8 0

Bitcoin Surpasses $104,000; Coinbase Stock Rises 24% Following S&P 500 Inclusion

Bitcoin (BTC) surpassed $104,000, driven by positive inflation data, Donald Trump's optimistic market outlook, and Coinbase's inclusion in the S&P 500. Key points include:

- April’s Consumer Price Index (CPI) was lower than expected, easing inflation concerns for the Federal Reserve.

- Trump stated at the Saudi–U.S. Investment Forum that markets could rise further.

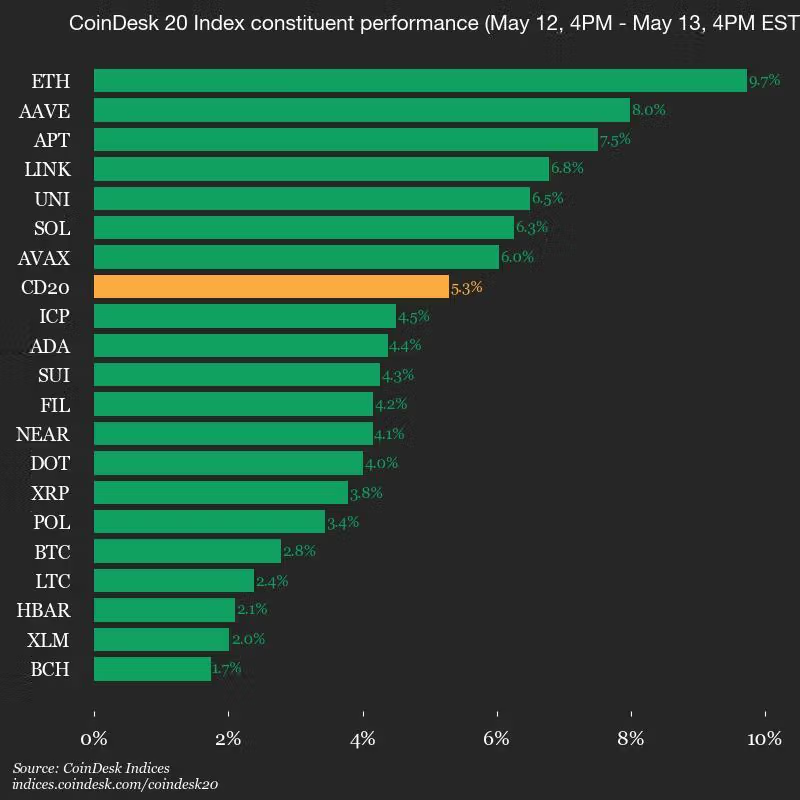

- At press time, BTC traded around $104,400, up 2.4% in 24 hours. Ethereum (ETH) rose over 9% to $2,700.

- Coinbase stock surged 24% amid its S&P 500 inclusion, potentially generating $16 billion in buying pressure, according to Jefferies.

- Market sentiment is favorable, with institutional interest growing due to improved regulation prospects.

Bitfinex analysts noted that BTC faces resistance between $104,000-$106,000, anticipating a short-term consolidation phase. They expect a new all-time high may be delayed until June, with a long-term target of $150,000-$180,000 for 2025-2026 due to increasing adoption and favorable policy developments.