Bitcoin Surges Past $72,000 Amid Predictions of $462,000 Peak

Bitcoin has surpassed $70,000 and $72,000 recently, indicating strong demand despite price fluctuations. The daily and weekly candlestick formations suggest an ongoing uptrend.

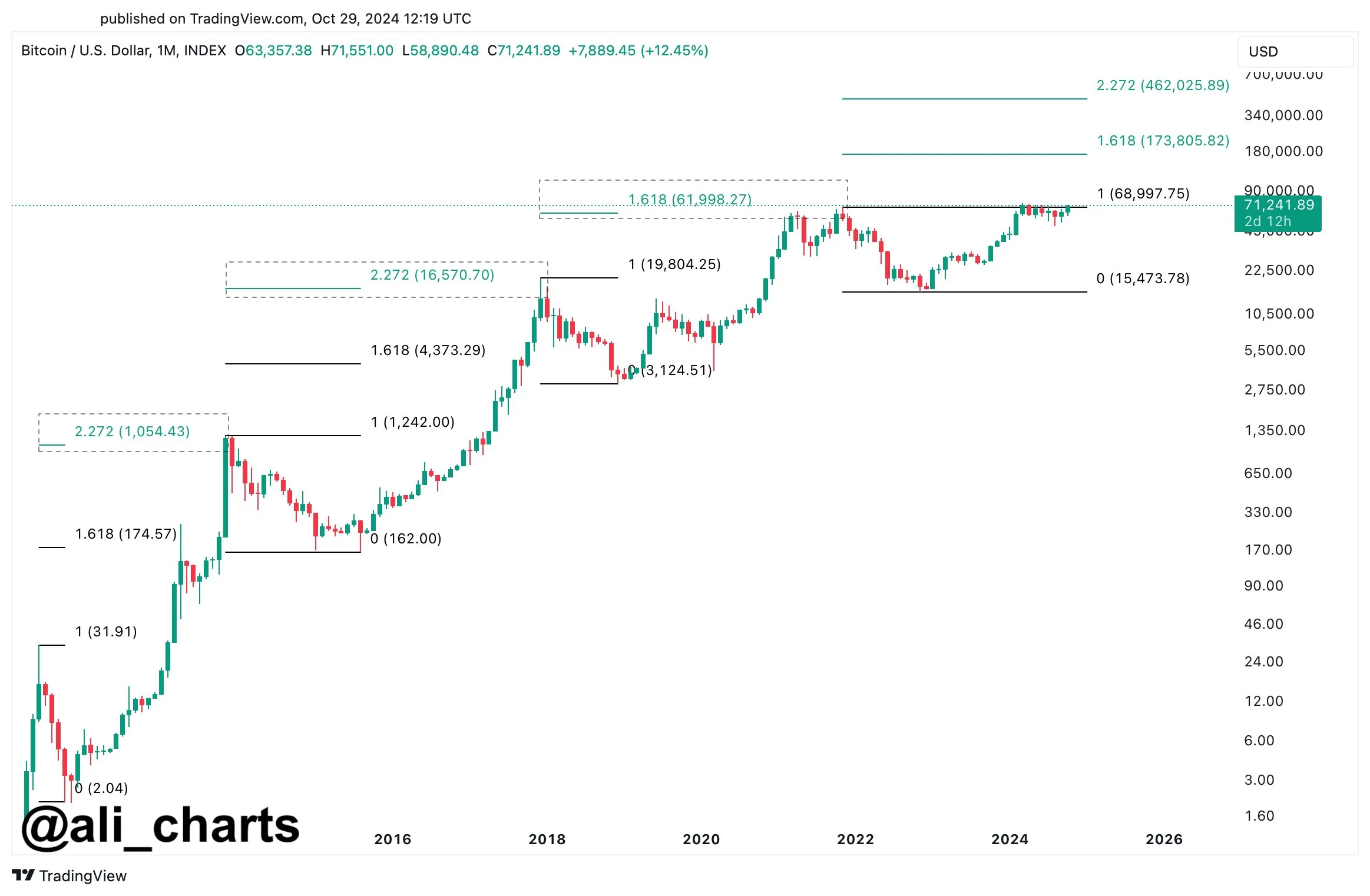

Is Bitcoin Preparing For A 6X Surge To $462,000?

An analyst on X forecasts that Bitcoin will break its all-time high of $74,000 and potentially rise to over $462,000. This prediction is based on the coin's breakout above key resistance levels and Fibonacci extension levels indicating a trend shift following the Q3 2024 decline.

The analyst highlights historical price patterns, suggesting BTC peaks between the 1.618 and 2.272 Fibonacci extension levels, which can indicate rapid price movements. If this pattern holds, Bitcoin could reach between $174,000 and $462,000, marking the lower and upper limits of past cycles' peak zones.

However, the range for Fibonacci extensions is subjective and may vary among analysts, affecting potential peak predictions.

Analysts agree that Bitcoin may achieve new all-time highs in Q4 2024. Another analyst noted that Bitcoin is currently in a bullish breakout formation, surpassing a descending channel or bull flag, while also breaking through resistance from a "cup and handle" pattern.

Institutions Buying As BTC Recovers

If bullish momentum continues, it would confirm gains from Q1 2024 and signal a recovery following a 30% decline from March highs.

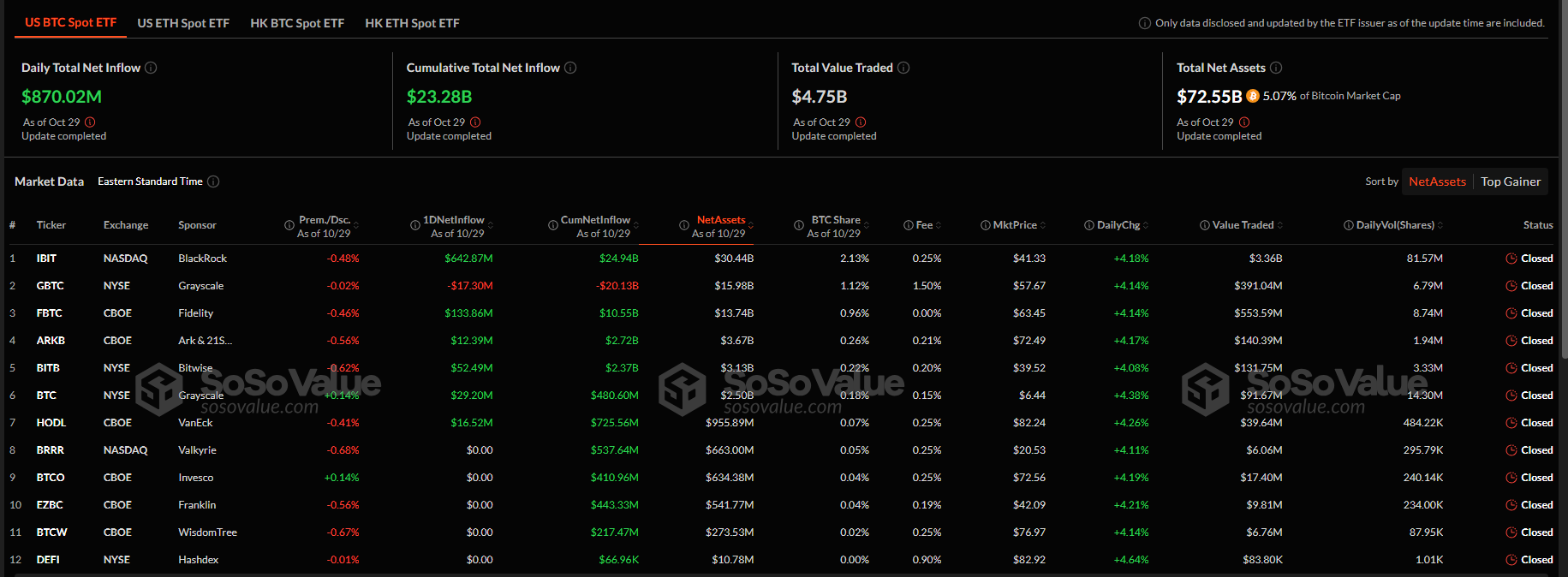

Institutional interest is increasing, particularly through spot Bitcoin ETFs. According to SosoValue, institutions are significantly buying shares for their clients.

On October 29, U.S. spot Bitcoin ETF issuers purchased $870 million in shares backed by BTC. BlackRock's IBIT received $642 million, increasing their Bitcoin assets under management to over $24.9 billion.