7 0

Bitcoin Surpasses $85,000 After 10% Surge in One Week

Bitcoin has rebounded over the past week, recovering from a dip below $80,000 to trade above $85,000, reflecting a nearly 10% increase. This recovery comes amid reassessed macroeconomic factors and on-chain signals.

On-Chain Trends Support Uptrend

Key metrics indicate Bitcoin remains undervalued:

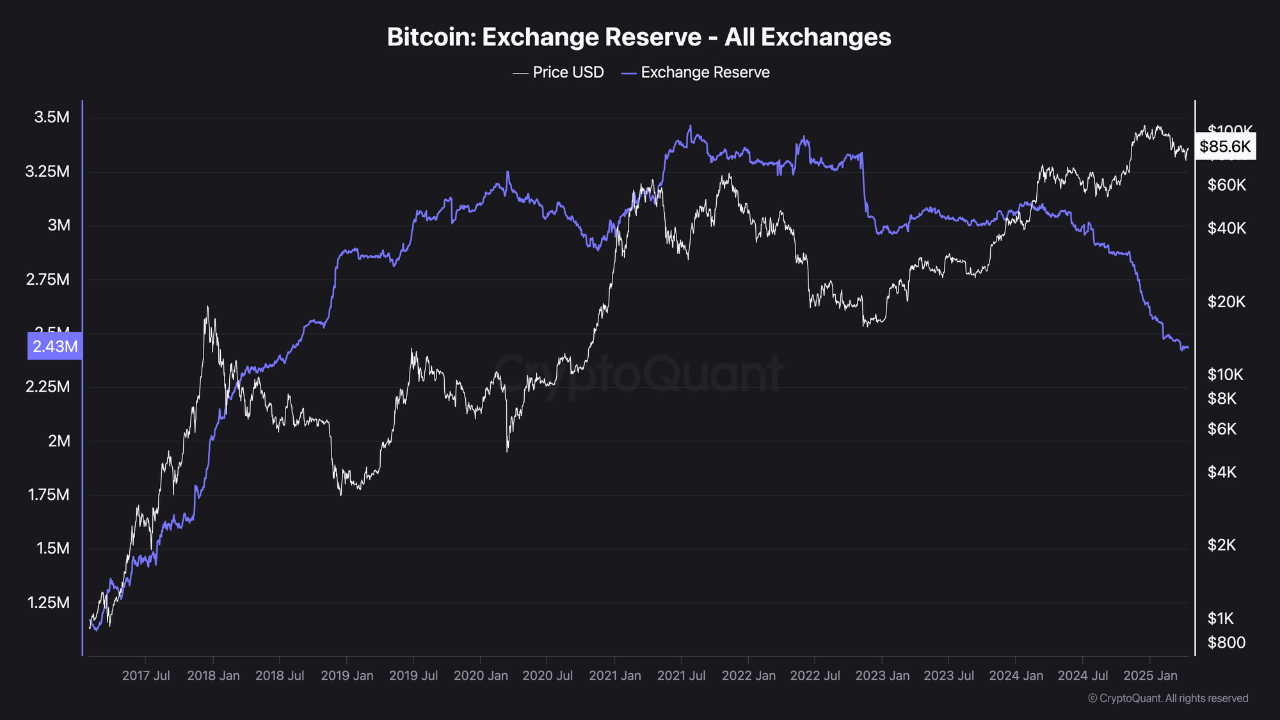

- Declining exchange reserves have reached levels not seen since 2018, with about 2.43 million BTC held on exchanges, down from 3.4 million during the 2021 peak.

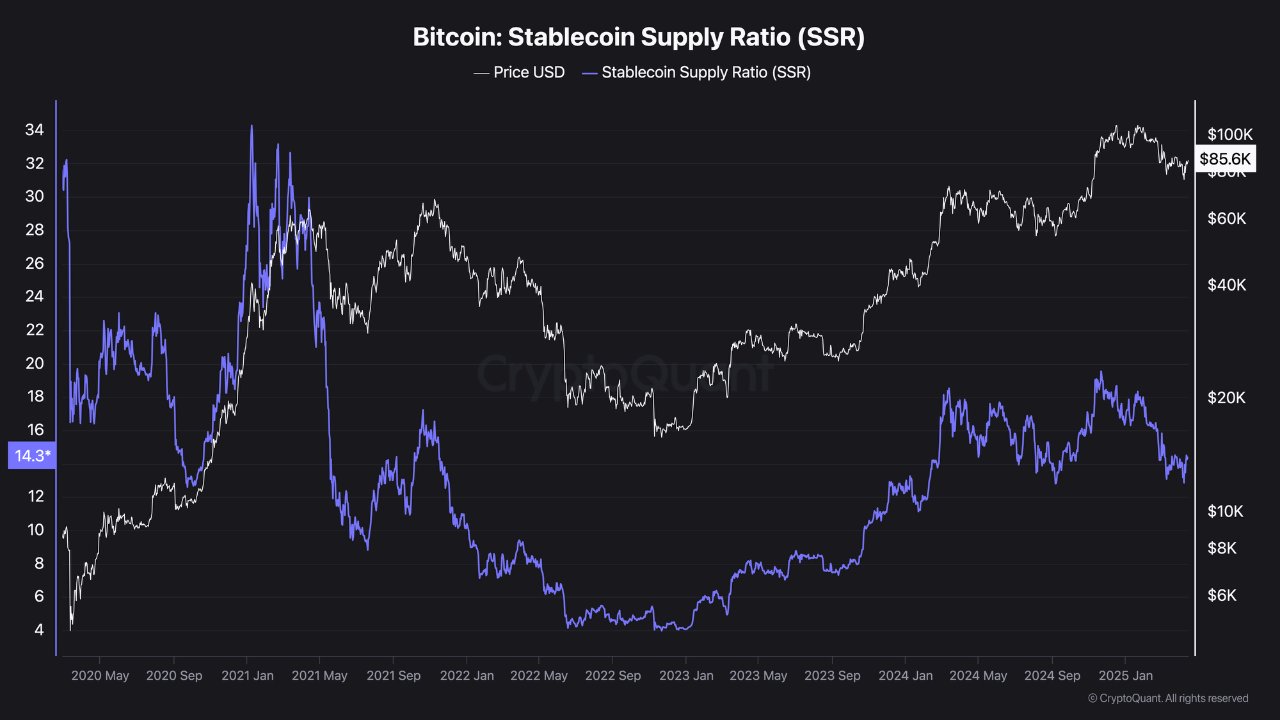

- The Stablecoin Supply Ratio (SSR) is at 14.3, suggesting available liquidity for new purchases.

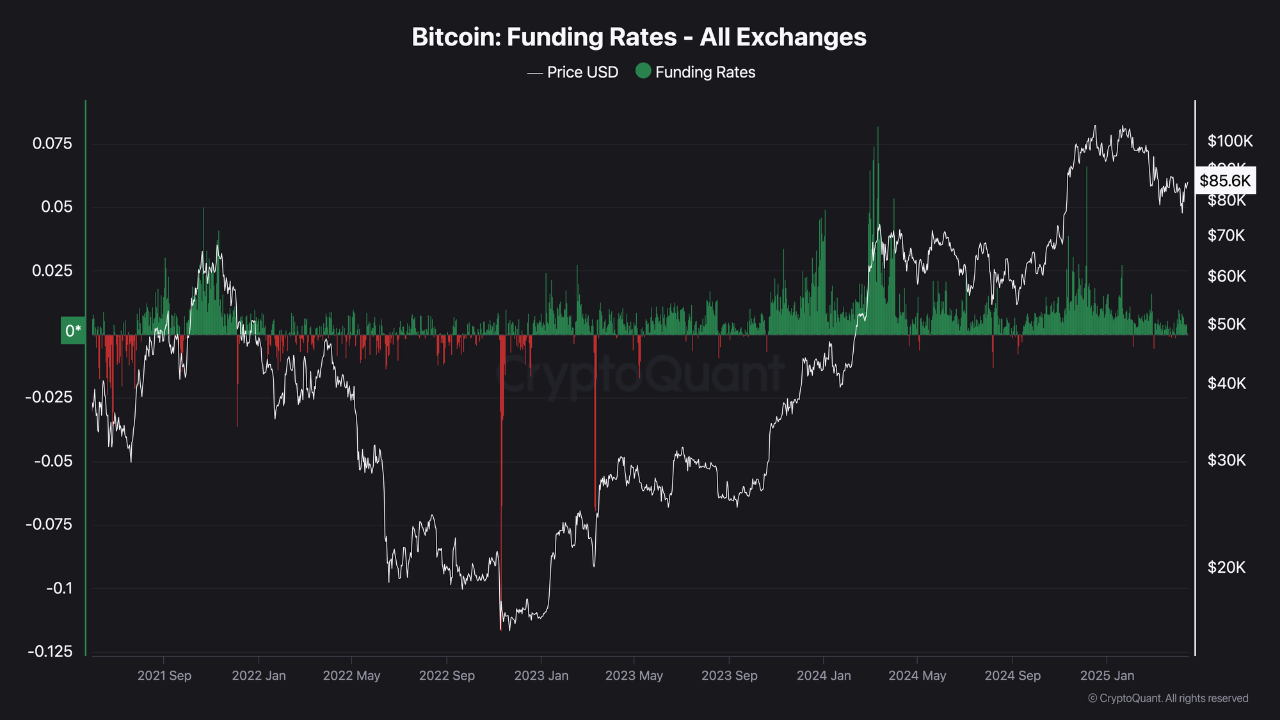

- Normalized funding rates are between 0.00% and 0.01%, indicating reduced short-term risk.

This combination of declining reserves, a stable SSR, and normalized funding rates fosters a positive outlook for Bitcoin. However, macroeconomic conditions will continue to impact sentiment.