10 1

Bitcoin NPRL Stabilizes Indicating Market Equilibrium at $90,000 Range

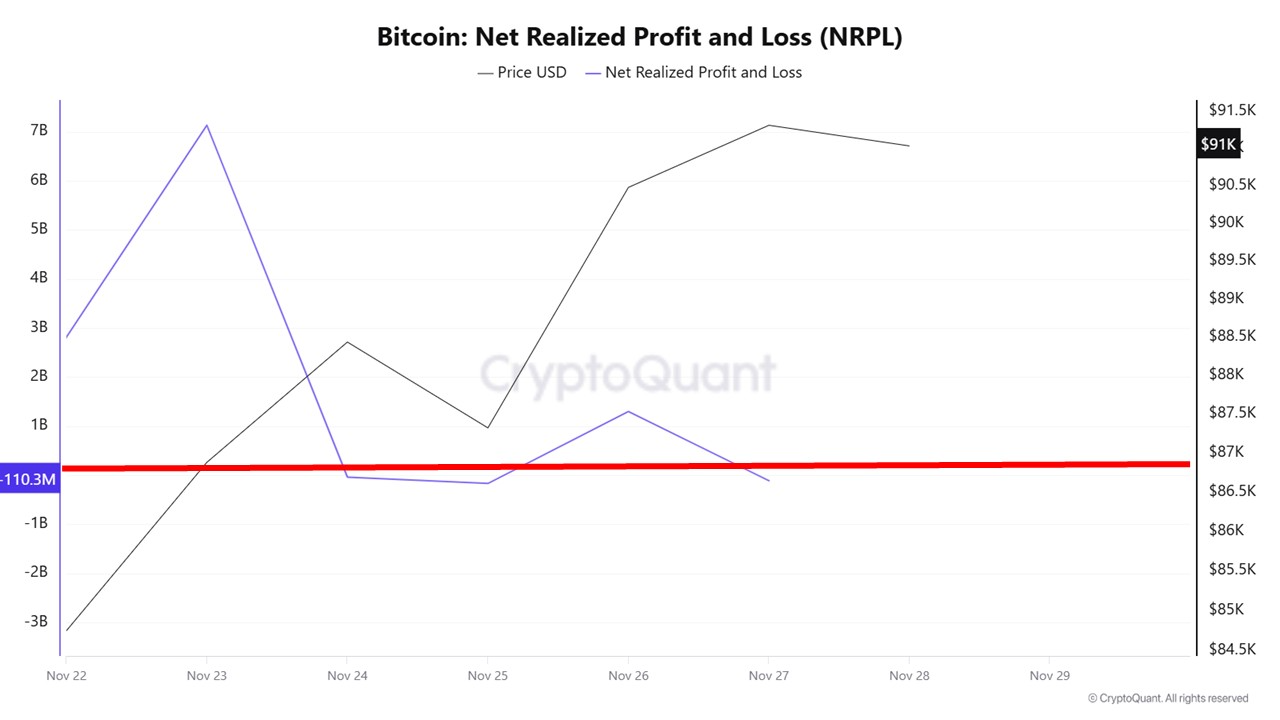

Blockchain analytics platform XWIN Research Japan reports that Bitcoin's NPRL has returned to a neutral zone after recent volatility. This aligns with Bitcoin's modest price gain over the past week.

NPRL Indicates Market Equilibrium

- The Net Realized Profit and Loss (NRPL) measures realized profit or loss when Bitcoin is sold.

- A positive NRPL indicates more BTC sold at a profit, while a negative suggests losses.

- Bitcoin’s NPRL showed significant deviations between November 22-24 but stabilized since November 25.

- This stabilization marks a transition from volatility to potential market consolidation.

- Bitcoin's price steadied around $90,000, suggesting the market is digesting recent changes.

Future Outlook for Bitcoin

- Key factor: Whether NRPL stays above zero, indicating strong demand and recovery potential.

- If NRPL turns negative again, it could signal renewed selling pressure.

- The current pattern suggests the market is resetting for a new trend.

Currently, Bitcoin trades at $90,485, reflecting a 0.65% loss in the last 24 hours, with a daily trading volume increase of 14.06%, totaling $57.04 billion.