7 1

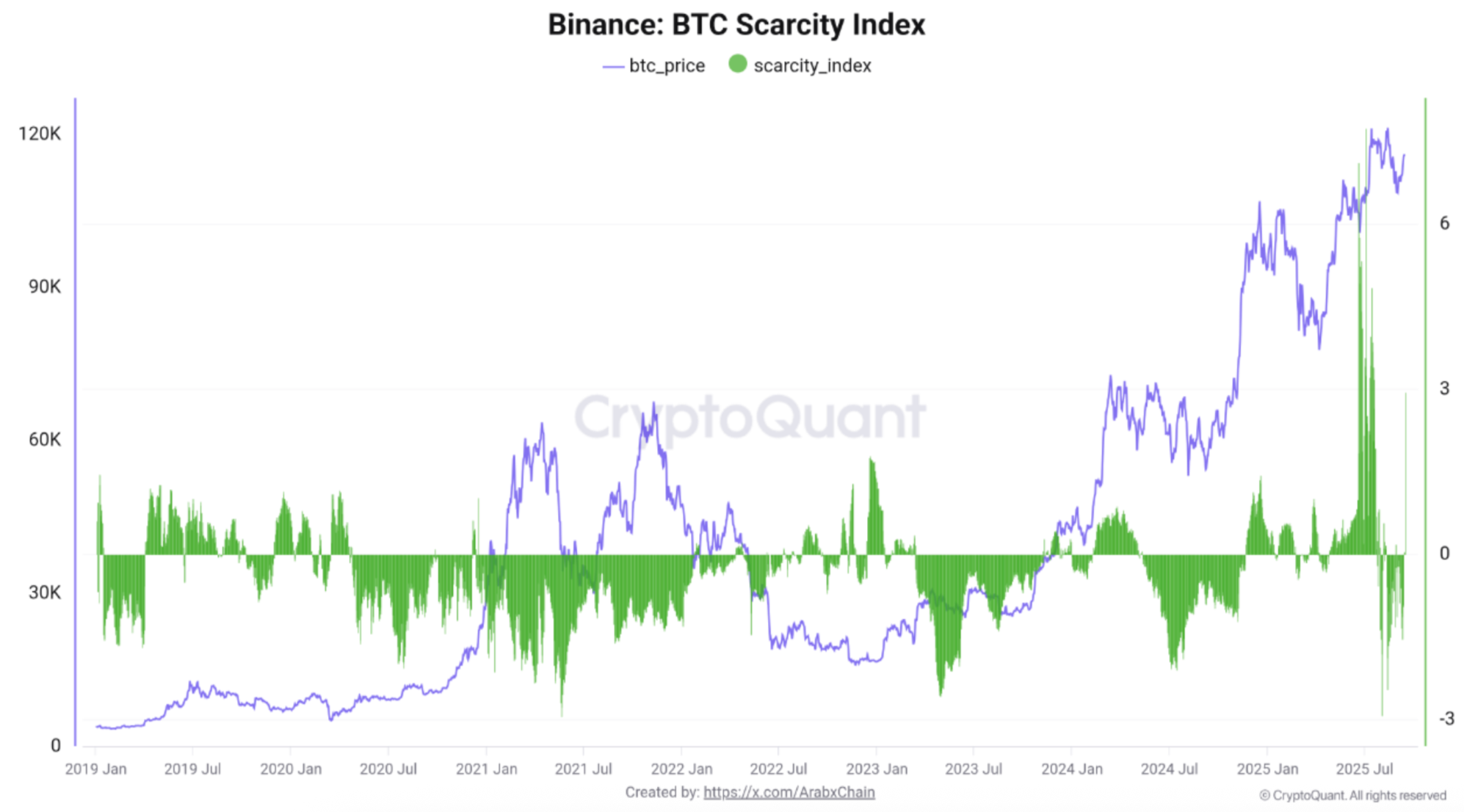

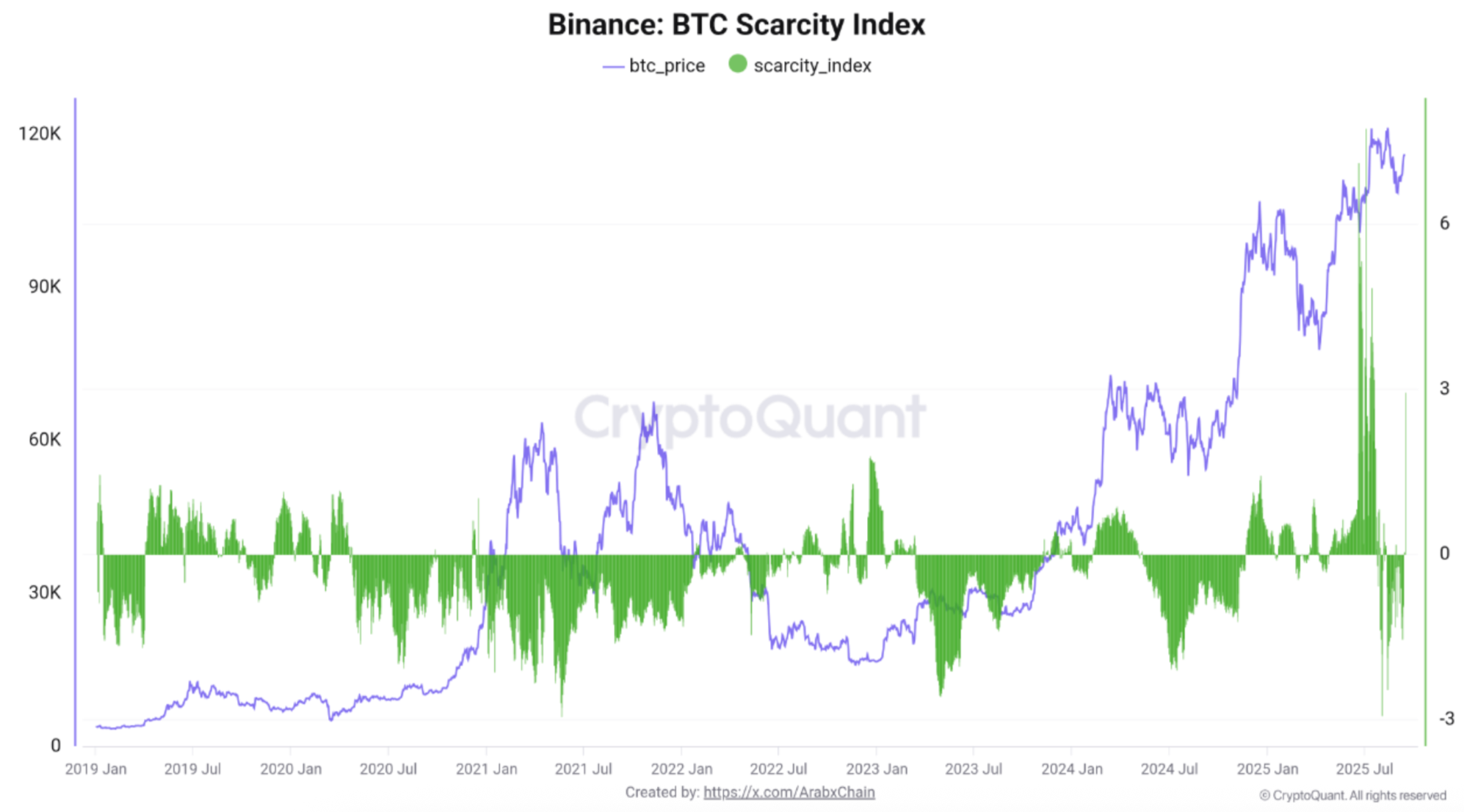

Bitcoin Supply Squeeze Emerges as Scarcity Index Spikes

After reaching a high of $116,689 on September 15, Bitcoin (BTC) slightly decreased to just over $114,000. Recent data from Binance indicates the first spike in the Bitcoin Scarcity Index since June 2025.

Key Points on Bitcoin Scarcity Index

- The Bitcoin Scarcity Index measures available BTC supply on exchanges against buying demand.

- A spike suggests strong accumulation by large investors or institutions, potentially indicating upward price pressure.

- The recent spike was attributed to either large BTC withdrawals from Binance or a drop in sell orders.

- This index rise could indicate an accumulation phase if sustained over several days.

- Quick increases followed by drops may suggest speculative activity or liquidations, possibly leading to corrections.

Market Trends and Technical Signals

- The rapid return of the index towards zero could indicate declining buying momentum.

- Despite this, BTC recently surpassed the mid-term holder breakeven level, suggesting potential for another rally.

- A technical signal known as the Golden Cross has appeared, forecasting possible price appreciation.

- As of now, BTC trades at $114,601, down 0.9% in the last 24 hours.