0 0

Bitcoin Remains Steady Amid Tensions Over Fed and Geopolitical Issues

Bitcoin's recent options expiry resulted in a minor decline of 0.6%, stabilizing just below $107,000. The BTC Volatility Index (DVOL) has dropped to its lowest level since late 2023, indicating trader calmness.

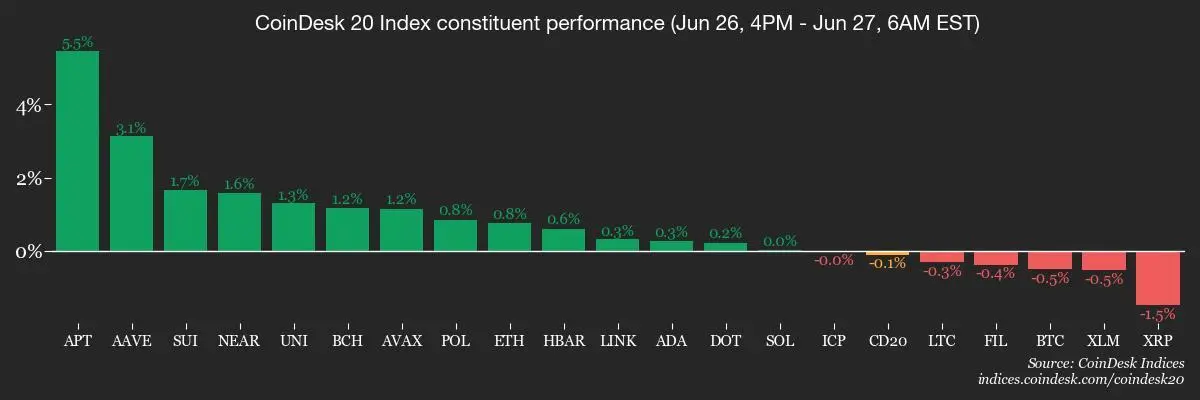

- CoinDesk 20 index fell by 1.2%.

- Market confidence may be bolstered by geopolitical tensions easing due to the Israel-Iran cease-fire.

- Investors await U.S. personal consumption expenditures (PCE) data, which could influence Federal Reserve policies.

Upcoming economic events include:

- June 27: Fed Governor Lisa D. Cook speaking at a Federal Reserve event.

- June 27: Release of Brazil and Mexico's unemployment rates.

- June 27: U.S. May consumer income and expenditure data due.

Token events are highlighted by:

- June 30: CME Group plans to introduce spot-quoted futures for Bitcoin and Ether.

- July 21: Coinbase Derivatives to launch perpetual-style crypto futures.

Market movements report:

ETF flows indicate:

- Spot BTC ETFs had daily net flows of $226.7 million; cumulative net flows at $48.35 billion.

- Spot ETH ETFs saw daily net outflows of $26.4 million.

In summary, the market remains steady with reduced volatility and anticipation surrounding upcoming economic indicators that may influence future trends.