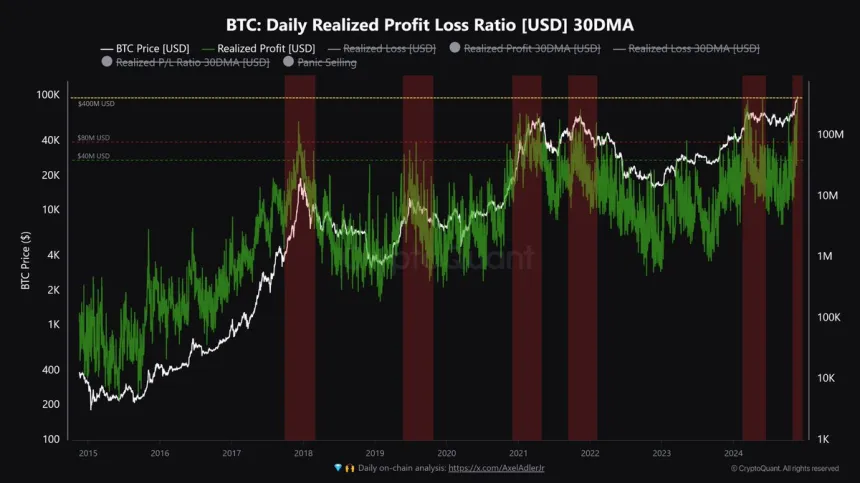

Bitcoin Surges Past $99,800 as Realized Profit Reaches $443 Million

Bitcoin has surpassed $99,800, nearing the psychological $100,000 barrier. Although this milestone demonstrates strong market performance, it has not yet secured this key level, leaving investors anticipating further movement. Robust market demand continues to drive optimism for a potential breakthrough above $100,000.

Data from CryptoQuant indicates that Bitcoin's Realized Profit reached an all-time high of $443 million in daily gains, signifying substantial buying pressure as traders and long-term holders realize profits. However, some investors express concerns that this profit-taking could signify a local top, potentially stalling the rally.

Despite mixed signals, overall market sentiment remains bullish. Bitcoin maintains its position above critical support levels, suggesting sufficient demand to advance toward $100,000. The next hours and days will be crucial in determining if Bitcoin can sustain its momentum or if a temporary consolidation may occur.

Bitcoin Rally Potential

Bitcoin's rise from $66,800 to $99,800 represents a notable bullish phase in 2024. As it approaches $100,000, many previously skeptical investors are adjusting their expectations. Strong demand and market confidence make a breakout seem likely. Analysts predict that such a breakout would lead to continued bullish momentum, reinforcing Bitcoin's dominance in the crypto market.

However, challenges may arise on the path to $100,000. Corrections could occur, which may benefit market health by allowing consolidation and giving altcoins space to recover.

Despite concerns about a potential local top, Bitcoin's growth trajectory remains promising. Sustaining support above $95,000 could bolster bullish momentum, while a healthy correction might provide necessary momentum for a stronger push beyond $100,000.

BTC Testing Supply Levels

Bitcoin is currently positioned above $97,000, maintaining bullish momentum as it targets the $100,000 milestone. This level serves as both a psychological and technical barrier, with optimistic market sentiment surrounding Bitcoin's potential to surpass it. Many investors are preparing for a significant surge that could shape Bitcoin's future trajectory.

Concerns persist regarding the possibility of a local top, which could lead to a consolidation phase lasting weeks as the market adjusts to recent gains. Analysts suggest that maintaining levels above $98,000 in the coming days is essential for retaining bullish momentum and facilitating a breakout above $100,000.

If Bitcoin fails to hold the $97,000 mark, it could indicate the beginning of a healthy correction, potentially retracing to $92,000—a key demand zone likely to act as strong support. Such a pullback would allow Bitcoin to consolidate and prepare for another upward move, reinforcing its long-term bullish trend.

Featured image from Dall-E, chart from TradingView