4 0

Bitcoin Faces Rising Structural Risk Amid Quiet Price Action and Liquidity Issues

Bitcoin's Current Market Dynamics

- Bitcoin remains below the $90,000 level, with bulls defending existing demand zones amidst a consolidation phase.

- Volatility is low, suggesting a market pause, but this may not indicate stability.

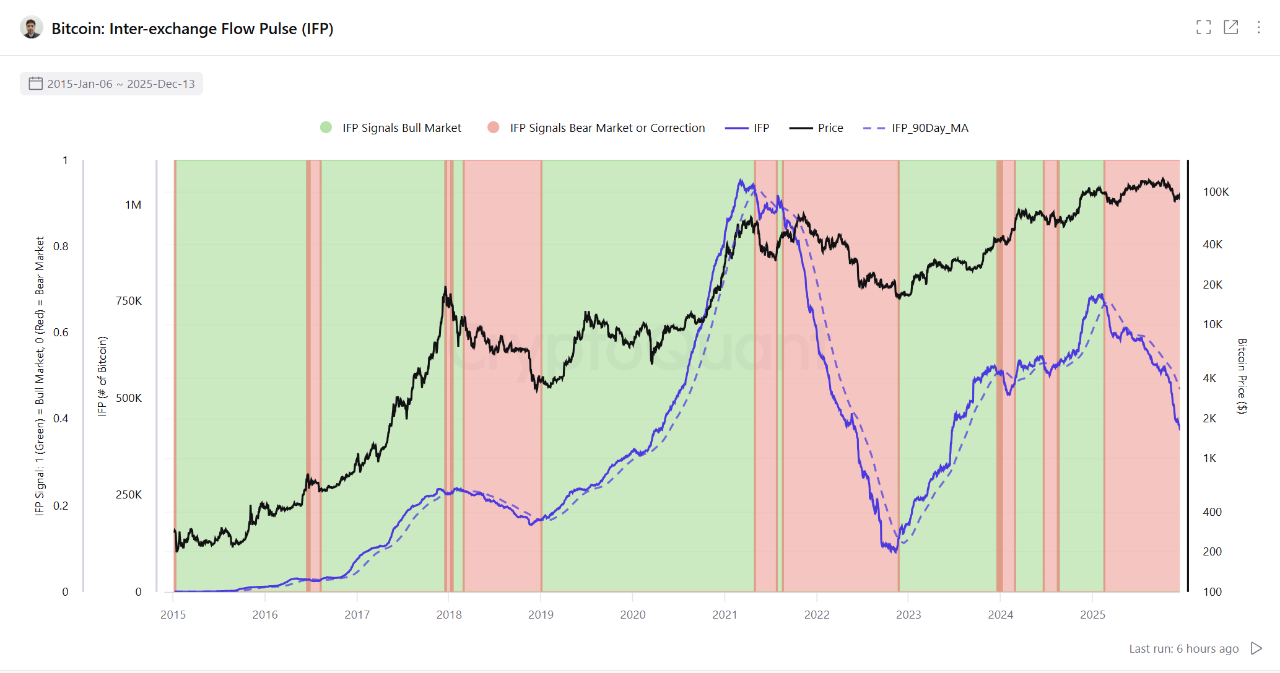

- The Inter-Exchange Flow Pulse (IFP) has turned red, highlighting structural risks and deteriorating liquidity conditions.

- Reduced exchange balances can limit selling pressure but increase the impact of sudden demand or forced liquidations.

Inter-Exchange Flow Pulse Insights

- The IFP measures Bitcoin movement between exchanges, indicating market liquidity and capital circulation.

- A decline in IFP suggests weakened liquidity, leading to increased price sensitivity and volatility.

- Low exchange balances create thinner order books, making markets more volatile during decisive price movements.

- With high leverage in derivatives markets, current instability is driven by forced reactions rather than directional conviction.

Price Consolidation and Moving Averages

- Bitcoin is consolidating after a corrective move, currently trading around $89,000–$90,000.

- The 200-period moving average on the 4-hour chart acts as resistance, with the 50 and 100 averages also sloping downward.

- Volume contraction indicates reduced trader participation, often preceding increased volatility.

- Structural vulnerability persists as long as Bitcoin trades below the $92,000–$94,000 resistance zone.

- Support is identified in the $87,000–$88,000 range; a breakdown could lead to further declines toward $84,000.