3 0

Bitcoin Faces Critical Support Test as Sellers Shift Focus to Ethereum

Bitcoin is at a critical juncture after failing to break above the $125,000 all-time high. A rejection led to a retracement, with bulls now defending demand zones between $110,000 and $112,000. This range is pivotal for determining Bitcoin's future trajectory.

- Market analysts are divided on Bitcoin's outlook.

- Some highlight buyer resilience maintaining higher lows.

- Others caution that failure to regain momentum may empower bears and prompt further corrections.

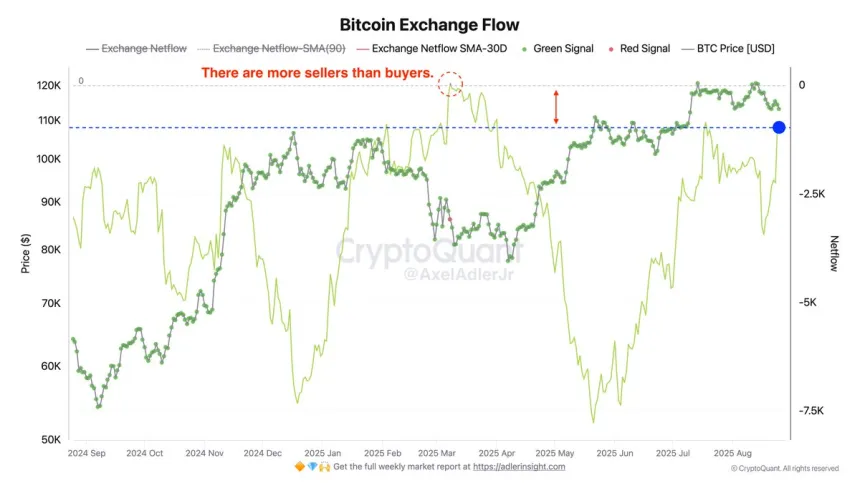

- Analyst Axel Adler noted an increase in large sellers on centralized exchanges without effective execution strategies, which could heighten volatility.

- Despite concerns, overall CEX Netflow remains positive, indicating buyer control for now.

- However, there is a shifting balance, with increasing seller presence potentially leading to downturns.

Bitcoin Bulls Face A Test As Focus Shifts To Ethereum

- Adler suggests this moment illustrates changing dynamics of institutional interest.

- He noted it’s an opportune time for corporate investors to buy Bitcoin.

- However, attention has shifted toward Ethereum due to whale accumulation and institutional flows.

- This shift has contributed to Bitcoin's current stagnation, even as ETH rallies toward new highs.

- Bitcoin's technical support is now around its previous ATH zone, essential for maintaining bullish sentiment.

- A failure to hold this level could lead to deeper corrections if capital continues rotating into ETH.

The daily chart shows Bitcoin under pressure. Trading around $111,829, it is just above the 100-day moving average at $111,567, forming a crucial short-term support. The 50-day moving average has turned into resistance at $116,544, indicating weakening bullish conditions.

- The $111K–$112K zone is decisive; closing below it could target the 200-day moving average near $100,866.

- Bulls need to reclaim the $115K–$116K region to regain momentum and retest the $123K ATH.

- Recent price action indicates seller control with lower highs, but maintaining the 100-day MA could lead to consolidation instead of reversal.