Bitcoin Could Surge to $189,000 With 2% Global Liquidity Capture

A report by CoinShares indicates that Bitcoin could rise over 65% from its current price of approximately $113,500 to around $189,000 if it captures a small percentage of major monetary pools.

Market Share Insights

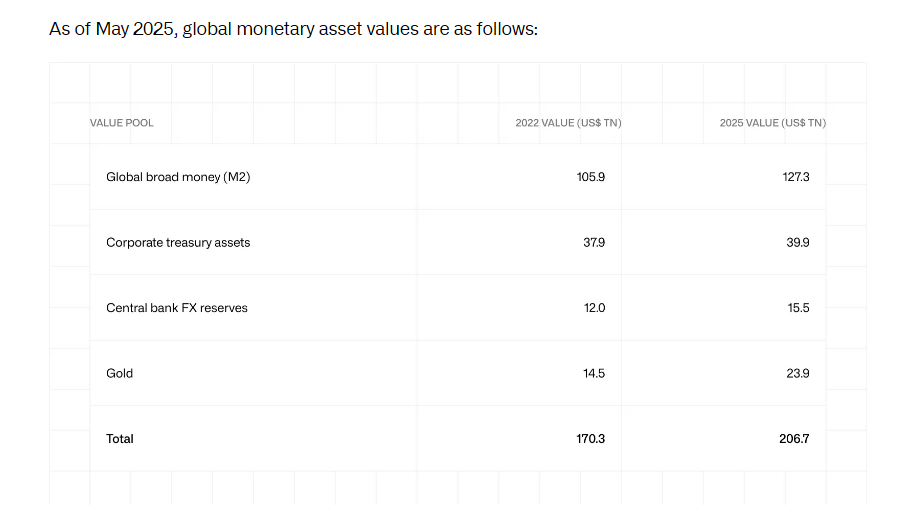

- Global liquidity (M2) is about $127 trillion.

- All mined gold totals nearly $24 trillion.

- If Bitcoin secures 2% of global M2 and 5% of gold's market cap, the projected price is $189,000.

Investment Sentiment

Investors find the model appealing due to its straightforwardness. A small share of cash and gold markets could significantly enhance Bitcoin's value without needing to dominate the entire market.

Model Methodology

The Total Addressable Market (TAM) model evaluates large financial pools—cash, deposits, gold—and estimates potential shares for newcomers. CoinShares uses data from reputable sources like the World Gold Council and Trading Economics.

Challenges Ahead

- Regulatory hurdles may hinder adoption.

- New digital currencies could compete with Bitcoin.

- Interest rate fluctuations can impact M2.

- Gold market value can change based on mining and central bank actions.

Bitcoin's potential market share growth depends on user trust, regulatory clarity, and institutional adoption. Achieving 2% of global liquidity and 5% of gold market cap is feasible but contingent on various factors.

Future Bitcoin prices will be influenced by policy developments, technological advancements, and investor interest. The TAM perspective offers insights into possible outcomes if Bitcoin begins to capture these market shares.