4 0

Bitcoin Surges Past $94,000 Amid Institutional Inflows and Geopolitical Events

Bitcoin Price Surge in 2026

- Bitcoin surpassed the $94,000 mark in early January 2026, driven by a mix of factors.

- Key drivers include shifting buying and selling pressures, increased institutional interest, stabilizing on-chain metrics, and political changes in Venezuela.

Geopolitical Impact and Institutional Investment

- Political developments in Venezuela, including the capture of President Nicolás Maduro, influenced global risk sentiment.

- Speculation about a potential $60 billion Bitcoin reserve in Venezuela added to market dynamics.

- US-based Spot Bitcoin ETFs saw significant inflows at the start of 2026, with notable net investments boosting Bitcoin's price.

On-Chain Metrics Indicate Market Stabilization

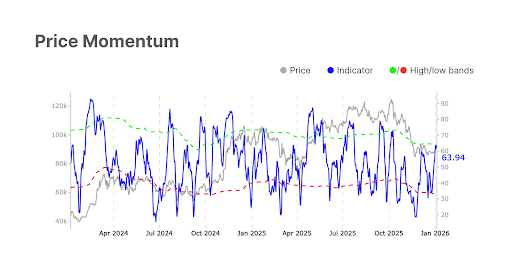

- Glassnode reports show Bitcoin's market stabilizing between $80,000 and $95,000, with reduced sell pressure and recovering momentum.

- The Relative Strength Index indicates upside potential, while open interest is cautiously rebuilding.

- Despite improving spot volumes, structural demand remains weak, making the recovery above $90,000 fragile.

These factors helped Bitcoin overcome resistance at $90,000, raising questions about whether this marks a sustained advance or a temporary peak. Currently, Bitcoin trades at $92,780, slightly below its recent high.