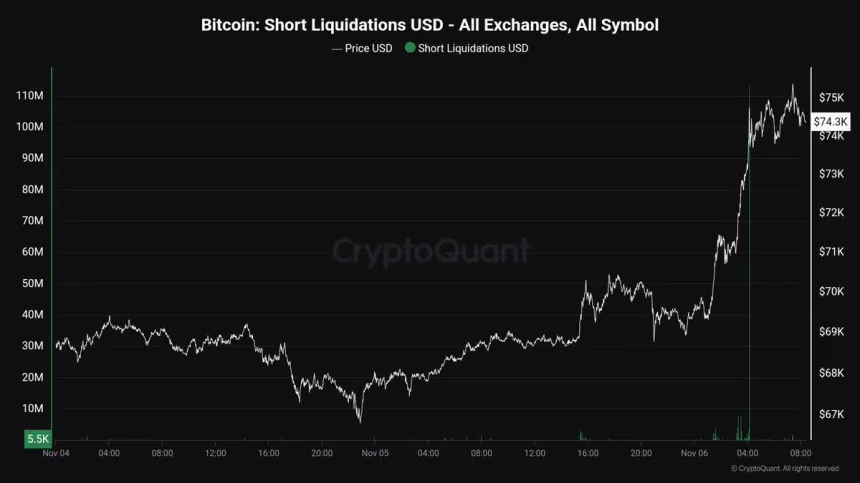

Bitcoin Surges to $75,300 as Short Liquidations Exceed $100 Million

Bitcoin reached an all-time high of $75,300 during election night, triggering significant liquidations across trading platforms. Data from CryptoQuant indicates short liquidations exceeded $100 million in a single minute, marking a historic moment for BTC.

The price surge followed Donald Trump's unexpected election win, which renewed interest in crypto assets amid anticipated economic policy changes. This outcome has generated a fresh rally in the crypto market, with Bitcoin leading the way.

Bitcoin’s rise above $75,000 signifies strong investor confidence despite economic uncertainties. As it enters price discovery mode, traders expect further volatility and potential higher price levels. The following days are crucial as Bitcoin's price action continues to influence liquidations and market outlook.

Bitcoin Bullish Phase Begins

Bitcoin has officially entered a bullish phase after Trump’s election victory, pushing its price beyond previous all-time highs. The bullish breakout coincided with a spike in liquidations, indicating strong buying pressure as bearish positions were closed. According to CryptoQuant analyst Maartunn, short liquidations surpassed $100 million in one minute, highlighting the rally's strength.

Volatility is expected as global markets react to the election results and prepare for the Federal Reserve's interest rate decision. A steady or dovish adjustment by the Fed could further enhance Bitcoin's rally and support the broader crypto market.

The outlook remains bullish as market sentiment improves with Bitcoin's new price discovery phase. While short-term fluctuations may occur, the long-term trend favors upward movement as Bitcoin leads the crypto market in this post-election period.

BTC Visits Uncharted Territory

Bitcoin is currently trading at $73,800 after surpassing its previous all-time high of $75,300. This breakout places BTC in uncharted territory, typically associated with substantial gains as bullish momentum builds.

Key focus points include maintaining momentum above the critical support level of $73,800, which could facilitate further price increases. However, this week is particularly volatile due to the upcoming Federal Reserve meeting.

The Fed's interest rate decision may introduce unpredictability, potentially impacting BTC's rise or causing a drop below $70,000 if outcomes diverge from expectations. Investors are monitoring key levels closely as Bitcoin navigates this price discovery phase.

Maintaining above $73,800 would reinforce the bullish narrative, while any decline would test support levels amid market uncertainty. This week could be critical for Bitcoin's future trajectory.

Featured image from Dall-E, chart from TradingView