4 0

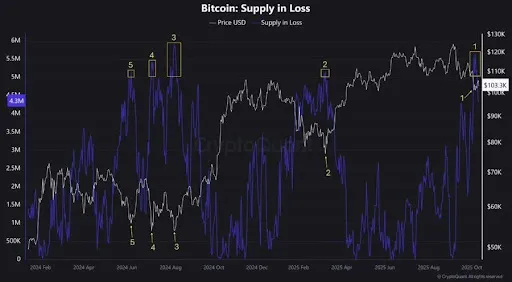

Bitcoin Supply-Loss Chart Indicates Potential Market Bottom Formation

The cryptocurrency market is experiencing a challenging period, with the Bitcoin Supply-Loss chart indicating a potential bottom.

Key Insights from Bitcoin Supply-Loss Chart

- High levels in the Supply-Loss chart signal fear and possible market bottoms, while low levels indicate market greed.

- On April 7, 2025, BTC's supply in loss was 5.159 million BTC when the price was $74,508.

- By November 5, 2025, BTC rose to $98,966, yet the supply in loss increased to 5.639 million BTC.

- Recent data shows a rise in supply-loss to 28%-33%, equivalent to 5.5-6.5 million BTC.

- This pattern may suggest short-term bearish pressure but could lead to a market bounce in Q4 2025 and Q1 2026.

Accumulation Phase Insights

- Bitcoin has undergone three major corrections, each followed by new all-time highs.

- According to analyst 0xBossman, current corrections are flushing out leveraged traders.

- Boredom and indecision lead to bearish sentiment, affecting altcoin markets.

- Consolidation phases typically end with significant upward movements.