Bitcoin Surges Past $97K With Long-Term Holders Retaining Supply

Bitcoin has surpassed the $97,000 mark, offering relief amid recent market uncertainty. However, many analysts remain cautious, viewing this as a potential counter-trend bounce within a broader bearish setup for 2026.

- Bitcoin broke through the $94,200 resistance zone and moved towards $97,500, showing resilience.

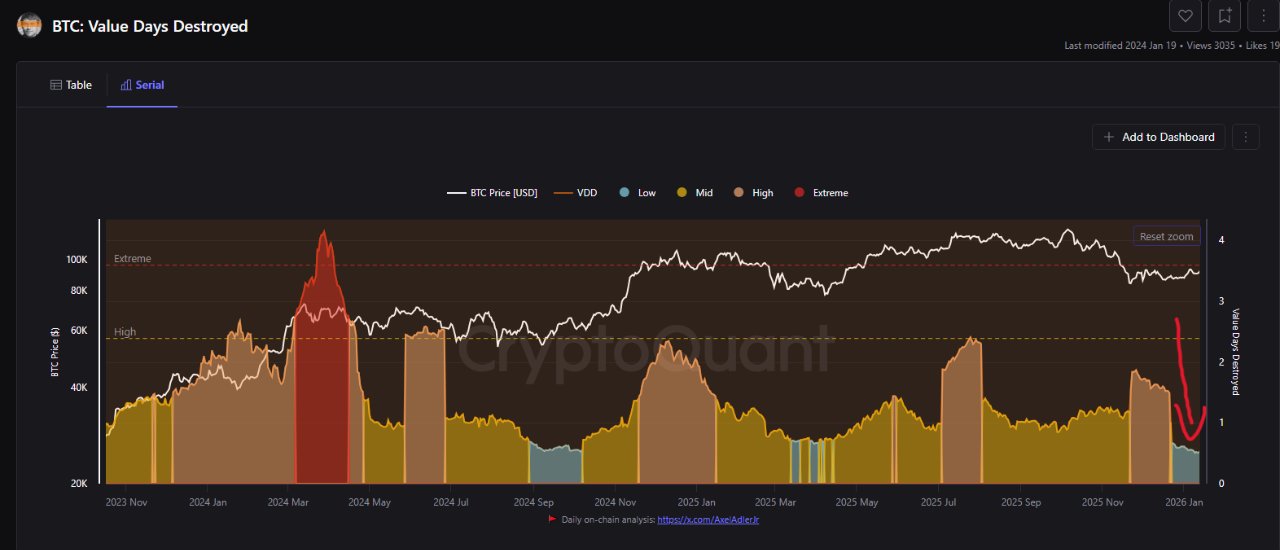

- The Value Days Destroyed (VDD) metric indicates that long-term holders are not selling, reinforcing the rally's strength.

- In January 2026, VDD is at a historically low 0.53, suggesting that the circulating coins are younger, while older holdings stay dormant.

Long-Term Holders and Rally Quality

Carmelo Alemán from CryptoQuant notes that despite Bitcoin's price rise, long-term holders remain inactive, improving the rally's quality. Historically, low VDD during rises suggests demand is met by newer supply rather than older sell-offs.

If VDD remains low, the rally's foundation is strong. An increase could signal distribution by long-term holders and rising selling pressure.

Price Tests Key Resistance

Bitcoin is stabilizing after rebounding from December lows, reclaiming the $96,000–$97,000 range. It faces significant resistance from the 100-day and 200-day moving averages between $100,000 and $108,000.

- The recent move shows higher daily timeframe lows, indicating a potential short-term trend reversal.

- Volume increase suggests genuine participation in the rebound.

- For bullish momentum, Bitcoin needs to sustain above $97,000 and approach the $100,000 level.