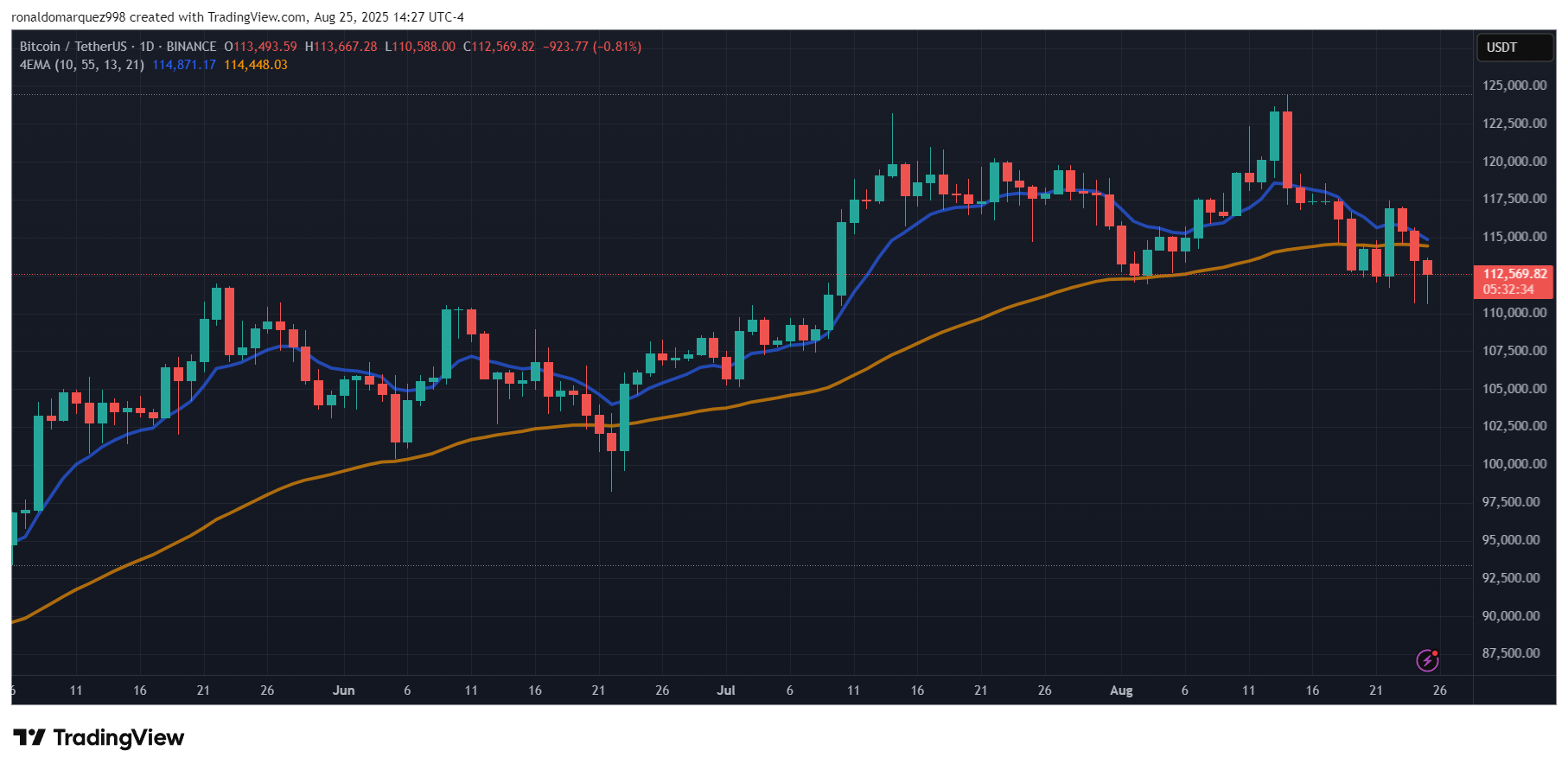

Bitcoin Attempts Stabilization at $112,000 After 10% Drop from ATH

Bitcoin (BTC) is attempting to stabilize around $112,000 after a drop to $110,000, reflecting a 10% decrease from its all-time high (ATH).

Fed Rate Cut Impact

- Doctor Profit predicts the Federal Reserve's upcoming rate cut could trigger a market correction in stocks and cryptocurrencies.

- The current market environment differs from previous cycles, leading to uncertainty among investors.

- Technical indicators for Bitcoin are bearish, with a significant gap at $93,000 needing attention.

- Charts show a potential correction with a double top formation and declining trading volume.

- The recent price surge to $124,000 was mainly driven by futures activity.

Market Sentiment and Price Forecast

- On-chain metrics indicate retail investors often buy high and sell low.

- During the last dip from $110,000 to $98,000, institutional investors capitalized while retail buyers missed opportunities.

- As Bitcoin nears the liquidation zone of $90,000 to $95,000, a shakeout may occur.

- Current market sentiment may reflect false optimism about an ongoing altcoin season.

- Doctor Profit forecasts Bitcoin could rise to $145,000 to $150,000, a potential 34% increase.

- Ethereum (ETH) is expected to reach between $7,000 and $8,000 post-September correction.

At present, Bitcoin trades at $112,560, a 6% decline over the past fourteen days. Ethereum has seen a 5% increase during the same period.