Bitcoin Surpasses $100,000 as Realized Cap Reaches $768 Billion

Bitcoin has surpassed the $100,000 mark as on-chain data indicates significant capital inflow into the asset.

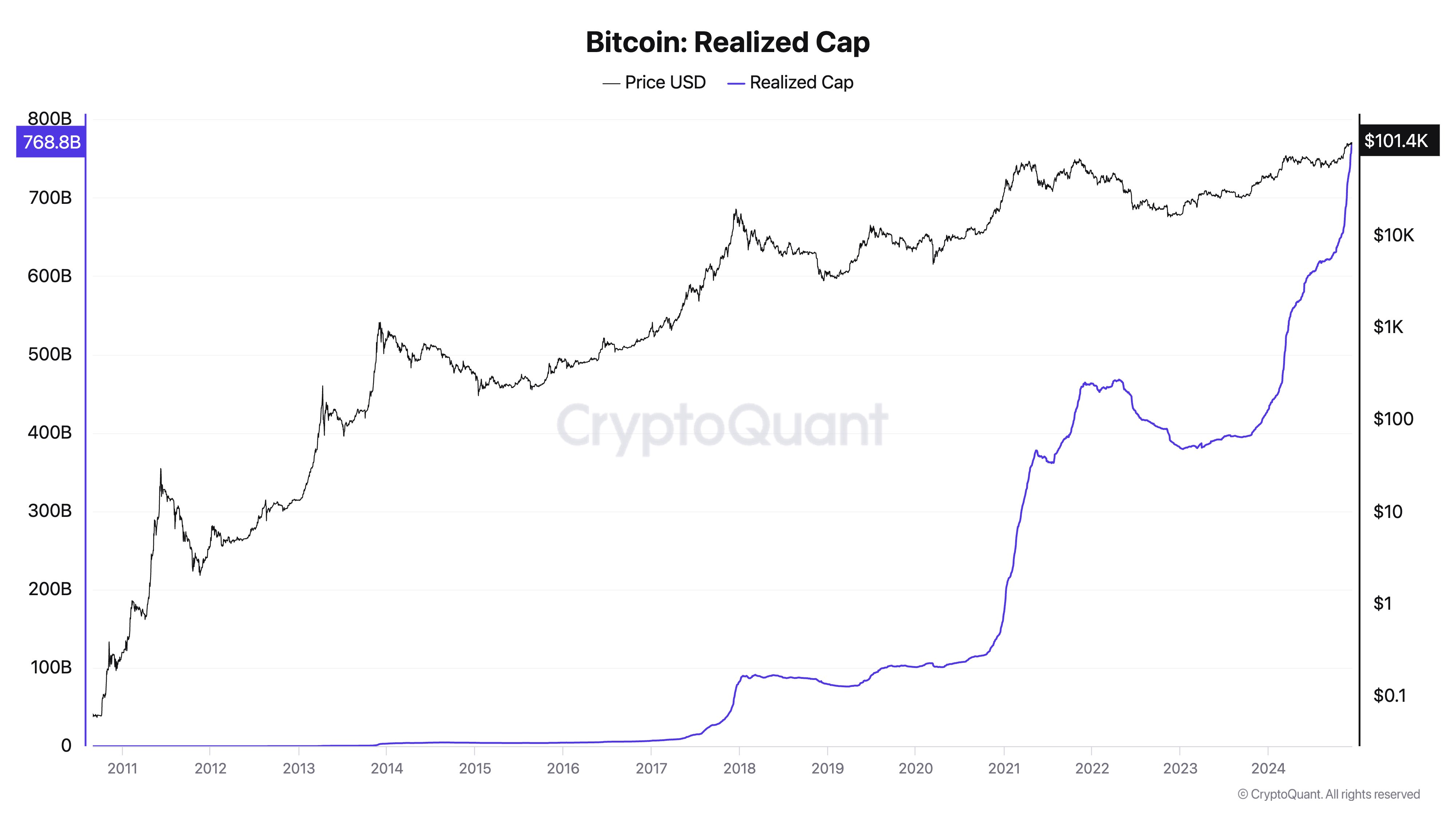

Bitcoin Realized Cap Crosses $768 Billion

CryptoQuant founder Ki Young Ju reported on X about the recent trends in Bitcoin's Realized Cap, an on-chain capitalization model that evaluates BTC’s total value based on the last transaction price of each token. This model calculates the total cost basis for all tokens in circulation, reflecting the cumulative investment made by all investors in Bitcoin.

The following chart illustrates the Realized Cap trend over Bitcoin's history:

The graph indicates a sharp increase in the BTC Realized Cap over the past year, suggesting rapid capital influx. Ju noted that Bitcoin is attracting $80 billion monthly, with nearly half of the capital in the market over the last 15 years added this year. Total BTC investment is nearing the $769 billion milestone, with ongoing demand for the asset evident.

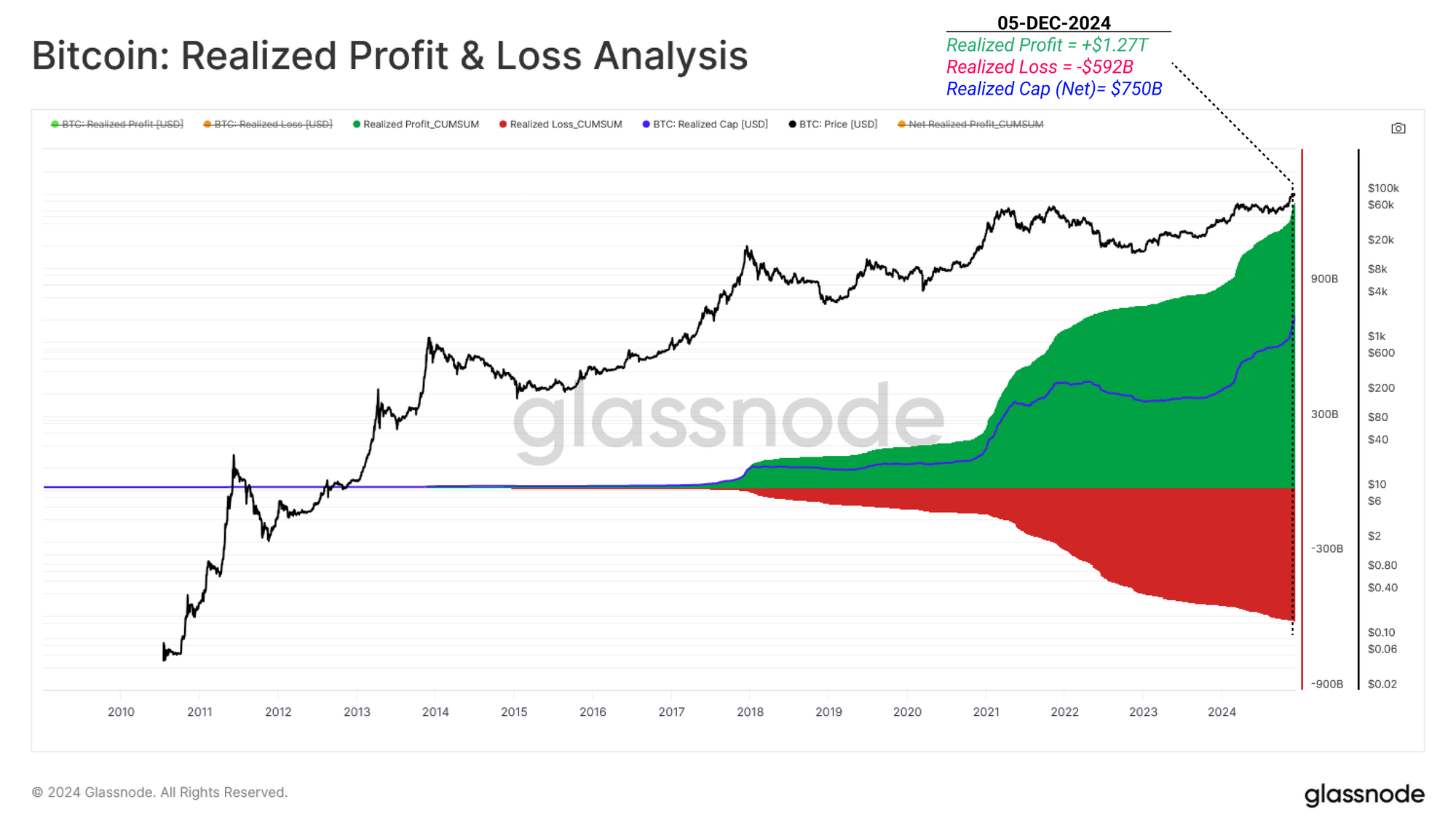

Glassnode's latest weekly report also examined this metric from another perspective:

This chart presents cumulative data for Bitcoin's Realized Profit and Realized Loss, measuring profits and losses realized by investors through selling. Historically, the difference between the cost basis and selling price for profitable transactions amounts to $1.27 trillion, while underwater transfers total $592 billion. The disparity between these metrics aligns closely with Bitcoin's Realized Cap.

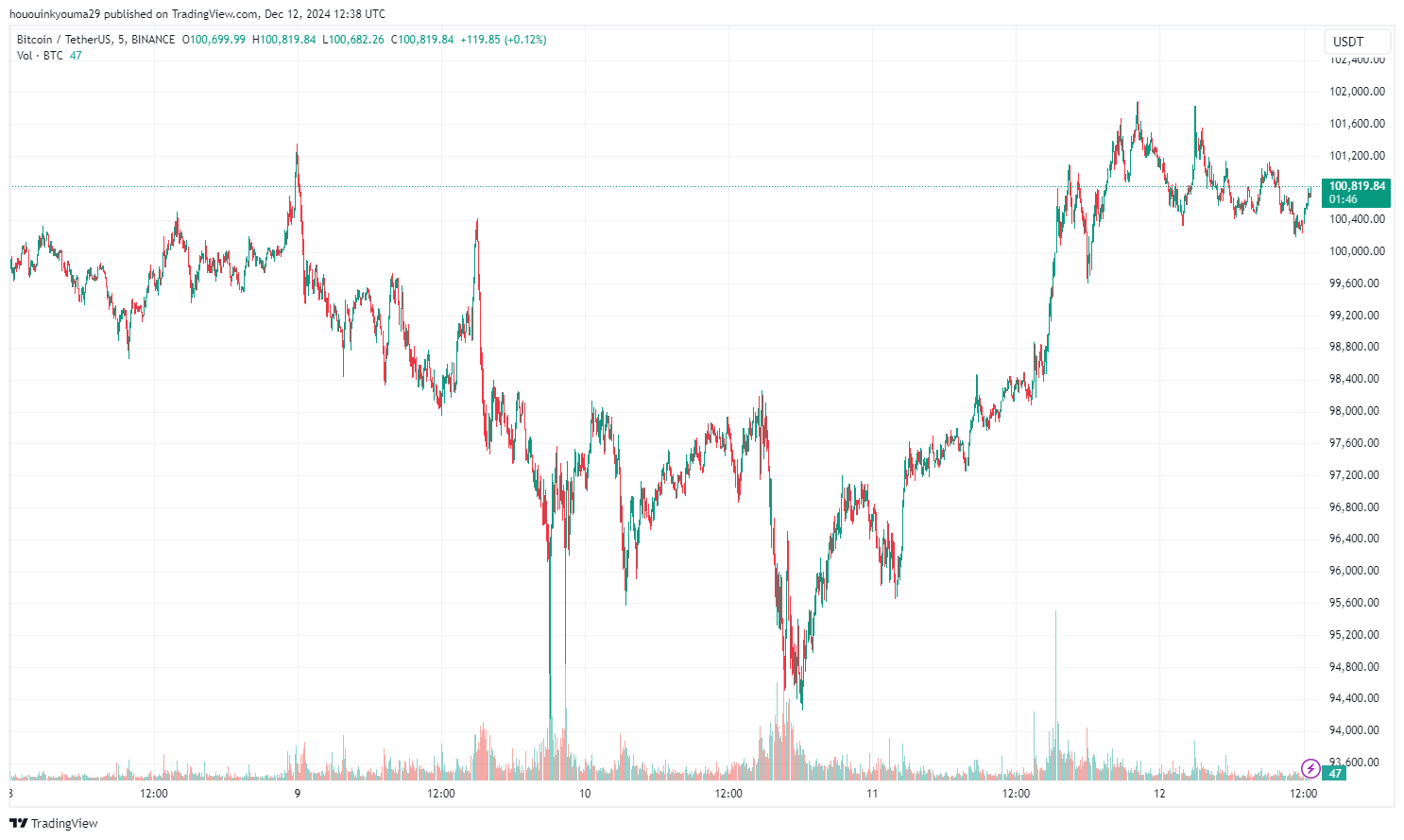

BTC Price

Bitcoin has recovered above the $100,000 level after briefly falling below $95,000 earlier in the week.