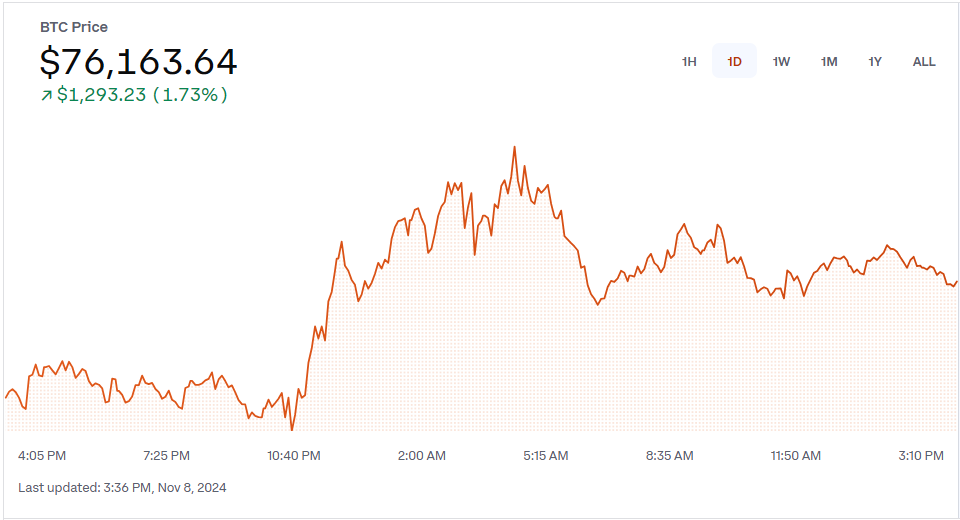

Bitcoin Surpasses $76,000 as Open Interest Reaches $45.41 Billion

Bitcoin has reached new highs, surpassing $76,000 for the first time. This increase follows Donald Trump's victory in the US presidential election, which investors believe may create a favorable environment for cryptocurrencies.

On TradingView, Bitcoin's price hit $76,152, marking a 2% increase in 24 hours and a 10% increase weekly.

Election Euphoria Fuels Bitcoin's Surge

The cryptocurrency market shows optimism. Many predict that a Trump presidency benefits digital assets. His previous negative stance on cryptocurrencies has shifted; he now presents himself as a pro-crypto candidate. His campaign accepts cryptocurrency payments and aims to position the U.S. as the "crypto capital of the world." This has led to a rise in Bitcoin’s value and increased stock prices of related companies like Coinbase and MicroStrategy.

This rally is bolstered by institutional investment, with over $50 billion invested in Bitcoin ETFs, showing traditional financial institutions' acceptance of cryptocurrencies. Analysts forecast Bitcoin could reach $150,000 by 2025 if current trends persist.

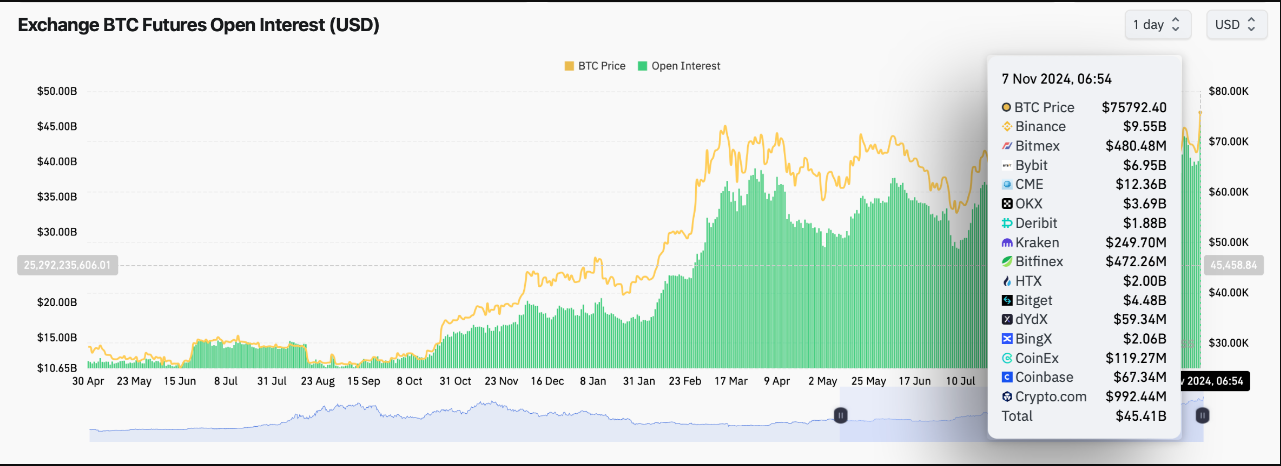

Record Open Interest Signals Confidence

The Open Interest (OI) for Bitcoin, reflecting outstanding futures and options contracts, rose significantly alongside its price. In two days, OI increased by 13.29%, reaching $45.41 billion.

The surge in OI indicates that traders are actively preparing for potential price increases, suggesting confidence in the market's upward trend. Evaluating market dynamics requires considering various factors.

Market participants are increasingly optimistic about Bitcoin's future, anticipating that institutional interest will grow as regulatory clarity improves under Trump's administration. A combination of market forces and political circumstances may further elevate Bitcoin.

Future Prospects for Bitcoin

Volatility in crypto markets is likely to continue as US election results unfold. Early indications suggest Trump's actions may lead to greater acceptance of cryptocurrencies. Investors are speculating on Bitcoin's potential growth.

The current market sentiment reflects a broader trend: Bitcoin often reaches new highs following elections. With ongoing optimism from institutional investors and rising retail interest, the question is not whether Bitcoin will rise, but how quickly it will grow in this new political landscape.

Featured image from DALL-E, chart from TradingView