Analyst Identifies Key Support Levels for Bitcoin Reaccumulation

The price of Bitcoin increased by 9.62% in the past week following Donald Trump's emergence as the next US President, reaching a new all-time high of $77,252 on November 8 before retracing over 0.5%. Analyst Ali Martinez suggests potential significant corrections may occur, providing opportunities for reaccumulation.

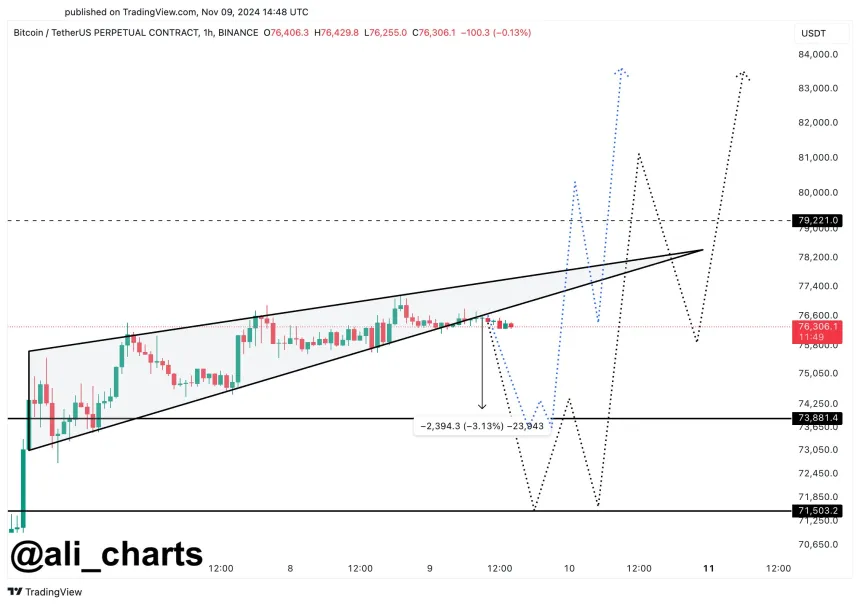

Bitcoin Likely To Fall To $69,000

In an X post on November 9, Martinez predicted that Bitcoin could experience a notable price pullback after a bullish trend driven by US election results and a 25 basis point rate cut from the Federal Reserve. Following its drop from above $77,000, Martinez indicated that the price movement reflects a descending pattern signaling a potential reversal. He predicts Bitcoin may decline to around $73,900, with further selling pressure possibly pushing it down to $71,500, and $69,000 serving as a strong support level in a worst-case scenario.

Martinez has set buy orders at these support levels, believing that any price correction offers a chance for substantial purchases at lower prices. This strategy stems from the belief that the Bitcoin bull market is still early, despite recent rallies. Analysts forecast a potential six-figure price target by the end of 2024, indicating possible significant gains ahead.

BTC Leverage Ratio Hits 2-Year High

Data from analytics firm IntoTheBlock indicates that Bitcoin's Open Interest to market cap ratio is 5.93%, the highest since the FTX collapse in November 2022. This suggests traders are holding high leveraged positions, leading to increased volatility with minor price changes, contributing to the sentiment around an impending price correction.

Currently, Bitcoin trades at $76,740, reflecting a 0.70% decline in the past 24 hours. Trading volume decreased by 44.63%, totaling $31.87 billion. Despite this, Bitcoin maintains global attention with a 27.76% price gain over the last month, resulting in a market cap of $1.51 trillion.