Bitcoin Surges Past $82,000 Following Trump’s Election Victory

Bitcoin's price surpassed $82,000 on Binance, reflecting a 17% increase since Donald Trump's victory announcement in the US presidential election on November 6. The BTC price also experienced a notable "weekend pump," rising over 6%. The primary driver for this surge is attributed to Trump's election win.

#1 The Bitcoin “Trump Pump”

Trump's victory has improved Bitcoin's market sentiment due to his campaign promises and legislative initiatives. He pledged to create a national Bitcoin reserve by retaining ownership of 208,000 confiscated Bitcoins from law enforcement actions.

Senator Cynthia Lummis introduced the Bitcoin Act, aiming to acquire 1 million BTC within five years. Key Bitcoin advisor David Bailey stated that this reserve could materialize within Trump’s first 100 days in office.

Matrixport indicated that expectations for Trump to foster a pro-crypto regulatory environment contribute to sustained bullish momentum. With inauguration set for January 20, 2025, the market anticipates continued rallying.

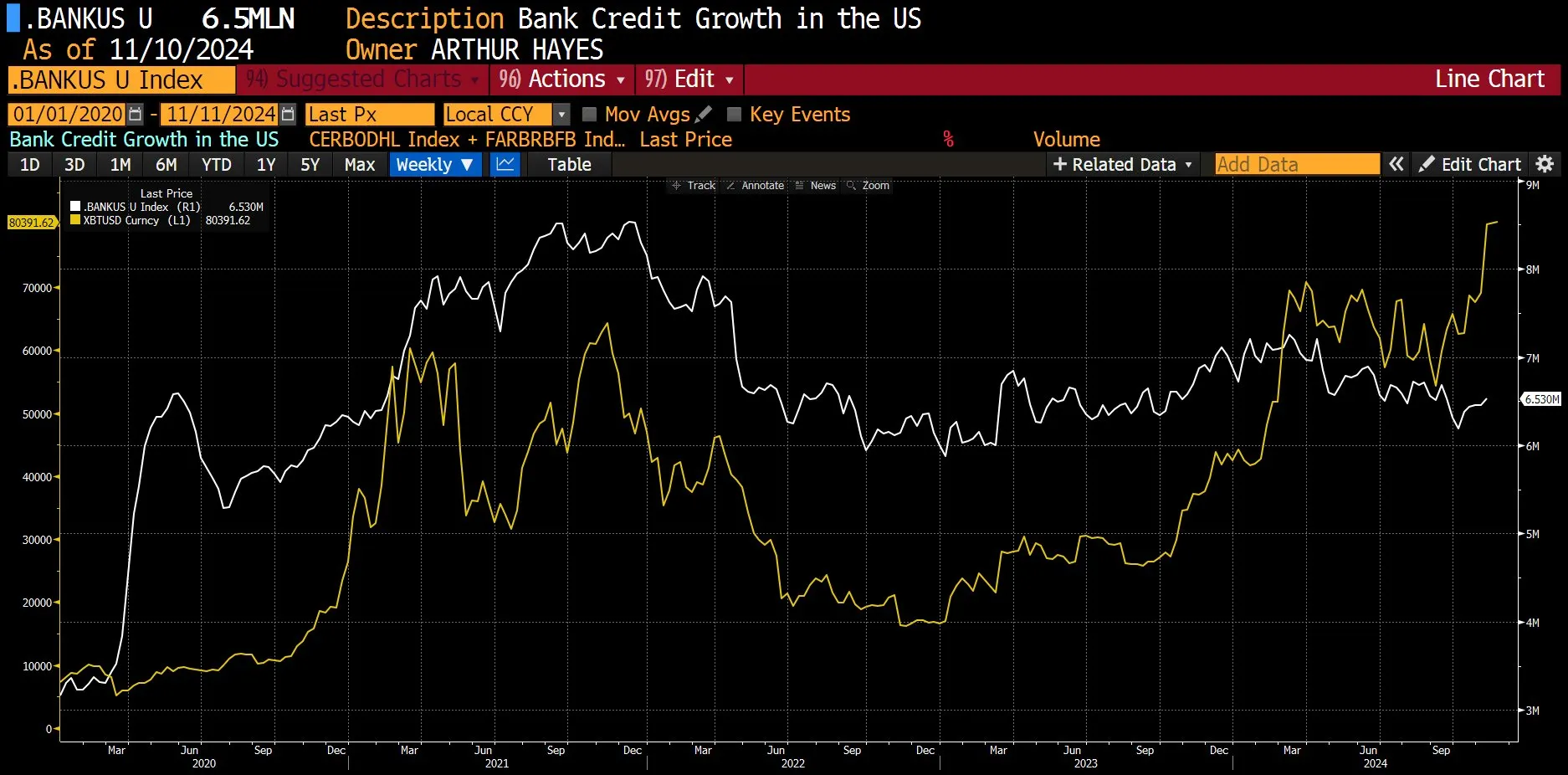

Arthur Hayes, founder of BitMEX, noted that Bitcoin's performance contradicts skepticism regarding monetary policy shifts under Trump. MacroScope highlighted that institutional investment strategies are adapting significantly post-election.

#2 Rumors About Bitcoin Nation-State Adoption

The proposed national Bitcoin reserve holds geopolitical significance, potentially initiating a global competition for Bitcoin reserves. David Bailey remarked on the rapid development of this scenario.

Mike Alfred reported significant interest from a major buyer in Bitcoin, suggesting heightened activity in the market. Bailey also indicated that at least one nation-state has become a top five Bitcoin holder.

There is at least one nation state that has been actively acquiring Bitcoin and is now a top 5 holder. Hopefully we hear from them soon.

— David Bailey

$0.85mm/btc is the floor (@DavidFBailey) November 9, 2024

#3 Short Squeeze

A noteworthy short squeeze contributed to Bitcoin's price rise, with approximately $1 billion in shorts liquidated during the recent weekend. Data from Coinglass showed $133.15 million in BTC shorts were liquidated on Sunday, further reducing selling pressure and aiding Bitcoin's upward momentum.

#4 Retail Is Back

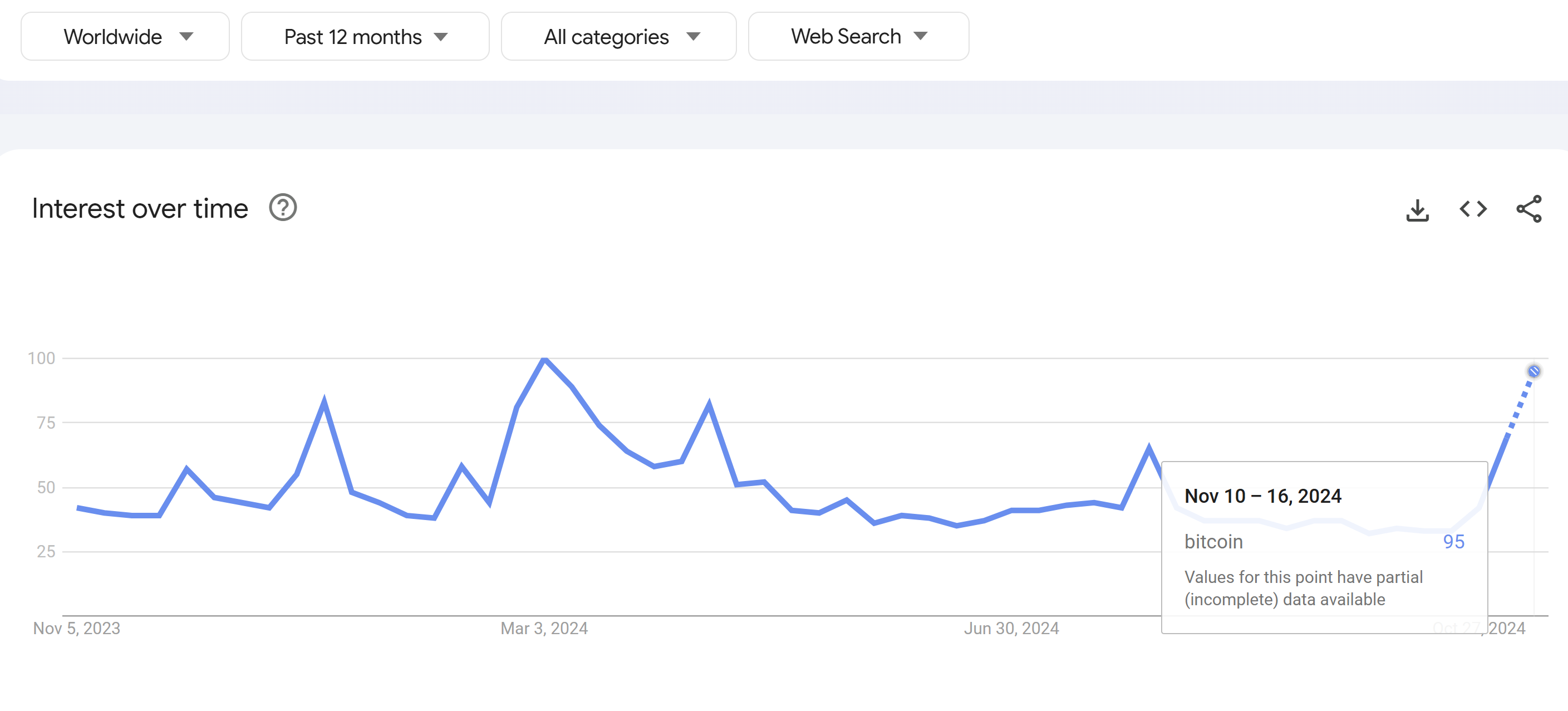

Retail investor interest has surged, with Cameron Winklevoss noting that ETF demand has played a crucial role in supporting Bitcoin's price. Google Trends data shows a 53% increase in Bitcoin-related searches since early October, peaking at 95 points on November 10, indicating growing retail engagement.

At press time, BTC traded at $81,259.