2 0

Bitcoin Surges Past $111,000 Amid Growing Institutional Demand

Bitcoin's price reached a new high above $111,000, driven by increased demand and corporate treasury purchases. Analysts predict that BTC could rise to $180,000 by year-end due to factors such as spot ETF inflows and institutional adoption.

- The OTC supply may be declining, impacting prices without affecting exchange trading volumes.

- Corporate treasuries have reportedly been buying BTC in large quantities.

- Moody's downgrade of the U.S. credit rating has spurred interest in BTC and ETH as hedges against fiat risk.

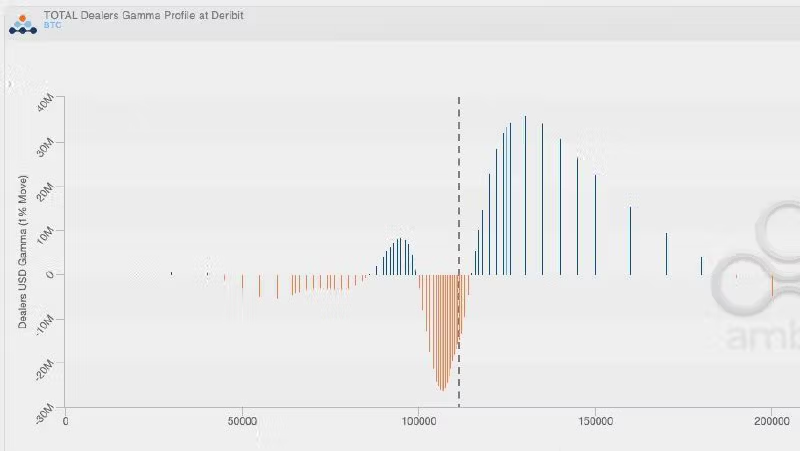

Price Resistance at $115K

Potential hedging activities from options market makers may limit BTC's ascent around $115,000. Dealers hold significant "positive gamma" exposure in this range, which influences their trading strategies.

- Positive gamma means dealers will sell more BTC as its price increases, acting as a stabilizing force.

- High dealer interest in selling higher strike call options indicates caution around potential breakouts.

- Clearing the resistance at $115K could lead to a stronger rally.