6 0

Bitcoin Surpasses $114,000 Amid Anticipation of U.S. CPI Data

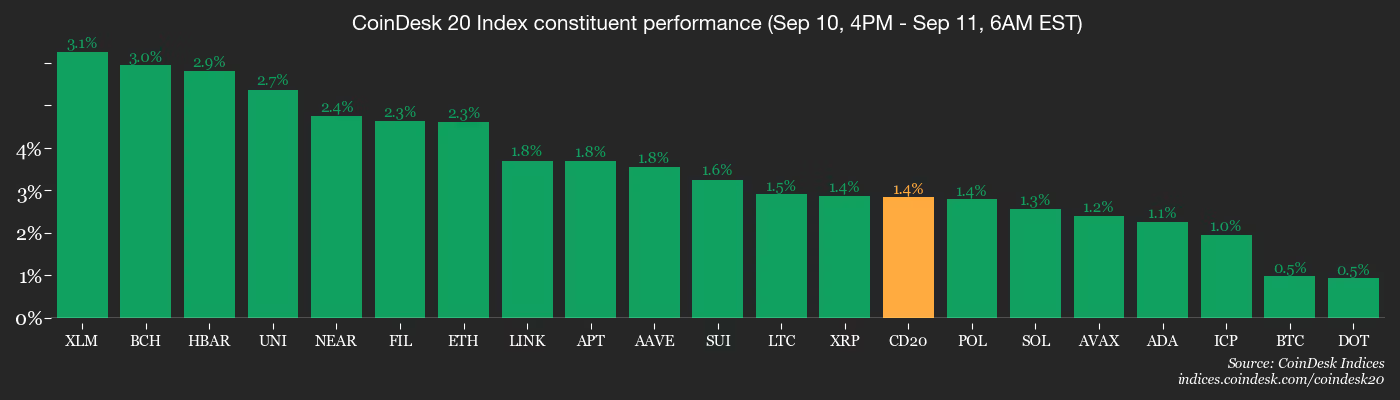

Bitcoin (BTC) has increased by approximately 1.4% in the last 24 hours as investors anticipate key U.S. inflation data that could influence Federal Reserve interest rate decisions. The European Central Bank is expected to maintain steady rates, but a surprise could impact markets.

Key points include:

- Forecasts suggest a modest rise in the U.S. Consumer Price Index (CPI), with expectations of a 25 basis-point rate cut this month at 79% probability, and an 8% chance of a 50 bps cut.

- Net inflows into spot bitcoin and ether ETFs reached $928 million yesterday, with bitcoin rising to $114,000.

- Analysts caution about stagflation risks due to persistent inflation and slowing growth.

- Gold prices remain near record highs, while the bitcoin-to-gold ratio approaches resistance levels indicative of potential crypto bottoms.

- Geopolitical tensions, such as recent airspace violations by Russia, raise concerns amidst these financial developments.

What to Watch

- Sept. 11: Swissblock webinar on “The Final Innings of This Bull Cycle.”

- Sept. 11: Figure Technology Solutions starts trading on Nasdaq under ticker FIGR following its IPO priced at $25 per share.

- Sept. 12: Gemini Space Station begins trading on Nasdaq under ticker GEMI with IPO price ranging from $24-$26.

- Sept. 11: August U.S. Core CPI estimates set for release.

Market Movements

- BTC increased by 0.26% to $113,916.87 (24hrs: +1.5%)

- ETH rose 1.93% to $4,414.68 (24hrs: +2.32%)

- CoinDesk 20 index gained 1.24% to 4,209.95 (24hrs: +2.13%)

- DXY up 0.2% at 97.98; Gold futures down 0.62% at $3,659.30.

ETF Flows

- Spot BTC ETFs recorded daily net flows of $741.5 million, cumulative net flows at $55.6 billion.

- Spot ETH ETFs had daily net flows of $171.5 million, cumulative net flows at $12.86 billion.

Token Events

- Compound DAO voting ends today on extending its COMP yield strategy targeting a 15% annual yield.

- Aptos (APT) to unlock 2.2% of its circulating supply worth $50.89 million today.

- Sky (SKY) listed on OKX; Unibase (UB) to be listed on Binance Alpha and MEXC tomorrow.

Technical Analysis

- S&P 500 e-mini futures display a rising wedge pattern, indicating potential bearish reversal risks.

- A sell-off in futures may negatively affect the bitcoin market.

Crypto Equities

- Coinbase Global (COIN): closed at $315.34 (-1.08%), +0.7% in pre-market.

- Circle (CRCL): closed at $113.69 (-3.64%), +1.46% in pre-market.

- Galaxy Digital (GLXY): closed at $26.08 (-1.88%), +0.73% in pre-market.

While You Were Sleeping

- Blockchain lender Figure priced its IPO at $25 per share, raising nearly $788M.

- U.S. CPI likely rose 0.3% in August amid rising costs in various sectors.

- Avalanche Foundation seeks to raise $1B for crypto-hoarding companies through new treasury vehicles.