6 0

Bitcoin Price Finds Support at $110,000 Amid Whale Activity Shift

Bitcoin's price is currently supported at $110,000 after a volatile week, with trading between $104K and $116K. Bitcoin whales are selling holdings, signaling a shift towards Ethereum.

Market Insights

- September has historically seen selling pressure for Bitcoin and altcoins.

- Crypto analyst Benjamin Cowen notes that Bitcoin often hits a low in September during post-halving years before rebounding in Q4.

- A potential 25 bps Fed rate cut on September 17 may increase market liquidity, positively impacting BTC prices.

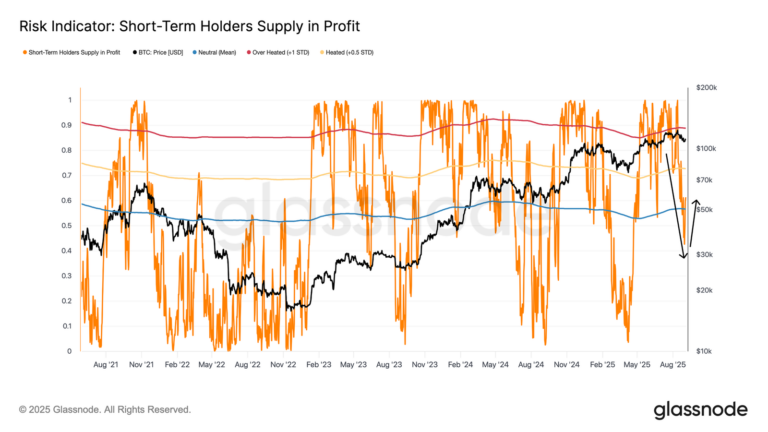

- Currently, Bitcoin is consolidating within the $104,000-$116,000 range, according to Glassnode.

- A move above $116,000 could signal an uptrend; a breakdown may lead to support around $93,000-$95,000.

- Over 75% of short-term holders would return to profit above $114K–$116K, potentially attracting new demand.

Chart showing Bitcoin short-term holders’ supply in profit. | Source: Glassnode

Demand Trends

- Spot Bitcoin ETF inflows have turned negative, indicating waning institutional demand.

- Futures data show subdued demand from traders.

- Investors are reportedly waiting on the sidelines as Satoshi-era Bitcoin whales sell some holdings for Ethereum.

- Regional liquidity impacts Bitcoin price movements more than ETF flows.

Other Developments

- Bitcoin Hyper (HYPER) presale has raised over $13.7 million, addressing Bitcoin’s transaction speed and cost issues.

- Current presale price is $0.012855, with staking offering up to 79% APY.