3 0

Bitcoin Struggles Below $116K Resistance as Selling Pressure Mounts

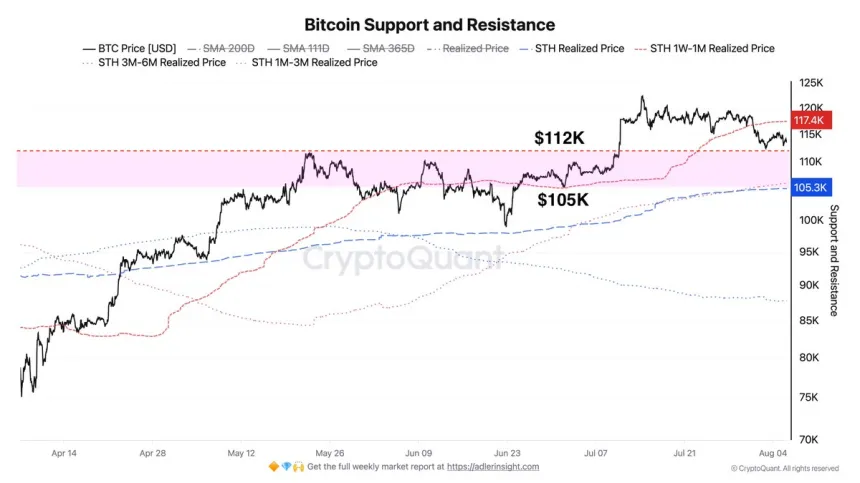

Bitcoin has lost the crucial $115,000 support level, leading to increased selling pressure and a shift in investor sentiment towards concern about a deeper correction below $110,000. Key points include:

- Short-term resistance is established at $112,000.

- The $112K–$105K zone is structurally fragile; breaking below $105K could trigger long liquidations.

- Macroeconomic uncertainty and declining ETF flows are impacting market sentiment.

Short-Term Holder Risk Grows

Growing vulnerability among short-term holders (STHs) is evident as their realized price sits at $117,000, indicating they are underwater. Key details are:

- Short-term holders may panic-sell if negative catalysts arise, causing broader market sell-offs.

- The $105,000 level is critical support based on STH Realized Price, potentially slowing the downtrend if reached.

- Weak US jobs data raises speculation of interest rate cuts, adding pressure to market sentiment.

Bitcoin Attempts Recovery Amid Resistance Cluster

Currently trading around $115,478, Bitcoin faces resistance near $116K. Important observations include:

- Key moving averages at $116,596 and $115,799 are acting as overhead resistance.

- A breakout above the resistance cluster could lead to a retest of the $122K high.

- Low volume compared to previous breakouts suggests buyer caution; failure to reclaim $116K could push prices back into the $112K–$113K range.