16 0

Bitcoin Supply In Profit Hits 2025 Low Amid Weak Demand Signals

Bitcoin Market Overview

- Bitcoin is currently trading below the psychological level of $100,000, with its supply in profit reaching a new 2025 low.

- Key factors include decreased institutional demand and cautious investor behavior, as noted by Glassnode analysts.

- Despite being oversold, Bitcoin has not yet reached full capitulation, indicating a fragile price balance.

Supply and Demand Dynamics

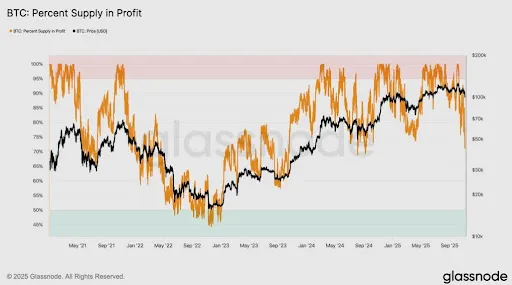

- The supply in profit for Bitcoin has sharply fallen, reflecting a reduction in market momentum and increased sell pressure.

- About 71% of Bitcoin’s supply remains in profit, near the lower end of the typical range during mid-cycle slowdowns.

- The Bitcoin price stability and potential recovery depend on renewed market demand.

- Bitcoin has dipped below the Short-Term Holder’s cost basis of approximately $112,500.

- Long-term holders are contributing to bearish pressure, with a net reduction of around 300,000 coins since July.

Off-Chain Indicators and Derivatives

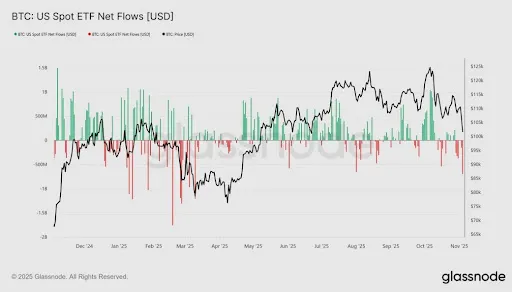

- US Spot Bitcoin ETFs have seen significant outflows, indicating reduced institutional interest.

- Bitcoin’s Cumulative Volume Delta on major exchanges has turned negative.

- The Perpetual Market Directional Premium has decreased, showing traders' reluctance towards high-risk positions.

Future Outlook

- Bitcoin remains structurally intact despite being oversold.

- Key resistance levels are at $112,000 and $113,000. A recovery at these points would indicate renewed demand, while failure could lead to further price corrections.